[Asia Economy Reporter Yoo Hyun-seok] Hotel Shilla, which achieved record-high performance last year, has encountered a stumbling block in the form of the novel coronavirus infection (Wuhan pneumonia). The period when the Jeju Shilla Hotel had to close temporarily during the 2015 Middle East Respiratory Syndrome (MERS) outbreak, which affected its performance, is now looming like a nightmare. This adverse event, occurring amid aggressive expansion of the hotel business, is likely to increase financial burdens.

◆The stumbling block 'Novel Coronavirus' appearing for the thriving Hotel Shilla= Hotel Shilla recorded its highest-ever performance last year, with consolidated annual sales exceeding 5 trillion won for the first time since its establishment. Consolidated sales and operating profit were 5.7173 trillion won and 295.8 billion won, up 21.3% and 41.5% respectively from the previous year. However, before even announcing its record-high performance, it now faces concerns over its first-half results this year.

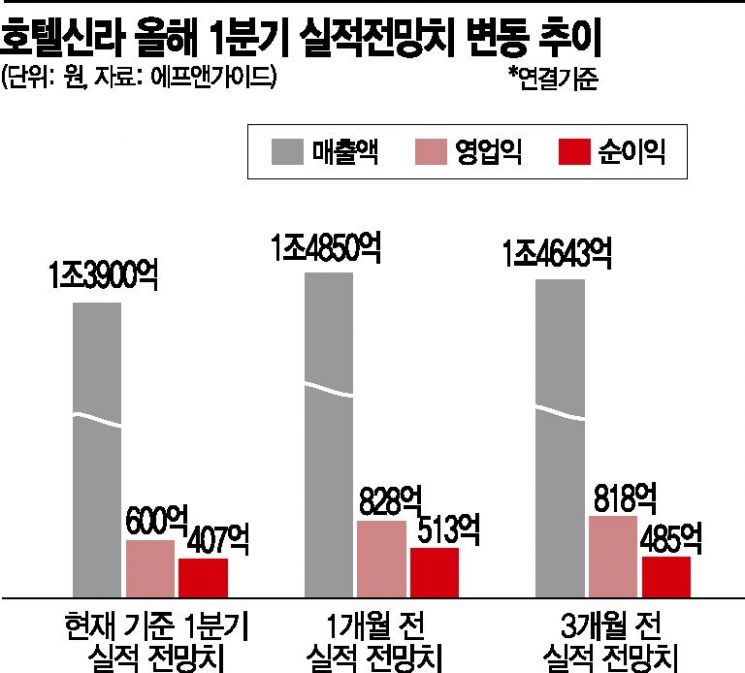

Recently, there are forecasts that Hotel Shilla's first-quarter operating profit may fall short of 10 billion won. Quarterly sales are also expected to dip below 1 trillion won. According to financial information provider FnGuide, the forecast for first-quarter sales and operating profit are 1.39 trillion won and 60 billion won respectively, but these projections are gradually declining as the novel coronavirus situation prolongs.

The prevailing analysis is that the performance shock will be greater than during MERS. In 2015, the Jeju Shilla Hotel had to suspend operations for about half a month after a MERS patient was confirmed to have stayed there. As a result, consolidated third-quarter sales and operating profit that year were 730.9 billion won and 2.8 billion won, down 7.7% and 95.1% respectively compared to the third quarter of 2014.

This time, the duty-free business is expected to suffer significant damage. The duty-free business accounts for over 90% of Hotel Shilla's total sales. The Shilla Duty Free Seoul branch temporarily closed from the 2nd following notification of a confirmed novel coronavirus patient visit. The Jeju branch, confirmed to have been visited by a Chinese patient diagnosed with the virus, also temporarily closed from the 2nd. After disinfection, it resumed operations on the 7th.

Considering that the Seoul branch's daily sales reach 8 to 10 billion won, it is estimated that the two locations will suffer sales losses exceeding 50 billion won over about five days. Furthermore, with the ongoing novel coronavirus situation, visits by daigou (Chinese personal shoppers) to duty-free shops have sharply declined, making sales recovery difficult despite reopening. Seo Jeong-yeon, a researcher at Shin Young Securities, analyzed, "The recent novel coronavirus outbreak has triggered emergency signals across the duty-free industry’s operating environment. The temporary closure of the Jangchung Seoul branch, confirmed to have been visited by a confirmed patient, and the impact on the Jeju branch, which has a high proportion of Chinese sales due to the visa-free entry ban, cannot be overlooked."

