Stalemate in Over 11-Hour Meeting... Second Session Scheduled for the 22nd

FSS and Banks in Sharp Conflict Over Disciplinary Measures for Executives

[Asia Economy Reporter Jo Gang-wook] The Financial Supervisory Service's (FSS) first disciplinary committee meeting regarding the overseas interest rate-linked derivative-linked fund (DLF) scandal, which caused massive principal losses, was held on the 16th but ended without a conclusion even after more than 11 hours of discussion. The FSS plans to hold a second disciplinary meeting on the 22nd, about a week earlier than the originally scheduled date of the 30th. Since the first disciplinary meeting focused mainly on KEB Hana Bank, discussions regarding Woori Bank are expected to intensify in the second session. Given the fierce battle over the level of disciplinary action against the CEOs, there is also a possibility that the disciplinary process will extend beyond three sessions.

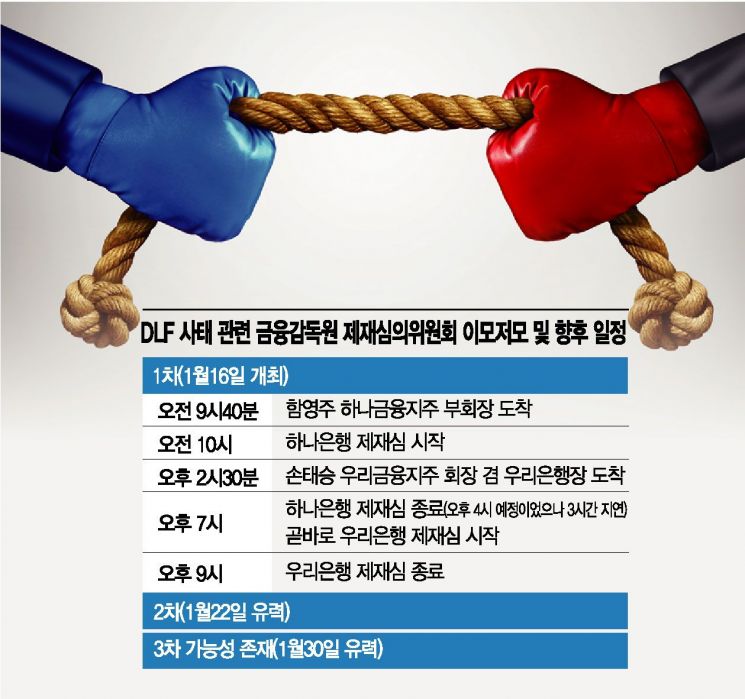

According to the FSS and banking sector on the 17th, the first disciplinary meeting started at 10 a.m. and ended around 9 p.m. The meeting was conducted in a dual-hearing format where both the FSS investigation department and the banks subject to sanctions presented their opinions. Sohn Tae-seung, Chairman of Woori Financial Group, and Ham Young-joo, Vice Chairman of Hana Financial Group, who had been pre-notified of severe disciplinary measures such as a written warning, attended the meeting in person to present their defense. The review of KEB Hana Bank reportedly continued until 7 p.m. Afterwards, the review of Woori Bank lasted only about two hours and ended without a conclusion. The disciplinary hearing for Woori Bank was originally scheduled to start around 4 p.m., but the KEB Hana Bank hearing did not conclude until after 7 p.m. Chairman Sohn Tae-seung arrived at the FSS's 11th-floor main conference room around 2:30 p.m. but had to wait for more than four and a half hours.

An FSS official stated, "The disciplinary committee reviewed the corrective measures based on the inspection results of KEB Hana Bank and Woori Bank, but due to prolonged discussions, it was decided to hold a re-examination later."

During the disciplinary meeting, the FSS and the banks reportedly took sharply opposing stances over the level of disciplinary action against the executives. The core issue was whether executives could be sanctioned for internal control failures. The FSS cited "lack of internal control" and "excessive management pressure" as grounds for sanctions. They pointed out that excessive sales efforts at the bank headquarters level and poor internal controls led to the mis-selling of DLFs. The FSS said it had already completed legal reviews.

However, the banks argued that there is weak legal basis for imposing severe disciplinary measures on CEOs for internal control failures. The current Financial Company Governance Act stipulates that "financial companies must establish internal control standards." The enforcement decree requires "effective internal control standards" to be established. However, there is no provision allowing punishment of CEOs for internal control failures. The Financial Services Commission announced last year that it would prepare grounds to hold CEOs and other executives responsible to prevent recurrence of consumer damage like the DLF incident. However, the related amendment to the Financial Company Governance Act remains pending in the Political Affairs Committee.

The banks also reportedly claimed that executives such as Chairman Sohn and Vice Chairman Ham were not directly involved in the mis-selling of DLFs. They emphasized their efforts to minimize customer damage and establish measures to prevent recurrence after the incident. Previously, the FSS's on-site inspection of DLFs did not find evidence that executives directly instructed the sale of DLFs.

Since both sides presented parallel arguments from the first disciplinary meeting, it is expected that a considerable amount of time will be needed before a decision is reached. The FSS announced through a notice that "the schedule for the next disciplinary meeting will be announced once confirmed." The second disciplinary meeting was originally scheduled for the 30th, two weeks later, but the schedule was moved up to accelerate discussions. The 22nd is the most likely date for the second meeting. The fact that the 23rd is the day before the Lunar New Year holiday is also believed to have influenced this decision. The second disciplinary meeting is expected to focus on Woori Bank. There is also a possibility of a third disciplinary meeting on the 30th.

Some voices criticize that placing all responsibility for the incident solely on the CEOs and imposing severe disciplinary measures contradicts the government's innovative financial policy direction. There is concern that holding CEOs accountable for hundreds of products sold by financial companies could lead to risk-averse behavior. Additionally, criticism has been raised that the FSS, which should prevent and manage financial accidents, is imposing excessive sanctions on financial companies to avoid responsibility.

Previously, the Board of Audit and Inspection pointed out in its 2017 audit of the FSS's institutional operations that the FSS imposed disciplinary actions on financial company employees without legal grounds. It instructed the FSS to clarify the legal basis for disciplining financial institutions and their employees and to establish legal grounds for exemptions from fines and related matters.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.