Beauty Investment by Men Increases, Nail Nutrients Grow 68%

Self-Care at Home Instead of Shops

Interest Evolves to Skincare, Color Cosmetics, and Nails

[Asia Economy Reporter Jo Yujin] Kwon, a single man living in Singongdeok-dong, Seoul, recently started purchasing nail care products from online shopping malls. He buys not only nail nutrients but also tools that help with cuticle and dead skin removal online. Kwon said, "Professional shops can provide more delicate care, but the cost is high and since these spaces are still mainly for women, I felt some pressure, so I started managing my nails myself."

As the number of men investing in beauty rapidly increases, the trend of enjoying nail care alone at home is spreading.

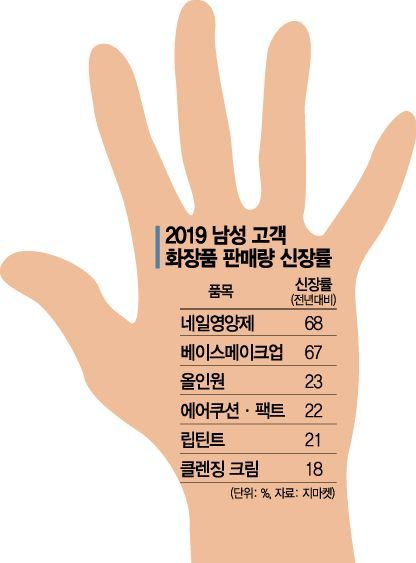

According to Gmarket on the 13th, last year, the sales growth rate of nail nutrients among male customers’ cosmetics purchases surged 68% compared to the previous year. This was followed by base makeup (67%), all-in-one (23%), air cushion/pact (22%), lip tint (21%), and cleansing cream (18%).

The most purchased items by men are all-in-one products with natural skin tone-up functions, mask packs, and foam cleansers. Among the top-selling men’s cosmetics brands on Gmarket are Beverly Hills, Tosowoong, Dunlop, IOPE, and O Hui, offering male-specific skincare products.

However, in terms of growth potential, the nail nutrient category stands out the most. Although there are no male-exclusive products, Etude House Help My Finger, Kerasel, and Label Young Shocking Rescue are popular.

The industry views that the changing perception of nail care, once considered a 'women-only culture,' has contributed to the expansion of the related market. The stereotype is breaking down as male celebrities receiving nail care at nail shops are frequently shown on TV.

As demand for nail care among men increases, male-only nail shops are emerging one after another. These shops mainly offer nail and foot nail trimming, spa, dead skin care, and massage rather than flashy nail art using gel or manicure.

Men who have experienced nail shops are showing interest in self nail care because they can easily imitate the 'shop care,' which costs from a minimum of 30,000 KRW to 120,000 KRW, at home.

Men’s interest in beauty, which in the past was limited to skin tone management products in skincare, is evolving beyond color cosmetics to nail care.

Consequently, the phenomenon of men preferring women’s products rather than male-specific cosmetics is also becoming more prominent. A 'gender-neutral' trend is blowing across the entire beauty spectrum, from women’s skincare products and perfumes to color cosmetics and nail care products.

A Gmarket MD in charge of men’s cosmetics said, "There are many men, especially those working in sales and service jobs, who have a strong interest in beauty, and the proportion of purchases of women’s products rather than male-specific products in the related goods market continues to increase."

As the number of men investing in beauty grows, the male-specific cosmetics market is also expanding. Amorepacific’s Be Ready reached its annual sales target within three weeks after its first launch in September last year.

Aekyung Industry’s Sneaky grew 346.1% in total sales in the first half of last year compared to the second half of 2018. According to market research firm Euromonitor, the size of the men’s cosmetics market exceeded 1.2 trillion KRW last year and is expected to reach 1.4 trillion KRW this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)