Conflicting Investment Opinions and Target Prices for OCI, CJ CGV, Hanssem, etc.

Careful Review Needed Due to Changing Environment

[Asia Economy Reporter Song Hwajeong] As companies continue to announce their fourth-quarter earnings for last year, securities firms are releasing numerous corporate analysis reports, with some stocks showing divergent investment opinions and target prices depending on the securities firm. Given the changes in companies' earnings and business environments, investors are advised to carefully review various reports before making investment decisions.

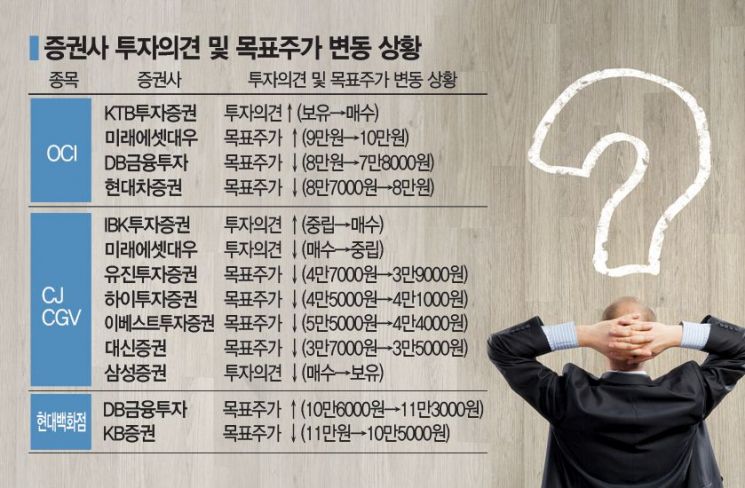

According to financial information provider FnGuide on the 13th, among the five reports presenting investment opinions and target prices for OCI, which announced its earnings on the 11th, one firm upgraded its investment opinion and one raised its target price. Conversely, two firms lowered their target prices. Notably, KTB Investment & Securities upgraded its investment opinion from "Hold" to "Buy" but lowered the target price from 88,000 KRW to 85,000 KRW.

Lee Hee-cheol, a researcher at KTB Investment & Securities, stated, "OCI recorded a large-scale loss in the fourth quarter of last year due to impairment losses related to its domestic polysilicon plant, and operating profit also declined due to price drops and inventory losses, expanding the deficit. However, a turnaround in performance is expected due to reduced depreciation expenses from asset write-downs, cost improvements at the Malaysian plant, and expanded sales of semiconductor-grade polysilicon domestically." He added, "Considering the lowered profits and asset values, the target price was slightly adjusted downward. However, given the expected recovery in operating profit and return on equity (ROE) after the first half of the year and the relatively low stock price compared to the past, the investment opinion was raised to Buy."

Mirae Asset Daewoo raised the target price for OCI, citing anticipated positive momentum. Park Yeon-ju, a researcher at Mirae Asset Daewoo, said, "Although the fourth-quarter earnings were weak due to large-scale amortization, the stock price momentum appears to have passed the bottom, and positive momentum is expected with the recovery of polysilicon prices and improved cost competitiveness." She added, "Reflecting the improved cost competitiveness in the polysilicon segment, we upgraded the business value of this segment and raised the target price by 11%."

On the other hand, DB Financial Investment lowered the target price reflecting the decline in book value per share (BPS) due to large impairment losses, and Hyundai Motor Securities downgraded the target price considering uncertainties in earnings related to potential costs from business suspension.

The same day, CJ CGV also saw mixed investment opinions. While most securities firms lowered their target prices, IBK Investment & Securities upgraded its investment opinion, and Mirae Asset Daewoo and Samsung Securities downgraded theirs. Park Yong-hee, a researcher at IBK Investment & Securities, stated, "CJ CGV's stock price sharply declined due to the recently worsened short-term business environment. The gap between the target price and the current stock price exceeds 20%, leading us to upgrade the investment opinion to Buy." Choi Min-ha, a researcher at Samsung Securities, explained, "Although there is clear business value in each region, limiting downside at the current stock price, structural market changes in the cinema industry, deteriorating business conditions, and financial burdens suggest limited upside, so we downgraded to Hold."

KB Securities raised the target price for Hanssem but did not recommend buying. On the 10th, after Hanssem's earnings announcement, KB Securities released a report titled "Why We Do Not Recommend Buying Despite Strong Earnings," raising the target price by 10.6% to 73,000 KRW but maintaining a Hold rating. Jang Moon-jun, a researcher at KB Securities, said, "Despite strong fourth-quarter earnings, we maintain a conservative view on Hanssem. Although housing sales rebounded strongly in Q4, most sales channels except for Rehouse dealerships shrank, resulting in a 14.6% year-on-year decline in separate basis sales, indicating a potential weakening of control over sales channels excluding Rehouse. Given the expected continuation of an unfavorable market environment in 2020, profit margin recovery through cost efficiency improvements is likely limited." He added, "The strong Q4 performance also reflects one-time gains from consolidated subsidiaries and non-operating income, so further performance verification is needed. However, we raised the target price reflecting upward revisions in earnings estimates due to cost reductions and reduced losses in the Chinese subsidiary."

With investment opinions and target prices varying among securities firms, investors are advised to scrutinize reports more carefully. A securities firm researcher commented, "Target price calculations and investment opinions consider various factors such as current stock price, industry conditions, earnings, consolidated subsidiaries, and future outlook, so they can differ depending on the situation. Investors need to examine the variables in detail and make informed investment decisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.