[Asia Economy Reporter Yuri Kim] Since the implementation of the December 16 measures imposing loan regulations on high-priced housing, the Seoul apartment market has been showing signs of polarization. The Gangnam area, where high-priced apartments are concentrated, experienced a decline centered on reconstruction projects as buyer sentiment weakened. In contrast, non-Gangnam areas such as Nowon, Gwanak, and Dobong districts, which have many mid- to low-priced apartments, saw an influx of demand, continuing the upward trend in housing prices. In the metropolitan area, housing prices rose sharply in some southern Gyeonggi regions like Suwon and Yongin, where accessibility to Gangnam improved due to transportation developments.

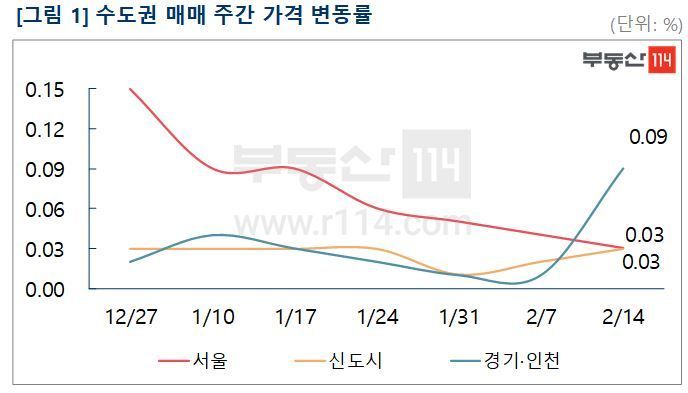

According to Real Estate 114 on the 14th, Seoul apartment sale prices rose by 0.03% this week. Reconstruction projects fell by 0.12% as major complexes such as Eunma in Daechi-dong, Gangnam-gu, and Jugong 5 Complex in Jamsil-dong, Songpa-gu, were adjusted downward. General apartments increased by 0.05%. New towns rose by 0.03%. Gyeonggi and Incheon saw a 0.09% increase as demand flowed into mid- to low-priced apartments.

In Seoul, the upward trend continued in non-Gangnam areas, with increases by district as follows: Nowon (0.23%), Gwanak (0.16%), Seongbuk (0.15%), Dobong (0.14%), Gwangjin (0.13%), Gangseo (0.12%), and Guro (0.12%). In Nowon, areas near Gwangwoon University Station and the Dongbuk Light Rail Line development, including Miryung, Miseong, and Samho 3rd complexes in Wolgye-dong, as well as Jugong 3 Complex and Bulam Hyundai in Sanggye-dong, rose by 5 to 20 million KRW. In Gwanak, large complexes such as Doosan in Bongcheon-dong, Seonghyeon Dong-A, and Sillim Prugio in Sillim-dong increased by 5 to 20 million KRW. In Seongbuk, inquiries continued for mid- to low-priced apartments, with Wolgok Doosan We’ve and Raemian Wolgok 1st in Hawolgok-dong rising by 5 to 15 million KRW. Conversely, high-priced apartment areas such as Songpa (-0.15%), Dongjak (-0.05%), and Gangnam (-0.04%) declined. In Songpa, Jugong 5 Complex, Lake Palace, and Jamsil Parkrio in Sincheon-dong fell by 15 to 30 million KRW. In Dongjak, Acro Riverheim in Heukseok-dong, which moved in 2018, was adjusted downward by 40 million KRW. In Gangnam, reconstruction complexes such as Eunma and Hanbo Mido Mansion 1 and 2 in Daechi-dong dropped by 5 to 75 million KRW.

New towns rose in the order of Dongtan (0.06%), Gwanggyo (0.04%), Bundang (0.03%), Pyeongchon (0.03%), and Sanbon (0.02%). In Dongtan, Cheonggye-dong Simbeom Yemi-ji, Bansong-dong Metapolis, and Neungdong Dongtan Supsok Maeul Jayeon & Gyeongnam Honorsville increased by 5 to 45 million KRW, mainly in medium to large-sized units. In Gwanggyo, after the supply was exhausted, Gwanggyo Hoban Verdi-um in Woncheon-dong and Gwanggyo Lake Park Hanyang Sujain in Hadong rose by 5 to 10 million KRW. In Bundang, Simbeom Samsung and Hanshin in Seohyeon-dong, and Mujigae 3rd Complex Shinhan and Geonyeong in Gumi-dong increased by 5 to 10 million KRW. In Pyeongchon, Choweon Daerim in Pyeongchon-dong and Mugunghwa Taeyoung in Hogye-dong rose by 5 million KRW.

