14th 'Macroeconomic Financial Meeting'

Lee Ju-yeol, Governor of the Bank of Korea, "Additional interest rate cuts should be carefully considered due to side effects"

Bank of Korea preparing support measures for affected companies

Hong Nam-ki, "Quickly preparing export support measures for aviation, shipping, and tourism... Consumption stimulation plan"

Difficulty in assessing specific economic impact

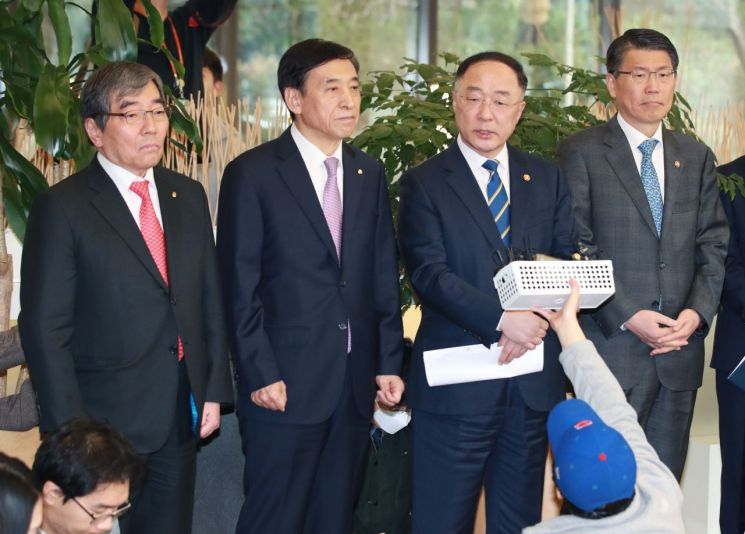

[Asia Economy Reporter Kim Eunbyeol] The heads of financial authorities, including the Ministry of Economy and Finance and the Bank of Korea, convened to discuss the impact of the novel coronavirus disease (COVID-19) on the Korean economy and possible support measures. The Bank of Korea stated that it should be cautious about further interest rate cuts but is preparing financial support measures for companies affected by COVID-19. The Ministry of Economy and Finance also said it would prepare support measures by industry and sector, while adding that the fear is excessive. Therefore, they urged the public to engage in normal economic activities.

Lee Ju-yeol, Governor of the Bank of Korea, after attending the 'Macroeconomic and Financial Meeting' held at the Bankers' Hall in Jung-gu, Seoul on the 14th, said, "Although the possibility of additional interest rate cuts has been raised by some, we must carefully consider the side effects and make a prudent judgment." He also mentioned that there was no discussion about interest rate cuts during the meeting. Furthermore, he stated, "At present, it is difficult to gauge how much and to what extent COVID-19 will affect our economy, so I think we need to confirm the impact through indicators."

Instead, the Bank of Korea is preparing support measures targeting companies damaged by COVID-19. This involves utilizing the Financial Intermediation Support Loan (FISL), which falls under the credit policy of the Bank of Korea's monetary credit policy. The governor said, "After holding meetings with industry stakeholders and hearing their stories from the field, we found that related companies face considerable difficulties," adding, "We are preparing specific financial support measures for the service industry, which is experiencing damage due to economic activity contraction caused by anxiety and a decrease in travelers, and for the manufacturing industry, which is facing production difficulties due to challenges in procuring raw materials and parts from China."

The FISL is a system where the Bank of Korea lends funds to commercial banks at an interest rate of 0.5?0.75% to promote loans to small and medium-sized enterprises (SMEs). By lowering the banks' funding costs, the Bank of Korea supports the flow of funds to SMEs with weak creditworthiness or funding capabilities. Unlike broad interest rate cuts that supply funds widely to the market, this method has the advantage of targeting specific companies that have suffered damage. It also reduces concerns about side effects from interest rate cuts. The Bank of Korea also allocated 650 billion won to support companies affected by the Middle East Respiratory Syndrome (MERS) outbreak in 2015.

The government also announced that it would swiftly prepare support measures. Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki said, "We will promptly prepare and implement support measures by industry and sector, including aviation, shipping, tourism, and export support." He emphasized, "We will continuously prepare emergency support measures to alleviate the difficulties faced by affected industries and companies, and we will expand communication opportunities with economic organizations, private companies, and small business owners to comprehensively address or mitigate difficulties in the field."

He added, "We will mobilize all possible policy tools to prepare and implement a comprehensive package of measures for private investment expansion, domestic demand activation, and export promotion to support economic recovery as soon as possible." He also said, "We will discover and execute investments worth 100 trillion won in the three major sectors of private capital, private sector, and public sector, as outlined in this year's economic policy direction, and swiftly supply 479 trillion won in policy finance."

Regarding the financial and foreign exchange markets, he said, "We will strictly monitor the situation centered on relevant authorities, and if abnormal market volatility expands, we will respond proactively, swiftly, and accurately according to contingency plans."

Meanwhile, it was reported that the four heads of financial authorities reviewed the economic ripple effects of COVID-19 by scenario during the meeting. They reached a consensus that although initial volatility appeared temporarily in the financial markets, the situation now shows relatively stable conditions.

However, they agreed that it is premature to quantify the economic impact of COVID-19. They said that clearer assessment requires more observation of economic indicators such as consumption, production, and exports. When asked whether the government’s 2.4% growth target could be achieved, Deputy Prime Minister Hong replied, "It is not the stage to answer with specific percentages or numbers."

The economic leaders expressed regret that COVID-19 occurred while the Korean economy was showing signs of improvement and urged the public to engage in normal economic activities. Deputy Prime Minister Hong said, "Besides the actual ripple effects, the economic consumption sentiment contraction caused by excessive fear and anxiety is significant," adding, "We ask the public to now carry out normal economic and consumption activities."

There are concerns that demand recovery may not be easy while COVID-19 fears persist, but regarding this, they said they would prepare measures to stimulate consumption and activate domestic demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)