[Asia Economy Reporter Park Hyungsoo] Hana Tour, which was set to pioneer the global travel market in earnest by partnering with domestic private equity firm IMM Private Equity (PE), has hit a snag. Overseas travel demand plummeted just over a month after the outbreak of the novel coronavirus infection (Wuhan pneumonia).

According to the Financial Supervisory Service's electronic disclosure system on the 12th, Hana Tour held a board meeting on December 23 last year and lowered the issuance price of new shares for the paid-in capital increase by about 4.3%, from the original 58,000 KRW to 55,500 KRW. The amount of capital invested by IMM PE also decreased from 134.7 billion KRW to 128.9 billion KRW. Hana Tour plans to use the raised funds for overseas investments aimed at securing global infrastructure and collecting content. Once the paid-in capital increase is completed, IMM PE will become the largest shareholder, holding 16.7% (2,323,000 shares) of Hana Tour's shares.

Hana Tour and IMM PE adjusted the new share issuance price considering that the domestic travel industry may not emerge from the recession tunnel for the time being due to the global spread of the novel coronavirus. On the 10th, Hana Tour's stock price was 48,600 KRW, down 4.9% from the closing price of 51,100 KRW on December 23 last year, when the paid-in capital increase was first resolved.

The investment banking (IB) industry believes that if the Chinese government had disclosed the outbreak of the novel coronavirus immediately after the patient was detected, IMM PE might have postponed the investment or invested under more favorable conditions than the current ones. The Chinese government disclosed the outbreak of the novel coronavirus at the end of last year. The first patient in Wuhan, China, was detected on December 12 last year. The announcement was delayed by nearly three weeks, and the Chinese government has been criticized for failing to respond properly in the early stages.

In Korea, the first confirmed case of the novel coronavirus occurred on the 20th of last month, and Hana Tour's stock price plunged more than 5% on the same day. Before the first confirmed case, Hana Tour's stock price was above 56,000 KRW but fell to 43,400 KRW at the beginning of this month. The rapid decline in Hana Tour's stock price was influenced by the learning effect from past outbreaks such as Severe Acute Respiratory Syndrome (SARS) and Middle East Respiratory Syndrome (MERS), when travel and airline stocks plummeted.

Not only has investment sentiment contracted, but changes that could affect Hana Tour's performance are also emerging. The number of package tour customers sent out by Hana Tour in January decreased by 50% compared to the same period last year. This is due to a decline in demand for travel to Japan amid deteriorating relations and a decrease in travel demand to China. The reservation rate for package tourists from February to April also dropped to half of the usual level. Ji Inhae, a researcher at Hanwha Investment & Securities, explained, "Last year, the proportion of Chinese travelers among Hana Tour's total travelers was 13%. Due to the impact of the novel coronavirus, cancellations of reservations by tourists planning to travel to China and neighboring Southeast Asian countries are continuing."

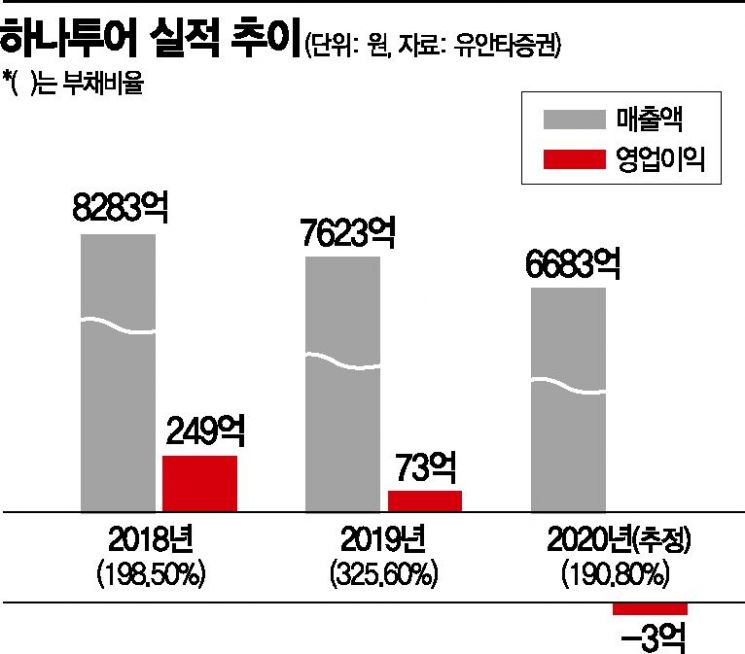

Hana Tour, which recorded an operating loss last year due to a sharp decline in Japanese travelers, is in a difficult situation to prepare self-help measures to overcome the crisis if IMM PE does not pay the capital increase funds by the 28th. Park Seongho, a researcher at Yuanta Securities, said, "Reflecting the sharp decline in travel demand in the first half of this year, we have lowered Hana Tour's consolidated operating profit forecast for this year from 27.8 billion KRW to a loss of 300 million KRW," adding, "We expect overseas travel demand to recover in the second half of the year."

With no way to predict how long the impact of the novel coronavirus will last, restructuring to improve the financial structure is inevitable. Earlier, Hana Tour received a credit rating from Korea Ratings in July last year to privately issue 70 billion KRW worth of corporate bonds.

Hana Tour maintained a virtually debt-free structure until the end of 2017. As of 2017 consolidated financial statements, Hana Tour's borrowings were only 25.5 billion KRW. In 2018, total borrowings exceeded 120 billion KRW due to new hotel-related finance lease liabilities in Tokyo, Japan, and won-denominated secured loans by the Japanese subsidiary for foreign exchange risk management. Last year, due to changes in accounting standards, operating leases worth 276.7 billion KRW were recognized as lease liabilities at once. As of September last year, total borrowings ballooned to 450.6 billion KRW. Net borrowings reached 138 billion KRW, breaking the debt-free structure. The debt ratio soared from 150.4% at the end of 2017 to 324.1%.

Although the financial structure has somewhat deteriorated, Korea Ratings evaluated the unsecured bond credit rating as A, as improvements appeared in existing loss-making business units such as duty-free and hotel sectors. The rating outlook was considered stable. Investors demanded a risk premium citing the downturn in the core travel business, but Hana Tour decided not to issue bonds to avoid increased financing costs. Having faced setbacks in funding plans, Hana Tour increased borrowings from financial institutions. The borrowing dependency rose to 46% as of September last year.

Lee Kihoon, a researcher at Hana Financial Investment, emphasized, "With IMM PE participating in management, intensive restructuring is expected," adding, "It is time to see whether the scale of restructuring over two to three years can justify shareholder value dilution caused by new share issuance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)