Q4 and Annual Earnings Announcement

Semiconductor Annual Operating Profit 14.02 Trillion KRW

IM Annual Operating Profit 9.27 Trillion KRW

[Asia Economy Reporters Dongwoo Lee, Jinju Han] Samsung Electronics halted its record-breaking streak last year due to a downturn in its core memory semiconductor market. Other divisions, such as smartphones and displays, also failed to deliver results strong enough to offset the semiconductor slump.

However, with signs of recovery in the semiconductor market, there is strong optimism for a full rebound starting this year. Nonetheless, the outbreak of the novel coronavirus (Wuhan pneumonia) poses a potential risk of worsening semiconductor demand.

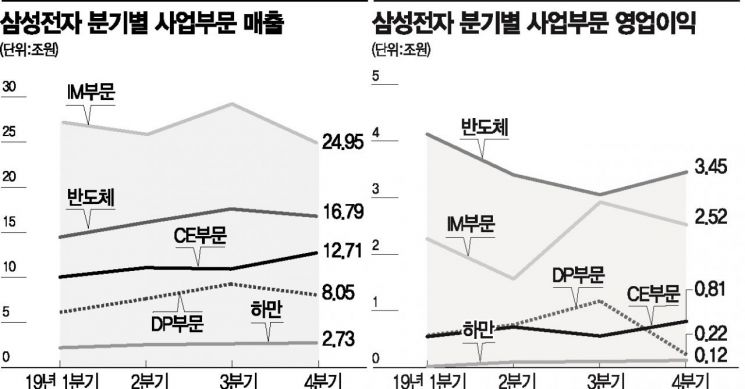

According to Samsung Electronics' announcement of its Q4 and full-year results for last year on the 30th, the semiconductor division's annual operating profit was 14.02 trillion KRW, falling short of the 15 trillion KRW mark. The smartphone business, one of Samsung's two main pillars alongside semiconductors, also experienced a downturn last year. The IM (IT & Mobile Communications) division, responsible for smartphones, posted an annual operating profit of 9.27 trillion KRW, breaking the '10 trillion KRW barrier.'

However, in Q4, the semiconductor division showed clear signs of recovery with improved performance compared to the previous quarter. The Q4 operating profit for semiconductors was 3.45 trillion KRW, slightly exceeding market expectations, which ranged from the high 2 trillion to low 3 trillion KRW. This represented a 13% increase from the previous quarter. Samsung Electronics explained, "Overall operating profit decreased by 3.64 trillion KRW year-on-year due to weak memory performance," but added, "Demand from key applications remained solid, supported by factors such as 5G (5th generation mobile communication)."

Industry insiders are placing weight on the possibility of a semiconductor market rebound based on the better-than-expected Q4 results. DRAM prices, which had sharply declined until July last year, stabilized toward the end of the year, while NAND flash prices have already begun a gradual upward trend. Samsung Electronics forecasted, "Although overall demand is expected to decline in Q1 due to seasonal factors, demand centered on data centers will remain robust throughout the year."

Samsung plans to strengthen its dominance in the premium market and improve profitability by expanding its lineup of foldable phones and 5G smartphones this year. The securities industry also anticipates improved performance for Samsung Electronics' IM division this year, driven by 5G and foldable phone products. The Consumer Electronics (CE) division was the only major segment to improve its performance last year, earning praise for the success of its premium new home appliance strategy. The CE division's annual operating profit rose about 30% year-on-year to 2.61 trillion KRW.

There is a prevailing view that Samsung Electronics' semiconductor performance will turn upward in the first half of this year. Park Yoo-ak, a researcher at Kiwoom Securities, predicted, "The increase in DRAM and NAND prices will exceed market expectations," forecasting Samsung's semiconductor division operating profit at around 5.7 trillion KRW in Q2. Choi Do-yeon, a researcher at Shinhan Financial Investment, also analyzed, "Mobile DRAM demand is expected to surge from the end of Q1, when 5G smartphone launches become full-scale."

The biggest variable is that if the novel coronavirus situation prolongs, the semiconductor market recovery could be delayed. Since China accounts for more than half of the global semiconductor market, an economic slowdown there would inevitably lead to widespread performance declines. An industry insider said, "If domestic consumption in China weakens, the semiconductor market will inevitably be affected," but added, "However, if the situation does not prolong, the impact will be limited."

Samsung plans to improve performance this year by expanding sales of differentiated products such as high-capacity storage and increasing cost competitiveness through expanded adoption of advanced process technologies. For non-memory semiconductors, the company intends to respond to market demand driven by the expanded adoption of 5G chips and high-resolution sensors, while promoting the expansion of EUV 5nm and 7nm processes and diversifying its customer base. The company plans to complete development of the 4nm process in Q1 and accelerate development of the next-generation foundry 3nm GAA process.

Meanwhile, Samsung Electronics invested 22.6 trillion KRW in its semiconductor division last year. The company explained that investment increased due to expansion of advanced process facilities such as 7nm EUV. This year, Samsung plans to execute investments flexibly according to demand fluctuations. Investments in future growth businesses such as system semiconductors will proceed as planned.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.