Real Estate Development Investment Process in Limbo, Former Vice President Lee Jong-pil Reported to Prosecutors

Focus on 'Pluto FI D-1' with Most Investors...Low Recovery Rate

[Asia Economy Reporter Ji-hwan Park] Among the Lime Asset Management funds worth around 1.6 trillion KRW that have suspended redemptions, approximately 200 billion KRW has gone missing during the real estate development investment process. Financial authorities have detected embezzlement and breach of trust charges against former Lime Asset Management Vice President Jongpil Lee, who was responsible for fund management, and have handed over related materials to the prosecution.

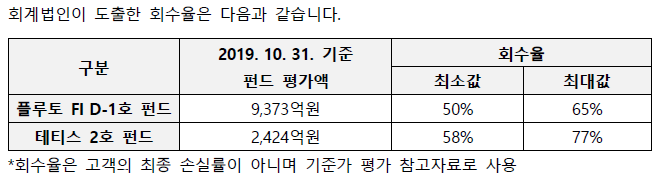

On the 11th, Lime Asset Management announced that the expected recovery rates for the suspended redemption mother funds 'Pluto FI D-1' and 'Tethys 2,' as received from Samil Accounting Corporation, which conducted the fund accounting audit, are approximately 50-65% and 58-77%, respectively. The valuation amounts of the two funds as of the end of October last year were 937.3 billion KRW for Pluto and 242.4 billion KRW for Tethys. Applying the expected recovery rates to the fund valuations, Pluto can recover between 468.7 billion and 609.2 billion KRW, and Tethys between 140.6 billion and 186.6 billion KRW.

Samil Accounting Corporation reportedly discovered a large number of assets suspected of embezzlement during the audit of Lime Asset Management funds. These mainly involved funds that flowed into domestic real estate finance and over-the-counter corporate bonds.

In particular, among the 250 billion KRW invested in the real estate developer Metropolitan, it was confirmed that the actual assets corresponding to 80%, or 200 billion KRW, are unclear. Metropolitan is a company currently pursuing real estate development projects in Hapjeong-dong, Seoul, and Jeju Island in South Korea. There are also suspicions that money flowed into nominee accounts during the acquisition of a resort and casino in Cebu, Philippines, and the sale of land in Suseong-dong, Daegu. In addition to real estate development matters, a significant amount of funds reportedly flowed out to some KOSDAQ-listed companies.

The investment funds in question were found to be heavily concentrated in 'Pluto FI D-1,' which attracted the largest number of individual investors among the Lime funds that suspended redemptions (937.3 billion KRW). This is also why Samil Accounting Corporation set Pluto’s recovery rate about 10% lower than that of Tethys, which invests in convertible bonds (CB) of KOSDAQ-listed companies.

A financial authority official stated, "The actual substance of some Lime fund investment targets is unclear, which could increase investor losses. We have handed over materials related to embezzlement and breach of trust concerning fund money to the prosecution, and there are many aspects expected to be further revealed through the prosecution’s investigation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.