(File photo)

[Asia Economy Reporters Yuri Kim, Donghyun Choi] The government is considering designating the Suwon, Yongin, and Seongnam areas (commonly known as 'Su-Yong-Seong'), where housing prices have surged due to the 'balloon effect' of the December 16 real estate measures last year, as regulated zones. However, there is growing controversy in the market over the effectiveness of these 'pinpoint regulations.' Experts point out that mole-whacking style regulations may only create a second Su-Yong-Seong. They explain that fundamental measures, such as securing alternative investment destinations for the overflowing liquidity in the market amid a low-interest rate environment, must accompany these regulations.

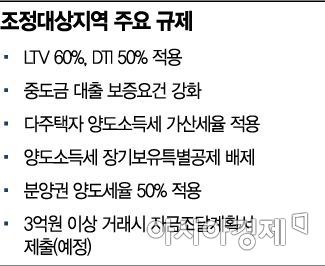

According to the Ministry of Land, Infrastructure and Transport and industry sources on the 14th, the areas within Su-Yong-Seong most likely to be designated as adjusted target areas are Suwon’s Gwonseon, Yeongtong, and Jangan districts. Previously, Paldal-gu and Gwanggyo district in Suwon, Suji and Giheung districts in Yongin, and the entire Seongnam area have already been designated as adjusted target areas. Experts expect that if additional designations are made, housing prices in these areas will see a short-term slowdown in their steep rise.

However, experts unanimously agree that strengthening regulations in these areas could instead trigger another balloon effect in housing price increases. After the December 16 measures, regulations tightened, including blocking loans for homes exceeding 1.5 billion KRW in speculative and overheated speculation zones, which led to overheating in housing prices in Suwon and Yongin. Buyers have focused on improvements in transportation conditions such as the extension of the Shinbundang Line and construction of the Indeokwon Line, as well as redevelopment benefits. If these areas are regulated, the market liquidity is expected to flow to other areas with favorable conditions. This highlights the limitations of the so-called 'pinpoint designation' experts mention.

Ham Young-jin, head of the Zigbang Big Data Lab, pointed out the limitations of mole-whacking style measures, saying, "With Seoul fully blocked and regulations spreading to places like Gwacheon, Hanam, and Gwangmyeong, interest is shifting southward," referring to the repeated cycle of soaring housing prices and regulations. He explained, "The overflowing money will seek similar favorable conditions." Heo Yoon-kyung, head of the Housing and Urban Research Division at the Korea Research Institute for Construction Industry, also said, "It is difficult to control housing prices unless interest rates are raised. However, interest rates must be decided comprehensively considering the overall economy, so it is a problem that is hard to solve in the short term."

Seo Jin-hyung, president of the Korea Real Estate Society and professor at Gyeongin Women's University, argued that there are limits to the government's pinpoint regulations. He diagnosed, "Last year's private land price ceiling system also started as a pinpoint measure but ended up spreading to most areas. If only parts of Su-Yong-Seong are regulated, balloon effects will inevitably occur in surrounding areas or other regions such as Incheon and Bucheon."

There were also criticisms that the government's impression after the December 16 measures?that "anything can be done if signs of rapid price increases appear"?has intensified market uncertainty and fear, thereby worsening distortions. Shim Kyo-eon, professor of real estate at Konkuk University, advised, "It is necessary to accurately analyze whether the price surge in some areas is a trend or a temporary event. Simply designating areas because prices have risen will cause funds to move to other markets such as land. Regulations without accompanying market trust will deepen distortions."

For these reasons, experts emphasize the need for fundamental measures to resolve excess liquidity, which is the root cause of localized housing price increases. Yang Ji-young, director of Yang Ji-young R&C Research Institute, stressed, "In a situation where there are not many places for funds to go, investors still have the expectation that 'real estate prices will rise' based on past learning effects. The fundamental causes such as supply shortages must be addressed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)