In Gyeonggi and Incheon, areas with increased expectations for transportation improvements, such as the preliminary feasibility approval for the southern extension of the Shinbundang Line (Gwanggyo Central-Homaesil), led the rise. By region, Suwon (0.29%), Yongin (0.16%), Uiwang (0.11%), Gwangmyeong (0.10%), Anyang (0.09%), and Incheon (0.07%) rose. In Suwon, due to expectations from transportation benefits, transactions continued, with Homaesil GS in Homaesil-dong and Hanjin Hyundai in Hwaseo-dong rising by 10 to 20 million KRW. In Yongin, Samsung Raemian 1st in Samgeo Village, Mabuk-dong, LG Village 1st in Seongdong Village, Seongbok-dong, and Shindongbaek Seohae Grand Blue 2nd in Jung-dong increased by 10 to 25 million KRW. In Uiwang, large complexes such as Poil Xi in Naeson-dong and Uiwang Naeson e-Pyeonhansesang rose by 5 million KRW. In Gwangmyeong, Prugio Haneulchae in Cheolsan-dong and Jugong 10 and 12 Complexes in Haan-dong increased by 2.5 to 10 million KRW, mainly in medium to large-sized units.

The jeonse (long-term lease) market saw localized decreases in inquiries due to the impact of COVID-19, but in Seoul, the shortage of listings continued, leading to a 0.06% increase. New towns rose by 0.02%, maintaining a similar trend to the previous week. Gyeonggi and Incheon rose by 0.04%, an increase from last week's 0.01%.

In Seoul, with jeonse listings scarce, prices rose in the order of Songpa (0.15%), Gangseo (0.12%), Gangbuk (0.10%), Seongbuk (0.08%), Gangnam (0.07%), Gangdong (0.07%), Mapo (0.07%), and Seocho (0.07%). In Songpa, Jamsil Els, Jugong 5 Complex, Jamsil Parkrio in Sincheon-dong, and Olympic Park Centreville in Ogeum-dong increased by 5 to 20 million KRW. In Gangseo, Wujangsan IPARK and e-Pyeonhansesang in Hwagok-dong, and Lotte Castle in Yeomchang-dong rose by 5 to 15 million KRW. In Gangbuk, Gyeongnam Honorsville and Hanil U&I in Mia-dong increased by 5 to 10 million KRW. In Gangnam, Yeoksam Prugio, Yeoksam e-Pyeonhansesang, Gaenari Raemian, and Acro Hills Nonhyeon in Nonhyeon-dong rose by 5 to 25 million KRW.

New towns rose in the order of Bundang (0.06%), Gwanggyo (0.04%), Pyeongchon (0.03%), Sanbon (0.02%), and Jung-dong (0.01%). In Bundang, Jeongja-dong Jeongdeun Dong-A 2nd Complex and Mujigae Cheonggu and Mujigae Daerim in Gumi-dong increased by 5 to 10 million KRW. In Gwanggyo, Gwanggyo Lake Park Hanyang Sujain in Hadong rose by 5 million KRW. In Pyeongchon, demand flowed into Gongjak Booyoung near Pyeongchon Station on Subway Line 4 and nearby amenities in Gwanyang-dong, leading to a 5 million KRW increase. In Sanbon, Sinan Moran in Sanbon-dong rose by 5 million KRW.

In Gyeonggi and Incheon, jeonse prices rose alongside the sharp increases in sale prices. By region, Suwon (0.09%), Yongin (0.08%), Gwangmyeong (0.04%), Siheung (0.04%), Uiwang (0.03%), Hanam (0.03%), and Pyeongtaek (0.03%) rose. In Suwon, Suwon LH Central Town 1 and 3 Complexes in Seryu-dong, Maetan Hyundai Hillstate in Maetan-dong, and Neulpureun Byeoksan in Mangpo-dong increased by 5 to 10 million KRW. In Yongin, medium to large-sized units such as Shindongbaek Seohae Grand Blue 1st in Jung-dong, Sujin Village 1st Complex Sunny Valley in Dongcheon-dong, and Yeonwon Village Seongwon in Bojeong-dong rose by 5 to 10 million KRW. In Gwangmyeong, demand flowed into large complexes, with Prugio Haneulchae in Cheolsan-dong and Jugong 12 Complex rising by 5 to 10 million KRW.

Recently, the government reviewed housing market trends in some metropolitan areas showing overheating after the December 16 measures and considered additional measures. Accordingly, some areas including Suwon, where housing prices rose sharply due to transportation benefits such as the Shinbundang Line and redevelopment projects in old downtown areas, as well as Yongin, are expected to be included in the regulation targets. Yeokyunghee, Senior Researcher at Real Estate 114, said, "Strengthening monitoring of the housing market and investigating the sources of funds for high-priced apartment transactions are expected to function as brakes on housing price instability, but there are concerns about side effects where demand moves to other areas to avoid regulations." She predicted that the jeonse market, overall facing a shortage of listings, will likely continue an unstable trend for some time as demand moves during the spring moving season, especially in areas close to workplaces and with good school districts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.