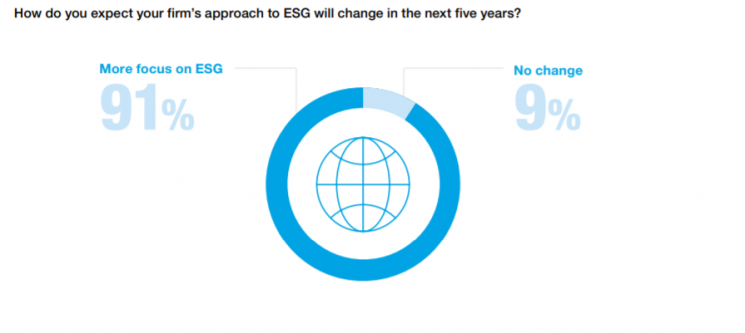

[Asia Economy Reporter Minji Lee] Macquarie Infrastructure and Real Assets (MIRA) announced on the 13th that 91% of investors in the real assets sector expect investments in Environmental, Social, and Corporate Governance (ESG) areas to strengthen within the next five years.

This survey was conducted among more than 150 institutional investors worldwide, managing a total of $20 trillion in assets. 91% of respondents plan to enhance ESG-related matters over the next five years, a significant increase compared to 58% in the survey conducted five years ago. Additionally, 78% of respondents agreed that sustainability strategies improve investment performance.

A MIRA representative explained, "Investors will pursue sustainable investments based on an 'investment exclusion' ESG model, such as not investing in coal businesses."

However, a lack of internal capabilities is acting as an obstacle to ESG investment. This means that despite active demands for establishing and applying policies in the ESG sector, proper preparation has not been made.

The survey results showed that only 24% of U.S. investors and 21% of Asian investors reported having dedicated in-house ESG teams. This contrasts sharply with Europe, the Middle East, and Africa (EMEA) at 72%, and Australia at 71%.

Phil Peters, Head of Client Solutions at Macquarie Asset Management Group, said, "As consensus forms around sustainability investment strategies that provide value to investors and bring positive change to communities, investors in the real assets sector are also facing a major turning point. To seize this opportunity, the industry must close ESG capability gaps and significantly improve measurement and reporting methods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.