[Asia Economy Reporter Park Jihwan] It has been pointed out that companies may receive an 'adverse' audit opinion if they fail to properly establish an internal control environment.

Samjong KPMG stated in its report titled "Comparison and Implications of Internal Accounting Control Systems between Korea and the U.S." published on the 22nd that companies can receive an adverse opinion solely due to insufficient establishment of the internal control environment, regardless of distortion or correction of financial statements. Therefore, companies must thoroughly prepare for audits of internal accounting control systems. The report analyzed statistics and cases of adverse opinions related to the U.S. ICFR (Internal Control over Financial Reporting) audit system and compared them with domestic systems.

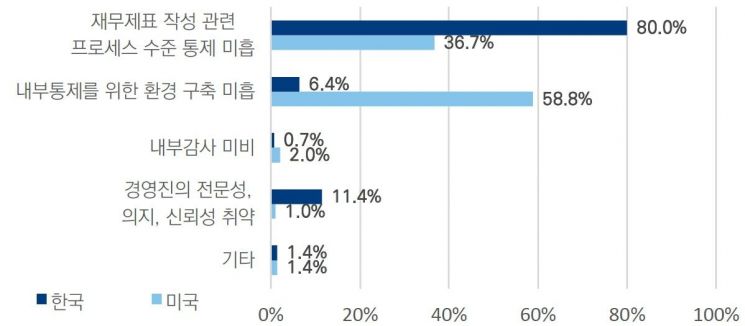

According to the report, among 490 reasons for adverse audit opinions by external auditors on internal control systems (ICFR) of 217 listed companies in the U.S. during the 2018 fiscal year, 288 reasons (58.8%) were due to 'insufficient establishment of the internal control environment.'

In contrast, in Korea, among 140 reasons for adverse review opinions by external auditors on internal accounting control systems of 56 listed companies, only 9 reasons (6.4%) were due to insufficient establishment of the internal control environment. Reasons for the lack of an internal control environment include 'lack of accounting personnel and expertise,' 'deficiencies in information technology (IT) controls or computer systems,' 'inadequate segregation of duties,' and 'insufficient controls related to disclosures.'

Notably, in Korea, no company received an adverse opinion solely because of failing to properly establish the internal control environment without any distortion or errors in financial statements. Conversely, in the U.S., 20.6% of companies that received adverse opinions did so solely due to insufficient establishment of the internal control environment for financial reporting. This figure is more than three times higher than in 2004 (8.6%), when the U.S. first introduced ICFR audits.

Regarding sanctions policies for internal accounting control systems, Korea regulates detailed violations related to internal accounting control systems, whereas the U.S. discloses detailed violations and issues suspension orders but allows a considerable correction period.

Heo Sebong, leader of the Internal Accounting Control System Advancement Team at Samjong KPMG, emphasized, "Looking at the U.S. case, after the introduction of internal accounting control system audits, Korea can also receive adverse opinions solely due to insufficient establishment of the internal control environment. Companies must thoroughly prepare for internal accounting control system audits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.