'Post Shin Kyuk-ho' Chairman Shin Dong-bin Stabilizes 'Korea-Japan Top-Tier System'

Hotel Lotte IPO Task... Accelerating Corporate Governance Improvement

Low Possibility of Japanese Executives Withdrawing Support for 'Shin Dong-bin's Management Rights'

[Asia Economy Reporter Lee Seon-ae] With the passing of Shin Kyuk-ho, Honorary Chairman of Lotte Group, on the 19th, the remaining task for Shin Dong-bin, Chairman of Lotte Group who is carrying the 'post-Shin Kyuk-ho era,' is to complete the holding company system of Korea Lotte.

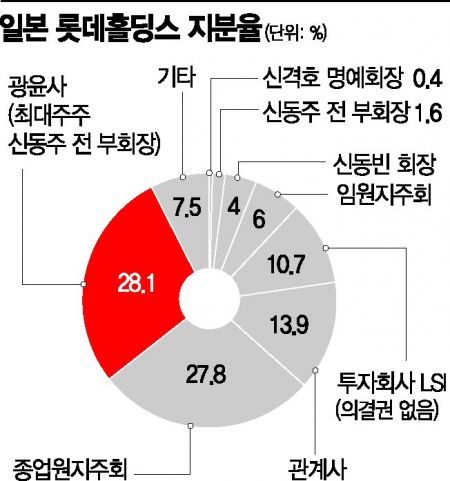

According to Lotte Group on the 20th, the major shareholders of Japan Lotte Holdings, which sits at the top of the Korea-Japan Lotte Group's governance structure, are Kwangyunsa (28.1%), Employee Shareholders' Association (27.8%), affiliates (13.9%), and Executive Shareholders' Association (6%). Shin Dong-joo, former Vice Chairman of Japan Lotte Holdings and elder brother of Shin Dong-bin, holds 50%+1 share of Kwangyunsa, but the other major shareholders, the Employee Shareholders' Association, affiliates, and Executive Shareholders' Association, all support Chairman Shin. Adding these shareholders' total shares (53.9%) to Chairman Shin's own shares brings the total to 57.9%, so no change in the governance structure is expected.

Although unlikely, variables do exist. If Tsukuda Takayuki, President of Japan Lotte Holdings and second-largest shareholder controlling the Employee Shareholders' Association, withdraws his support for Chairman Shin, the management rights could be shaken. However, considering that during the governance restructuring process, Chairman Shin strengthened trust with Japanese management and shareholders, was appointed CEO of Japan Lotte Holdings in February last year, and was re-elected as a director at the June Lotte Holdings regular shareholders' meeting without any issues, the possibility of withdrawing support is low.

Previously, Chairman Shin cut all 748,963 circular shareholdings as of June 2014 by April 2018. He launched the holding company system in October 2017 and incorporated major group affiliates Lotte Shopping and Lotte Chemical as subsidiaries of Lotte Holdings in 2017 and 2018, respectively. However, the listing of Hotel Lotte remains. Japan Lotte Holdings is the largest shareholder (19.07%) of Hotel Lotte, which is the holding company equivalent of Korea Lotte, and when combined with shares held by L Investment Company, which is 100% controlled by Lotte Holdings, it holds 99%. Hotel Lotte holds significant shares in major affiliates such as Lotte Construction (41.42%), Lotte Chemical (12.68%), Lotte Property & Development (31.13%), Lotte Aluminum (25.04%), Lotte Trading (34.64%), Lotte Capital (26.60%), and Lotte GRS (18.77%), so if it goes public, Chairman Shin's 'one-top system' can be solidified.

After the listing of Hotel Lotte, Chairman Shin plans to separate the shares of affiliates held by Hotel Lotte and bring them to Lotte Holdings to fully complete the holding company system. He also plans to reduce Japan Lotte Holdings' shareholding ratio to 50% through the listing of Hotel Lotte. The inheritance of shares from Honorary Chairman Shin Kyuk-ho is also unlikely to be a significant variable. The shareholding structure of Lotte Holdings, the holding company of Korea Lotte Group (based on voting common shares), is Shin Dong-bin 11.7%, Shin Kyuk-ho 3.1%, Shin Dong-joo 0.2%, and Hotel Lotte 11.1%. Even if all of Honorary Chairman Shin's shares are inherited by former Vice Chairman Shin, the possibility of Chairman Shin's management rights in Lotte Holdings being shaken is very low.

A Lotte Group official said, "The property issues of Honorary Chairman Shin Kyuk-ho will be handled according to the procedures prescribed by law," adding, "Regardless of how the decisions are made, there is no room for the governance or management rights of Lotte Group to be shaken."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.