Vietnam Franchise Market Growing Rapidly at 20-30% Annually

Korean Food Service Companies Expand in Vietnam, Escaping Overcompetition... Continuous Entries

[Asia Economy Reporter Choi Saeng-hye] Domestic dining franchise companies are making swift moves toward Vietnam, the "land of opportunity." While escaping the domestic market where external growth is difficult due to a sluggish domestic economy, excessive competition, and the proliferation of copycat brands, they are rushing to enter the rapidly growing Vietnamese franchise market, which is expanding at an annual rate of 20-30%, leveraging the Korean Wave.

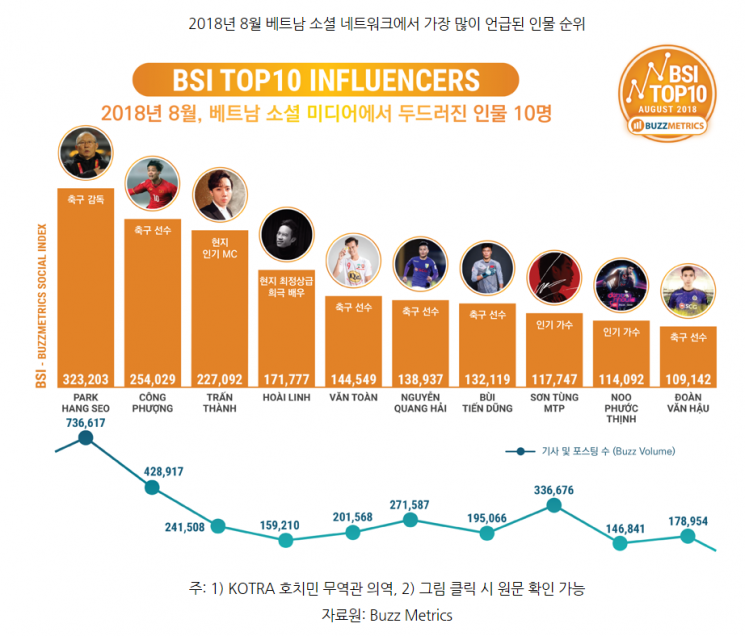

According to the Korea Trade-Investment Promotion Agency on the 22nd, the Korean franchise industry's entry into Vietnam has been continuous for several years due to the increasing consumption of Korean Wave content and the popularity of coach Park Hang-seo. According to the Korea Agro-Fisheries & Food Trade Corporation (aT), the Vietnamese franchise market size is about 1.2 trillion won annually and is growing rapidly at an annual rate of 20-30%. The average age of the Vietnamese population is 30, with many young consumers, and interest in K-food is the highest among Southeast Asian countries.

Apgujeong Bonggu Beer signed a contract for its first store in Ho Chi Minh, Vietnam, on December 17 last year.

Apgujeong Bonggu Beer signed a contract for its first store in Ho Chi Minh, Vietnam, on December 17 last year.

Bonggu Beer, operating about 500 franchise stores domestically, plans to open its first store in Ho Chi Minh City, Vietnam, next month. To this end, it completed a master franchise contract last December. Future expansion to Hanoi and Da Nang is also under consideration. Bonggu Beer had 475 stores in 2017, but as copycat brands emerged and competition intensified, it reduced the number of stores to 431 in 2018 and focused on strengthening its fundamentals. A Bonggu Beer representative said, "We judged that our fundamentals have become solid enough and plan to open a store in a major commercial district in Ho Chi Minh City, the center of the Korean Wave." Based on its past experience opening the first and second stores in Shanghai, China, Bonggu Beer plans to use thorough localization to make Vietnam a foothold for entering the Southeast Asian market.

Chicken franchises are also actively entering Vietnam. Don Chicken opened its 30th and 31st stores in Da Nang in October and November last year, respectively. It operates 12 stores in Hanoi and 17 in Ho Chi Minh City. The plan is to increase the number of local stores to 200 by 2025. Goobne Chicken opened its second store in Ho Chi Minh City in September last year. Don Chicken differentiates itself with various Korean dishes such as hot stone bibimbap, japchae, and tteokbokki, while Goobne Chicken offers items like the "Chissam Set," reflecting local food culture.

SLF&B, which operates King Kong Army Stew, signed a master franchise contract for northern Vietnam last December and is preparing to open its first store in Hanoi. Haemaro Food Service's Mom's Touch, operating about 1,200 franchise stores domestically, runs two stores in Vietnam. Recently acquired by a private equity fund, it is expected to accelerate overseas market expansion. Dookki, a tteokbokki unlimited refill franchise that entered Vietnam in November 2018, signed contracts to open 30 stores by August last year.

However, bakery franchises, where global brand competition has intensified, are focusing on qualitative improvement rather than quantitative growth. Paris Baguette has operated only four stores in Hanoi and six in Ho Chi Minh City since its first entry into Vietnam in 2012. Tous Les Jours, which entered Vietnam in 2007 and currently operates 35 stores, has not increased its number of stores for several years. An industry insider hinted, "Korean bakeries tend not to have great price accessibility due to their premium image."

There are also notable cases of failure in master franchise and localization efforts. MP Group's Mr. Pizza opened its first store in Hanoi at the end of 2016 but withdrew the following year due to contract issues with the master franchise. Hollys Coffee opened its first store in Ho Chi Minh City in 2015 but ceased operations due to localization failure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)