[Asia Economy Reporter Moon Jiwon] If Suwon, Yongin, and Seongnam (collectively known as 'Su-Yong-Seong') are designated as adjusted target areas, various regulations such as loans and taxes will apply. Since the regulatory intensity on adjusted target areas has increased compared to the past, it is analyzed that the rise in housing prices will slow down somewhat.

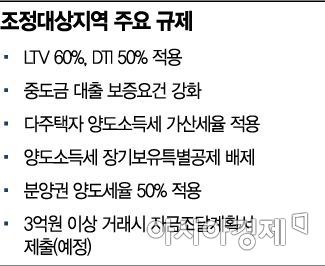

Once designated as an adjusted target area, the loan-to-value ratio (LTV) for mortgage loans will be lowered from 70% to 60%. Additionally, the debt-to-income ratio (DTI) will be strengthened to 50%, and the requirements for interim payment loans will become stricter. Furthermore, capital gains tax will be increased for multi-homeowners, and the long-term holding special deduction, which reduces the capital gains tax base depending on the holding period, will be excluded. Although not as strict as speculative overheated districts, the burden in terms of loans and taxes will increase, making it more difficult for buyers without sufficient funds to purchase homes.

In particular, starting next month, submitting a funding plan will be mandatory when trading houses priced over 300 million KRW even in adjusted target areas. Currently, the submission of funding plans is limited to houses over 300 million KRW in speculative overheated districts, but the government expanded this to houses over 300 million KRW in speculative overheated and adjusted target areas, and over 600 million KRW in non-regulated areas through the December 16 measures.

Experts also predict that with strengthened loan regulations and funding investigations in Su-Yong-Seong, it will become significantly harder for genuine buyers to secure their own homes. In the past, if loans were not available, some 'workarounds' such as raising funds through family members were somewhat possible, but recently, due to the government's strengthened investigations, even this has become difficult. The government plans to increase monitoring intensity by soon establishing the 'Real Estate Market Illegal Activities Response Team' directly under the Vice Minister of Land, Infrastructure and Transport, and the 'Permanent Real Transaction Investigation Team' under the Korea Appraisal Board.

Some analysts do not rule out the possibility that the government may immediately designate these areas as speculative overheated districts depending on the rapid rise in housing prices. If designated as speculative overheated districts, LTV and DTI will be further strengthened to 40%, and when trading houses exceeding 900 million KRW, up to 15 types of documents including funding plans, deposit balance certificates, tax payment certificates, and debt certificates must be submitted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.