[Asia Economy Reporter Park Jihwan] The Lime Asset Management fund, which caused a redemption suspension incident worth about 1.6 trillion KRW, has seen its net asset value effectively halved after price adjustments. In particular, some funds that borrowed total return swaps (TRS) from securities firms are now in a state of total loss.

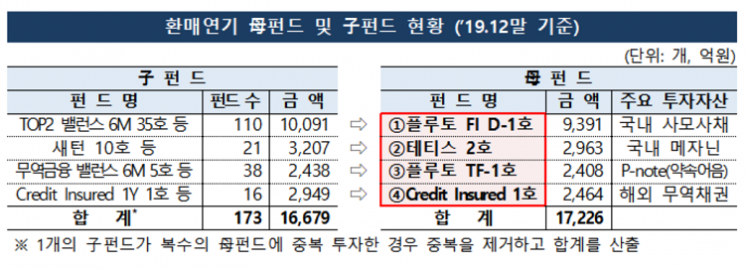

On the 14th, Lime Asset Management issued a press release stating that as of the 18th of this month, the net asset values of two master funds compared to the previous day were adjusted to -46% for 'Pluto FI D-1' (937.3 billion KRW as of the end of last October) and -17% for 'Tethys 2' (242.4 billion KRW). This price adjustment was based on the fund accounting audit report received from Samil Accounting Corporation on the 10th, followed by an evaluation by the Collective Investment Asset Valuation Committee. Lime Asset Management plans to complete the net asset value adjustments for the sub-funds related to these two master funds by the 21st.

The loss rate for investors is expected to vary significantly depending on whether the sub-funds only hold the master funds Pluto and Tethys or if they used leverage through TRS. In particular, some funds that hold only the master funds as underlying assets and also used TRS may incur total losses.

Lime Asset Management stated, "The three funds Lime AI Star 1.5Y No.1, Lime AI Star 1.5Y No.2, and Lime AI Star 1.5Y No.3 have incurred total losses following the master fund price adjustments." The reason for the significant drop in these funds' net asset values is explained by the use of TRS with a leverage ratio of 100%. The value of the underlying assets has fallen below the margin, making it currently possible that the customers' invested funds will be completely lost.

For the trade finance fund (Pluto TF Fund), which is still undergoing accounting audits, a net asset value decline of about 50% is expected. Lime Asset Management explained, "The Cayman-based fund invested in by the trade finance fund has decided to sell beneficiary certificates of several funds, including the International Investment Group (IIG) fund, directly or indirectly to a Singapore-based company, and in return received promissory notes worth 500 million USD."

They added, "Regarding the promissory notes, there are contractual terms related to principal reduction, but final consent for the equity transfer was not obtained from the IIG fund directors, resulting in a principal reduction of 100 million USD."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)