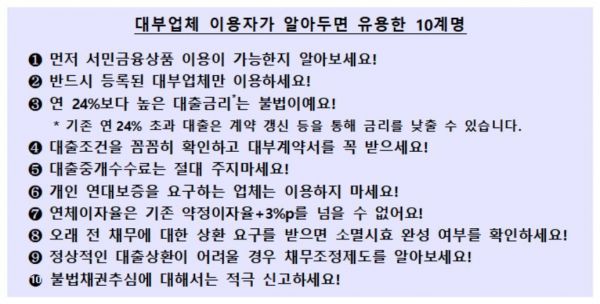

Financial Supervisory Service Announces 10 Commandments for Using Loan Companies

[Asia Economy Reporter Kim Hyo-jin] When using loan companies, you should check whether the overdue interest rate exceeds the limit (3 percentage points). Avoid companies that require personal joint guarantees. Interest rates exceeding 24% per annum are illegal, and the excess can be reduced through contract renewal or other means.

On the 16th, the Financial Supervisory Service announced the "10 Commandments Useful for Users of Loan Companies" containing these details.

With the amendment of the Loan Business Act, the overdue interest rate on loans from loan companies is limited to within +3 percentage points of the agreed interest rate. This applies to contracts signed, renewed, or extended after June 25 of last year.

For registered loan companies, the practice of requiring joint guarantees was abolished from January last year. Accordingly, personal loans no longer require joint guarantees. Joint guarantees in existing contracts are discontinued when the contract is changed or renewed.

The Financial Supervisory Service also recommends checking whether you can use public financial products for low-income earners before using loan companies. By visiting the Financial Supervisory Service’s financial consumer information portal "Fine," you can check your eligibility for low-income financial products and view your personal credit information up to three times a year for free.

Interest rates higher than 24% per annum are illegal. Existing loans exceeding 24% per annum can have their interest rates lowered through contract renewal or other means. However, the statutory maximum interest rate applies only to contracts signed, renewed, or extended after the enforcement of the Loan Business Act (February 8, 2018).

Therefore, users of existing loans exceeding 24% per annum are advised to apply the reduced interest rate by renewing contracts or signing new contracts after repayment.

The Financial Supervisory Service also urged users to use loan companies registered with financial authorities or local governments, as using unregistered illegal private loans may expose them to high interest rates and illegal debt collection.

If normal loan repayment is difficult, you can use debt adjustment systems that support economic recovery through repayment deferral or debt reduction.

Since the 28th of last month, a system has been in operation that provides free support of debtor representatives and litigation lawyers for victims or those at risk of illegal private finance. This applies to those who have been subjected to illegal collection by loan companies or have used loans exceeding the statutory maximum interest rate. Applications for support can be made to the Financial Supervisory Service or the Korea Legal Aid Corporation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.