Impact of Liquidity Controversies Including Lime Crisis

Full Implementation of Soundness Inspection Within Q2

Funds with Poor Results to Be Suspended from Subscription and Sales

[Asia Economy Reporter Park Jihwan] Financial authorities have decided to fully implement a 'stress test' system in the second quarter to resolve liquidity issues in private equity funds that surfaced following the Lime Asset Management incident, which caused a fund redemption suspension crisis worth approximately 1.6 trillion KRW. Going forward, asset management companies will be proactively monitored for timely responses to investors' redemption requests.

On the 14th, the Financial Services Commission and the Financial Supervisory Service announced the 'Private Equity Fund System Improvement Plan' based on these points. The financial authorities pointed out that a direct cause of the recent Lime redemption suspension incident was operating an open-ended fund despite a high proportion of illiquid asset investments.

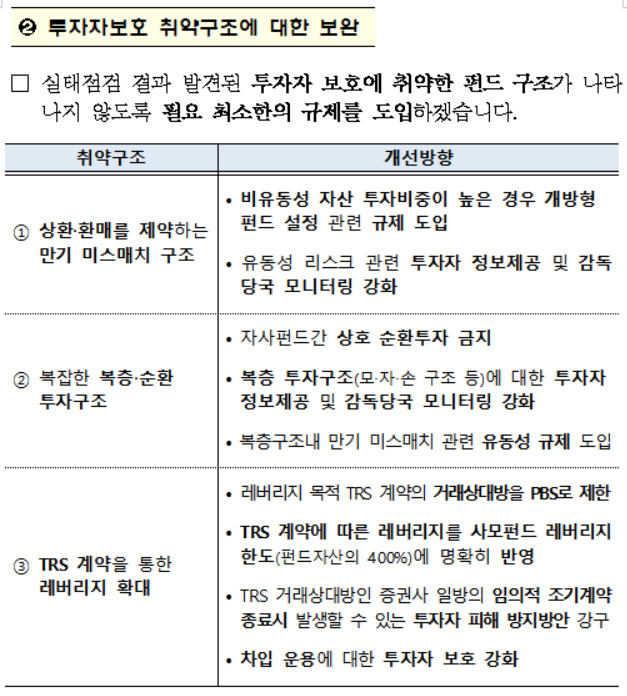

Kim Jeonggak, Capital Market Policy Officer at the Financial Services Commission, stated, "Due to a maturity mismatch structure that restricts redemption and repayment, it was difficult to respond to investors' redemption requests during fund setup and management, causing liquidity problems."

Accordingly, the financial authorities will introduce regulations related to the establishment of open-ended funds for funds with a high proportion of illiquid asset investments, applicable to both public and private equity funds. Specifically, setting up open-ended funds will be prohibited if the illiquid asset investment ratio exceeds 50%.

Additionally, the financial authorities will mandate periodic liquidity stress tests for open-ended funds. Based on the test results, asset managers must establish liquidity risk contingency plans, including risk response measures and cooperation plans with custodians, investors, and administrative service providers. If liquidity concerns arise from the stress test results, measures to suspend subscription and sales of the relevant fund through consultation with private equity fund managers must also be prepared.

Measures to eradicate 'nominal private equity funds' that appeared in the Lime incident have also been prepared. This is to block the practice of selling public funds in the guise of private equity funds. If a fund with identical or similar underlying assets and profit-loss structures is sold to more than 50 people within six months, it will be principally regarded as a public offering.

Plans to resolve information asymmetry between investors, sellers, and asset managers are also included. Investor information provision obligations will be strengthened so that investors can invest in private equity funds based on the principle of self-responsibility. Sellers must inform qualified general investors of key information such as liquidity risks and whether the fund involves layered structures when recommending investments. In particular, for layered investment funds, information on investment structure, final underlying assets, costs, and risks must be provided to investors, and mutual circular investments among the company's funds are prohibited. Asset managers must provide quarterly asset management reports to individual investors.

Supplementary measures for leverage investments, which exacerbated investor damage in the Lime incident, have also been prepared. The counterparties for total return swap (TRS) contracts for leverage purposes will be limited to securities firms' prime brokerage services (PBS). Moreover, the leverage ratio under TRS contracts will be clearly capped at 400% of the fund's assets. Measures to prevent investor damage caused by unilateral early termination of contracts by securities firms, the TRS counterparties, will also be established.

Furthermore, to prepare for financial accidents, the minimum compensation liability capacity of specialized private equity fund managers will be expanded. Instead of only maintaining the existing minimum capital of 700 million KRW, additional capital must be accumulated proportionally to the entrusted assets.

The financial authorities will promptly conduct fact-finding investigations on dispute resolutions related to incomplete sales in connection with Lime Asset Management's redemption suspension incident. As of the 7th of this month, 214 dispute resolution applications have been received. If incomplete sales violations are confirmed, inspections of fund sellers such as banks and securities firms will also be conducted.

Based on this system improvement direction, the Financial Services Commission plans to finalize and announce detailed system improvement measures next month after gathering opinions from stakeholders and experts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)