[Asia Economy Reporter Park Jihwan] Large-scale losses among investors in Lime Asset Management, who faced a fund redemption suspension crisis involving approximately 1.6 trillion KRW last October, have been confirmed. According to an audit by an accounting firm, not only did the fund value halve, but some investors are in a situation where they cannot recover a single penny. Accordingly, investors' legal actions and prosecution investigations are expected to intensify.

According to the financial investment industry on the 16th, so far, 37 investors have filed lawsuits against Lime Asset Management and distributors through law firms: 34 through Law Firm Gwanghwa and 3 through Law Firm Hannuri. Additionally, two investors are known to have filed lawsuits individually. Furthermore, Hannuri is currently preparing additional lawsuits and civil suits requesting the cancellation of fund contracts. Law Firm Woori is also preparing both lawsuits and legal actions.

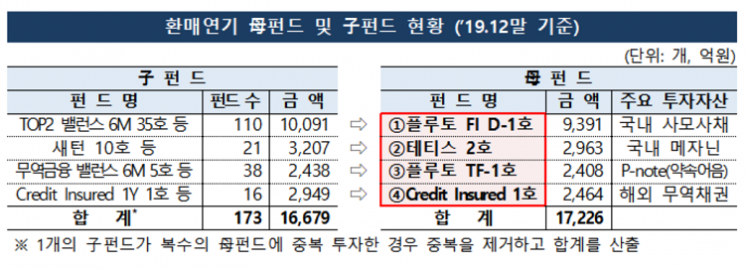

On the 14th, Lime announced that compared to the end of September last year, before two mother funds declared redemption suspension, the 'Pluto FI D-1' fund suffered a 49% loss and the 'Tethys 2' fund a 30% loss, and they plan to adjust the valuation accordingly.

The Financial Supervisory Service (FSS) revealed that in the recent inspection, Lime and Shinhan Financial Investment knew as early as June 2018 that the 'Pluto TF Fund' (a trade finance fund) invested in the International Investment Group (IIG) fund did not calculate its net asset value (NAV), yet arbitrarily adjusted the NAV to increase by 0.45% monthly until November of the same year. They also received emails in November 2018 regarding the insolvency and liquidation procedures of the IIG fund but concealed the trade finance fund's insolvency by restructuring five funds, including overseas trade finance funds, into a mother-child structure, thereby transferring the insolvency to normal funds.

With such large-scale losses confirmed and illegal activities during fund management revealed, investors' legal responses are expected to accelerate. Investors who have already sued the asset management and distributor executives are expanding their lawsuits to include private bankers (PBs) and other frontline staff who directly sold the products.

Hannuri stated that over 150 investors have consulted regarding lawsuits and legal actions so far, indicating the number of plaintiffs could more than double. Law Firm Woori is recruiting plaintiffs among investors who subscribed to the Lime funds at the Banpo WM Center of Daishin Securities, as it is believed that the center did not prepare contracts or conduct investment propensity analyses when selling the funds.

Some law firms are also considering applying for dispute mediation regarding the trade finance fund, which the FSS is preparing, instead of filing lawsuits. Dispute mediation usually allows investors to recover their funds within a year, offering a shorter timeframe than civil litigation.

The prosecution is also accelerating investigations related to Lime. It is reported that prosecutors are focusing on investigating profit manipulation for fund rollover and illegal activities during the investor recruitment process.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.