Apartment Regulation Balloon Effect

Land Transactions in the Seoul Metropolitan Area Total 1.1 Trillion Won

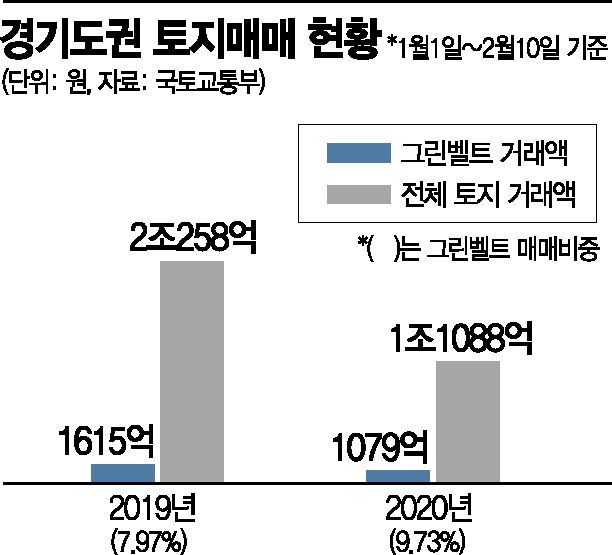

9.7% of This Is Greenbelt

Concentration of Land Around 3rd New Towns

[Asia Economy Reporter Choi Dong-hyun] It has been revealed that massive funds have been flowing into the development-restricted areas (Greenbelt) around Gyeonggi Province since the beginning of the year. As the soaring apartment prices in Seoul have slowed down due to the government's stringent regulations, it is understood that liquidity in the market is seeping into lands around the 3rd New Towns. In this process, land share transactions suspected of involving speculative real estate agents have also increased, requiring investors to exercise caution.

According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system on the 14th, about 1.1088 trillion KRW worth of land was traded in the Gyeonggi area from the beginning of the year until the 10th. Among these, Greenbelt land accounted for 107.9 billion KRW, or 9.73%. During the same period last year, Greenbelt land accounted for 161.5 billion KRW, or 7.97%, out of the total land transaction amount of 2.0258 trillion KRW. Considering that the real estate contract reporting period is 60 days, experts analyze that the volume of Greenbelt land transactions in Gyeonggi Province this year is continuing at a level comparable to last year's record high.

Land investments are mainly concentrated around large-scale development projects. The main target areas include the 3rd New Towns such as Namyangju Wangsuk, Goyang Changneung, Hanam Gyosan, Bucheon Daejang, as well as housing development districts like Siheung Geomo and Hajung, Gwacheon Knowledge Information Town, Ansan Jangsang, and Yongin Guseong. At the end of last month, an investment of about 4 billion KRW, the largest single parcel transaction to date, was made in Jeongwang-dong, Siheung City. Jeongwang-dong is located between the planned Geomo District development project site and the Pyeongtaek-Siheung Expressway. Massive investment funds are also flowing into the Greenbelt around Yongdu-dong, Deogyang-gu, adjacent to Goyang City's Changneung District. The land transaction amount in Yongdu-dong is 11.5 billion KRW, accounting for 10.65% of the total Greenbelt land in Gyeonggi Province this year.

Greenbelt areas in regions where the government and local governments have established large-scale development plans are generally designated as land transaction permission zones or development activity restriction areas, making transactions complicated. Instead, surrounding lands typically see prices soar due to expectations of development benefits. Mr. A, a land transaction specialist instructor, said, "Among land investors, the surrounding commercial areas attract more attention than the government-developed housing sites," adding, "Even if the Greenbelt is lifted later, the market price of residential land or farmland where buildings can be constructed immediately is formed at three to four times higher than that of forest land, which may not be developed."

So-called 'parcel splitting' suspected share transactions are also rampant. Among 1,891 Greenbelt parcels traded in Gyeonggi Province this year, 843 cases, accounting for 78.9%, were share-type transactions. During the same period last year, 83.2% (1,575 cases) of the total 1,891 transactions were conducted in this manner. In fact, advertisements for trading Greenbelt land in the 3rd New Towns can be easily found on blogs or real estate investment online communities on internet portal sites. One advertisement offered shares of Greenbelt farmland and isolated land in Hwajeong-dong, Deogyang-gu, Goyang City, at 1 million KRW per 3.3㎡, enticing investment by attaching photos of road construction projects reminiscent of transportation development benefits.

Experts expect that land transactions in Gyeonggi Province, including Greenbelt areas, are likely to record an all-time high this year. This is because a record-breaking 45 trillion KRW in land compensation is expected to be released, with about 38 trillion KRW, or 80%, concentrated in the metropolitan area. If this astronomical land compensation money flows back into real estate, it could act as a catalyst to raise not only land prices but also housing prices. Especially this year, with the development of the metropolitan area express railroad (GTX) and various development pledges pouring out during the April general elections, there is a high risk of fueling such a mood. Shin Tae-soo, CEO of Jijeon, said, "Although the land compensation money has not yet been released, 'early purchase' around the 3rd New Towns is trending, with investors taking loans secured by land to invest in lands near development sites," adding, "Due to government revenue decline and Korea Land & Housing Corporation (LH)'s expanding deficits, it is difficult to prepare incentives for land compensation in kind, so the land price increase rate in the metropolitan area this year is expected to record an all-time high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)