Most Income Goes to Principal and Interest Repayment... Consumption and Savings Shrink

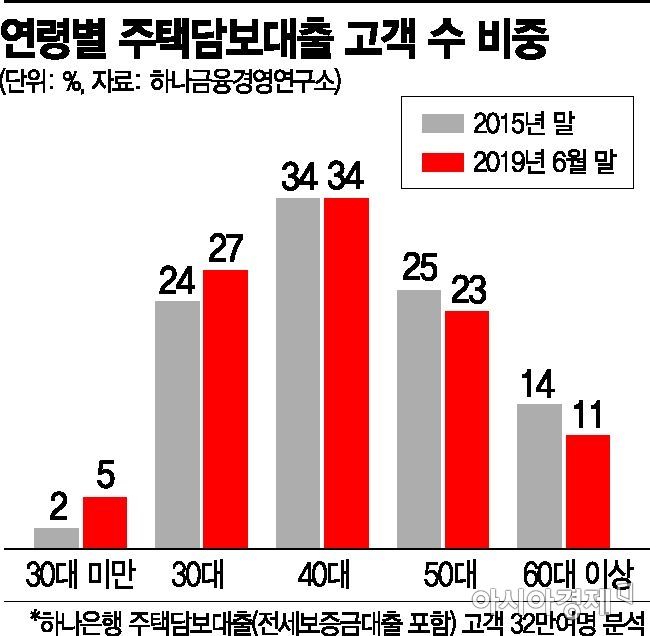

Share of Mortgage Loans for Under 30s Rises from 26% to 32% in 4 Years

Net Financial Assets of 30s and 40s Down 10 Million Won Last Year

[Asia Economy reporters Kangwook Cho and Minyoung Kim] The 30s and 40s age group, known as the "economic backbone," has been identified as the main driver behind the growth of household debt, the biggest risk factor for our economy. This group tends to take on excessive debt to buy homes, pouring most of their income into principal and interest repayments. As a result, not only consumption but also savings and financial assets have significantly shrunk.

According to the "Household Principal and Interest Repayment and Fund Management Behavior Review Report" released on the 12th by Hana Financial Management Research Institute, as of the end of June last year, 32% of customers who took out mortgage loans (including jeonse loans) from Hana Bank were aged 30 or younger, up 6 percentage points from 26% at the end of 2015. During the same period, the proportion of customers in their 40s remained steady at 34%, while those in their 50s and 60s and above decreased by 2 and 3 percentage points respectively over four years, recording 23% and 11%. This analysis was based on 322,500 customers who had taken out mortgage loans from the bank.

Kim Sujeong, senior researcher at Hana Financial Management Research Institute, analyzed, "This is the result of a complex interplay between real demand driven by family division and rising living costs, and the expansion of real estate investment demand among young people using debt."

In fact, according to data released last year by the Ministry of Land, Infrastructure and Transport and the Korea Real Estate Board, the proportion of apartment sales transactions in Seoul by age group showed that those in their 30s and 40s accounted for 28.8% and 28.7%, respectively, exceeding half of the total.

Moreover, more than 7 out of 10 households in their 30s and 40s were in debt. As of last year, 75.3% of households in their 30s and 76.0% in their 40s held debt, significantly higher than 72.1% for those in their 50s and 47.7% for those in their 60s. The proportion of indebted households under 30 also surged from 51.8% in 2014 to 57.0% in five years. For those in their 30s, the proportion increased by 2.2 percentage points compared to 2014.

The 30s and 40s, who went all-in on buying homes by incurring excessive debt, have seen their net financial assets (financial assets minus liabilities) sharply decline due to increased principal and interest repayment burdens and a steep drop in savings. Net financial assets of households in their 30s and 40s, which had risen to the mid-10 million KRW range in 2014, fell to negative 10 million KRW last year. All other age groups, excluding this group, maintained positive net financial assets. It is analyzed that while the 30s and 40s increased their assets by purchasing expensive homes with bank loans, most of their disposable income is spent on principal and interest repayments and living expenses.

It is not only the 30s and 40s. As debt increases, the number of customers at commercial banks who feel burdened by principal and interest repayments or have reached a risk level is rapidly growing. Comparing the distribution of borrowers by DSR (Debt Service Ratio) groups between the end of 2015 and the end of June last year, the stable group (DSR below 20%) decreased from 56% to 46%, while the livelihood burden group (DSR 20-40%) increased from 27% to 31%. Even the high-risk group (DSR above 40%) rose by 5 percentage points from 18% to 23%. High-risk households face heavy principal and interest repayment burdens and find it difficult to repay debts even by selling assets.

A more serious problem is that most indebted households are disposing of their current financial assets such as savings, trusts, and insurance to repay their debts. According to an examination of deposit and loan changes from the end of 2015 to the end of June last year for 167,000 customers of Hana Bank who simultaneously held mortgage loans and deposits of 1 million KRW or more, the high-risk group showed a decrease in the balance proportions of most financial products except bank deposits and housing subscription savings, including bancassurance (17%→13%), investment trusts (8%→7%), and trusts (17%→14%). In terms of amounts, while the DSR stable group showed an increase in balances across all product categories including short-term and income-generating products, the high-risk group experienced a sharp decline in deposits for all financial products except pension-type products. This suggests that in the high-risk group, balances in time deposits and insurance premiums have sharply decreased, indicating a significant number of early terminations of these products due to debt repayment burdens.

Senior researcher Kim stated, "The inducement of principal and interest installment repayments not only reduces the scale of household fund management but may also hinder the formation of financial assets in terms of returns." He added, "It also leads to a conclusion that debt repayment can strengthen the short-term tendency of market funds." He further pointed out, "From the perspective of financial institutions, they need to respond to the decrease in household deposits caused by debt reduction," emphasizing, "Especially for households just below the DSR threshold, enhanced risk management is required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.