Purpose of Providing Social Safety Net for Marginalized Groups

104 Local Governments Enroll in Citizen Safety Insurance

Lack of Promotion Raises Effectiveness Concerns

[Asia Economy Reporter Ki Ha-young] Local governments are increasingly subscribing to 'Citizen Safety Insurance,' which provides a minimum safety net in unexpected natural disasters and accidents. Although local governments take out insurance on behalf of individuals, there are criticisms that the system is ineffective due to insufficient promotion.

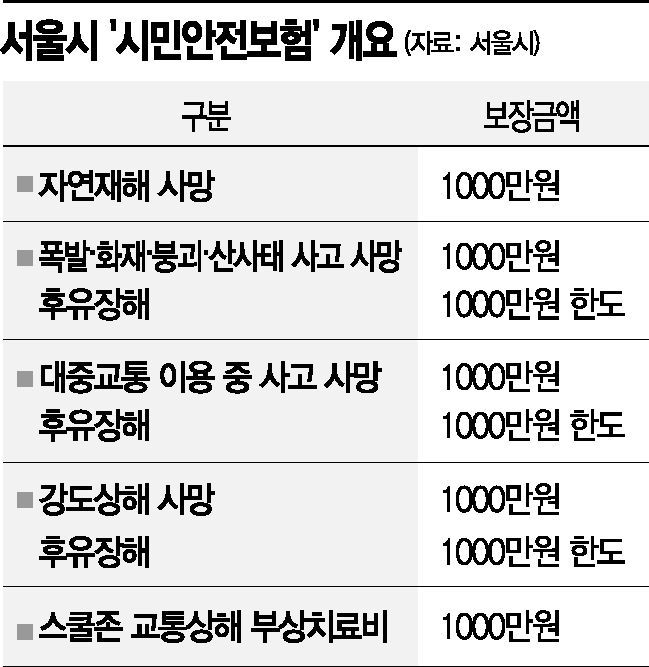

According to the insurance industry on the 12th, Seoul City started implementing 'Citizen Safety Insurance' this year, which pays up to 10 million KRW in insurance benefits from NH Nonghyup Property & Casualty Insurance, contracted with the city, to citizens who suffer damage from natural disasters, fires, collapses, and other safety accidents. Last year, Incheon City and Daegu City were the first metropolitan cities to introduce Citizen Safety Insurance. According to the General Insurance Association, as of 2018, 104 out of 226 local governments nationwide operate Citizen Safety Insurance.

Citizen Safety Insurance is a system where local governments directly contract with insurance companies to guarantee citizen safety. Although details vary by local government, it covers damages if a citizen dies or suffers permanent disability due to natural disasters, accidents, public transportation accidents, robbery, and more. Since the local government contracts with the insurance company on behalf of citizens, no separate enrollment procedure is required. The insurance premium is also fully paid by the local government. For example, in Seoul, any citizen registered in the city is automatically enrolled. Coverage can overlap even if the individual already has personal insurance.

However, insurance claims must be filed directly by the affected citizens to the insurance company. Even if the local government has subscribed to Citizen Safety Insurance, citizens cannot receive benefits unless they apply for insurance claims.

Local governments have introduced Citizen Safety Insurance with the purpose of providing a basic social safety net for marginalized and low-income groups. Recently, the coverage scope has been expanding beyond fires and disasters to include injuries. Last year, Suwon City became the first in the nation to introduce 'Accident Treatment Expense Support.' It reimburses up to 500,000 KRW for minor accidents and provides insurance benefits even if the accident occurs on facilities managed by Suwon City, such as roads, parks, and buildings. Because of this, some express concerns that Citizen Safety Insurance could be subject to abuse.

There is also ongoing controversy over the effectiveness due to lack of promotion. The fact that such an insurance system exists is not well known, resulting in relatively few insurance claims so far. An industry official said, "The number of local governments subscribing to Citizen Safety Insurance has been increasing in recent years and is expected to continue expanding. It is a useful system for citizens, but since many people are unaware of it, promotion must be strengthened for the system to take root."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)