Overseas duty-free shops where Hotel Shilla has entered, such as Singapore Changi Airport and Hong Kong Chek Lap Kok Airport, are also expected to experience performance declines. During the MERS outbreak in the third quarter of 2015, the Changi Airport duty-free shop recorded a quarterly operating loss of 140 billion won, impacting Hotel Shilla’s performance.

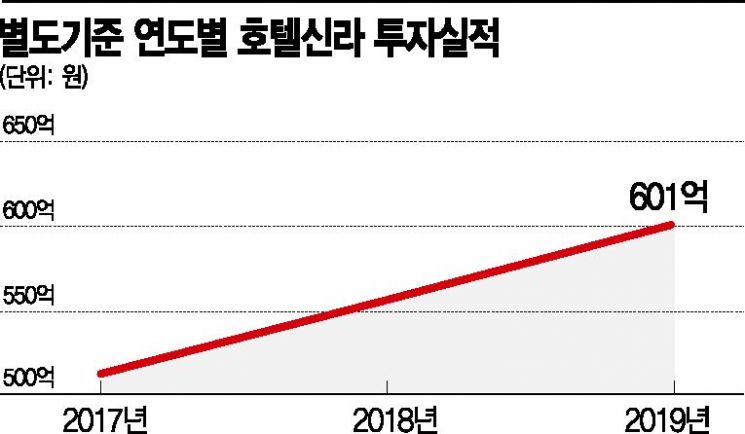

◆Cash flow shock amid hotel business expansion... Financial improvement 'halted'= While increasing investments in the hotel business, concerns are rising that cash flow reductions due to the novel coronavirus will negatively affect the financial situation.

Hotel Shilla is expanding its hotel business under the leadership of CEO Lee. It has established three hotel brand systems: 'The Shilla,' 'Shilla Monogram,' and 'Shilla Stay,' and is preparing for overseas expansion. It plans to open 'Shilla Monogram Danang' in Danang, Vietnam, within the first half of this year.

It plans to enter more than ten overseas locations including Southeast Asia, the United States, and China, and will open 'Shilla Stay San Jose' in San Jose, home to Silicon Valley, in 2021. Domestically, it is preparing a hanok (traditional Korean house) hotel. In October last year, the hanok hotel passed architectural review by the Seoul City Architectural Committee. Approximately 300 billion won is expected to be invested in constructing the hanok hotel.

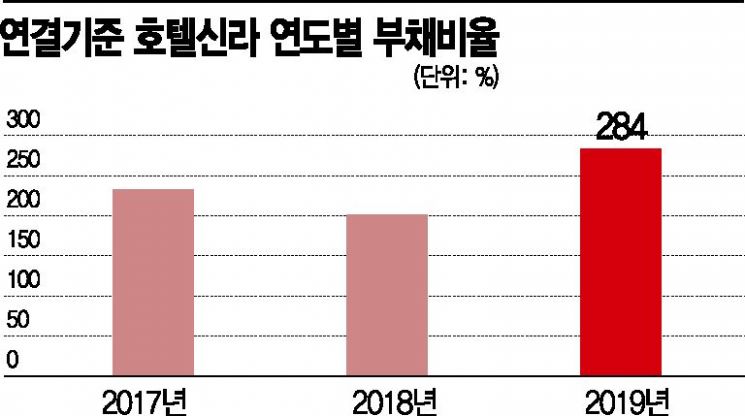

As investment increases due to business expansion, financial burdens are also rising. Consolidated borrowings, which were only in the 600 billion won range until the second quarter of last year, increased to 1.9035 trillion won by the end of the third quarter. This sudden increase in borrowings is due to existing lease liabilities being recognized as borrowings. Hotel Shilla has been leasing airport duty-free shops and business hotels like Shilla Stay. To rapidly expand new businesses, securing business sites through long-term leases has been pursued.

Additionally, it is analyzed that the actual borrowing burden has been continuously increasing. Net borrowings excluding cash equivalents amount to about 1.4265 trillion won. A credit rating agency official evaluated, "Hotel Shilla has been significantly affected by accounting standard changes due to extensive use of leases for rapid expansion. Borrowings including leases have steadily increased."

The future outlook is also challenging. Even if the novel coronavirus situation subsides, competitors are pushing to enter downtown duty-free shops. A securities firm researcher said, "Performance and cash flow are expected to recover from the second quarter when the novel coronavirus situation eases," but added, "The business environment is not entirely favorable due to new downtown duty-free shop entries by Hyundai Department Store and others."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)