[Asia Economy Reporter Park Jihwan] In December last year, foreign investors' investment funds in domestic listed stocks showed a net inflow for the first time in five months. This is interpreted as a result reflecting the agreement on the first phase of the trade dispute between the United States and China and expectations of improvement in the semiconductor industry. Regarding bonds, there was a net withdrawal for three consecutive months since October.

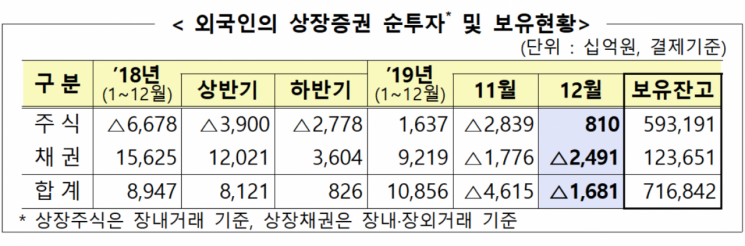

According to the 'Foreign Securities Investment Trends in December 2019' announced by the Financial Supervisory Service on the 13th, foreign investors net purchased 810 billion KRW worth of domestic listed stocks last month. They bought 350 billion KRW in the KOSPI market and net purchased 460 billion KRW in the KOSDAQ market. This marked a shift to net buying for the first time in five months since turning to net selling in August.

European investors led the net buying of stocks. European investors (3 trillion KRW) net purchased, while investors from the United States (-2.9 trillion KRW), Asia (-200 billion KRW), and the Middle East (30 billion KRW) net sold. By country, investors from the United Kingdom (1.2 trillion KRW) and France (900 billion KRW) net purchased, whereas investors from the United States (-2.9 trillion KRW), Singapore (-400 billion KRW), and Japan (-300 billion KRW) net sold.

By investor holdings, the United States held the largest amount at 251.7 trillion KRW (42.4% of all foreigners), followed by Europe at 171.5 trillion KRW (28.9%), Asia at 75.7 trillion KRW (12.8%), and the Middle East at 20.6 trillion KRW (3.5%). At the end of last month, the total stock holdings of foreigners amounted to 593.2 trillion KRW, an increase of 34.8 trillion KRW compared to the end of the previous month.

Foreigners net purchased 4.05 trillion KRW worth of listed bonds in December. Due to maturity repayments amounting to 6.541 trillion KRW, a total of 2.491 trillion KRW was net withdrawn. This marks the third consecutive month of net withdrawal following October.

At the end of last month, foreigners' bond holdings were recorded at 123.7 trillion KRW, a decrease of 1.1 trillion KRW compared to the end of the previous month.

By region, investors from Europe (-700 billion KRW), the Middle East (-400 billion KRW), and Asia (-200 billion KRW) net withdrew. By bond type, net withdrawals occurred in Monetary Stabilization Bonds (-1.5 trillion KRW) and government bonds (-1 trillion KRW). By remaining maturity, net investments were made in bonds with maturities over 5 years (200 billion KRW) and between 1 to 5 years (2.2 trillion KRW), while bonds with less than 1 year maturity (-4.9 trillion KRW) were net withdrawn.

At the end of last month, by investor region, bond holdings were highest in Asia at 50.8 trillion KRW (41% of total), followed by Europe at 45.7 trillion KRW (36.9%), and the Americas at 11 trillion KRW (8.9%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.