Fear of Redemption Suspension Growing Even Among Normal Funds

Chain Insolvency Triggered by Rolling Over Bad Funds

Additional Suspensions Possible Due to Circular Shareholding Relations

Financial Authorities Judge It Won't Exceed 2 Trillion Won

Investors Focus on Bank Incomplete Sales Dispute Mediation

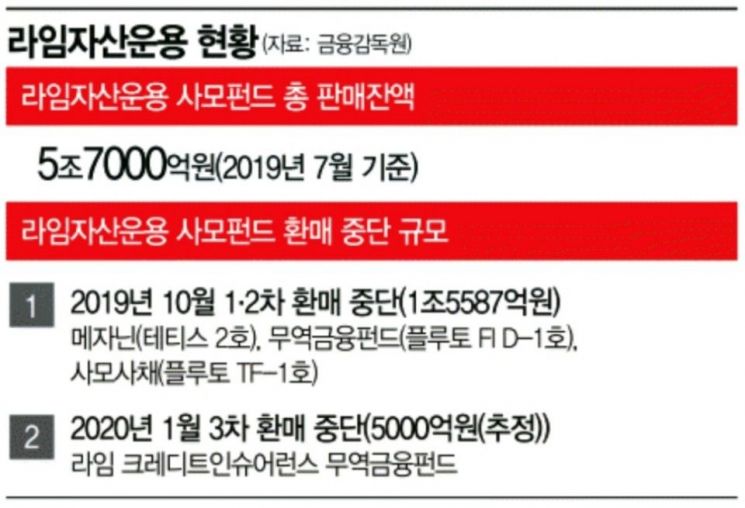

[Asia Economy Reporters Kim Hyo-jin, Park Ji-hwan] Lime Asset Management has decided to suspend redemptions for an additional fund worth 500 billion KRW. Including the 1.5 trillion KRW that was suspended twice last October, the total amount of suspended redemptions reaches 2 trillion KRW. As the Lime fund crisis spreads, concerns are growing that even the funds previously classified as normal may face additional redemption suspensions.

According to the financial investment industry on the 15th, Lime Asset Management recently sent an official letter to fund distributors such as banks and securities firms, notifying them of the suspension of redemptions for the 'Lime Credit Insurance Trade Finance Fund,' which is scheduled to mature in April. The fund's size is approximately 320 billion KRW. Unlike the problematic 'Lime Pluto FI D-1' and others from last year, this was a normally managed product.

The financial investment industry believes that a significant portion of this fund's capital was invested in the troubled funds whose redemptions were suspended last year, causing a chain reaction of insolvency through a process of rolling over. Additionally, if redemptions are suspended for Lime Asset Management's KOSDAQ Venture Investment Funds, which sold about 140 billion KRW worth, the total amount of funds facing additional redemption suspension is expected to reach 500 billion KRW. Considering the first and second rounds of redemption suspensions by Lime Asset Management last October, the total suspension amount could reach up to 2 trillion KRW.

As the Lime crisis worsens, there are concerns about further redemption suspensions for funds sold by Lime Asset Management. A securities industry official explained, "In Lime's case, the parent and subsidiary funds are intertwined through circular shareholding relationships, so if one fails, redemptions may be suspended just before the repayment date," adding, "If additional funds face redemption suspension, the damage could increase."

The financial authorities believe that the scale of redemption suspensions is unlikely to grow further. A financial authority official stated, "Although the total sales amount of funds sold by Lime Asset Management is known to exceed 5 trillion KRW, due to the parent-subsidiary fund structure, the sales volume is counted twice," explaining, "From the actual investor's perspective, it is just over 2 trillion KRW." Considering the double counting, the scale of redemption suspensions is unlikely to exceed 2 trillion KRW.

As the damage reaches the trillion KRW level, lawsuits among investors, asset management companies, and distributors surrounding Lime Asset Management are intensifying. In particular, investors seem to be focusing on dispute resolution regarding banks' incomplete sales practices.

Because of this, the joint response team composed of 16 banks and securities firms that sold Lime funds, including Woori, Shinhan, KEB Hana Bank, Shin Young, and Samsung Securities, argued, "According to relevant regulations, it was difficult to detect the risk of fund management by Lime Asset Management in advance." They claim that since they were completely unaware of the irrational design and management practices to the extent of fraud allegations, they are also victims in this incident.

A joint response team official said, "Once the audit results from Samil Accounting Corporation are released, we plan to strongly request the reestablishment of the fund's redemption schedule," adding, "Afterward, we will initiate civil and criminal actions for damages caused by Lime Asset Management's operational negligence and illegal activities."

The regulation pointed out by the joint response team is Article 45 of the Capital Markets Act and its subordinate laws. It states that "fund managers shall not provide fund composition details and management information, which have a high possibility of conflict of interest with distributors and are not yet disclosed to the general public, to distributors."

A representative from a commercial bank participating in the joint response team emphasized, "In conclusion, distributors could not intervene in fund management at all, and information exchange was also blocked." Investigations so far have confirmed that, except for a few key personnel such as internal staff responsible for trade finance at Lime Asset Management, others were unaware of the details.

Another commercial bank official lamented, "It is nearly impossible for distributors to grasp information that even Lime Asset Management's internal executives did not fully know and to detect insolvency or illegality based on that." The common voice among distributors is that it is unimaginable for them, who operate based on long-term trust with investors, to intentionally conceal insolvency and participate in illegal activities.

The joint response team held a public hearing last October to proactively request Lime Asset Management's liquidity securing and repayment plans. The fund audit currently being conducted by Samil Accounting Corporation also started at the joint response team's request. The joint response team plans to focus all future activities on investor protection.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.