Similar to Just Before the Daewoo Shipbuilding & Marine Engineering Collapse

[Asia Economy Reporter Lim Jeong-su] Park Yong-jin, a member of the Democratic Party of Korea (Seoul Gangbuk-eul, former National Assembly Committee on Economy and Finance), urged the Financial Supervisory Service (FSS) to conduct an audit, citing serious signs of insolvency at Doosan Heavy Industries.

On the 14th, Park claimed through the 'Analysis Results of Doosan Heavy Industries' Financial Statements and Audit Reports' that the amount of insolvency at Doosan Heavy Industries is estimated to be approximately 1.0888 trillion KRW, and there are suspicions of violations of the FSS's accounting treatment guidelines.

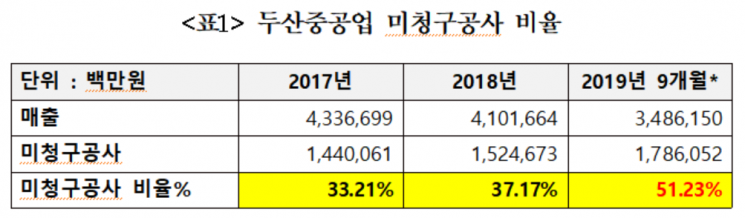

According to the data, the ratio of unbilled construction work on Doosan Heavy Industries' financial statements exceeded 51% as of the end of the third quarter of 2019. Converted into an amount, it reaches 1.786 trillion KRW. Unbilled construction work refers to the amount for which construction costs have not been requested.

This usually occurs due to a lack of agreement between the client and the contractor (construction company) on the progress rate of the construction. For example, in a project with a total construction cost of 100 billion KRW, if the contractor has completed 20% of the work and billed 20 billion KRW, but the client recognizes only 15% completion, then only 15 billion KRW is paid as construction fees, and 5 billion KRW is treated as unbilled construction work.

As of the end of the third quarter last year, Doosan Heavy Industries' sales amounted to 3.4861 trillion KRW. The normal range of unbilled construction work at 20% is estimated to be 697.2 billion KRW. It is analyzed that Doosan Heavy Industries overestimated the progress rate of construction internally, overstating sales by more than 1 trillion KRW, and thus the insolvency is expected to be significant.

As of the end of 2018, the ratio of unbilled construction work to loans was about 6% for Samsung C&T, 8% for Daelim Industrial, 14% for GS Construction, and 16% for Hyundai Construction. Park said, "Experts generally consider an unbilled construction work ratio around 20% to be normal," and pointed out that "Doosan Heavy Industries' unbilled construction work ratio is excessively high compared to other construction companies."

Park also claimed that Doosan Heavy Industries is violating the FSS guidelines.

After the accounting fraud incident at Daewoo Shipbuilding & Marine Engineering, the FSS announced the 'Measures to Enhance Accounting Transparency in the Order-based Industry' to prepare for risks unique to the order-based industry. When reflecting company estimates such as construction progress rates in the books, the verification details by external experts must be included in the audit report. However, Park explained that Doosan Heavy Industries' audit report lacks verification details by external experts.

He stated, "Not only unbilled construction work but also various indicators confirm that Doosan Heavy Industries has significant insolvency," and pointed out, "Since the insolvency has increased during the expansion of coal-fired power generation projects supported by public financial institutions such as the Korea Development Bank and the Export-Import Bank of Korea, there is a high possibility of waste of taxpayers' money."

He also argued, "It has been revealed that the FSS guidelines were not followed," and said, "If the FSS issues guidelines but does not verify compliance, it is tantamount to neglect of duty."

In this regard, a Doosan Heavy Industries official said, "We have received the insolvency-related materials from Representative Park and are currently reviewing the contents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)