Increased Stakes in Six Stocks Including BNK, Shinhan, and KB in the Second Half of Last Year

Significantly Expanded Holdings of Undervalued Regional Financial Stocks Like DGB Over 5%

[Asia Economy Reporter Park Ji-hwan] It has been revealed that the National Pension Service (NPS) increased its shareholding ratio in financial stocks in the second half of last year. This is interpreted as accelerating the accumulation of relatively undervalued regional financial stocks, which had maintained low stock prices compared to their solid performance so far.

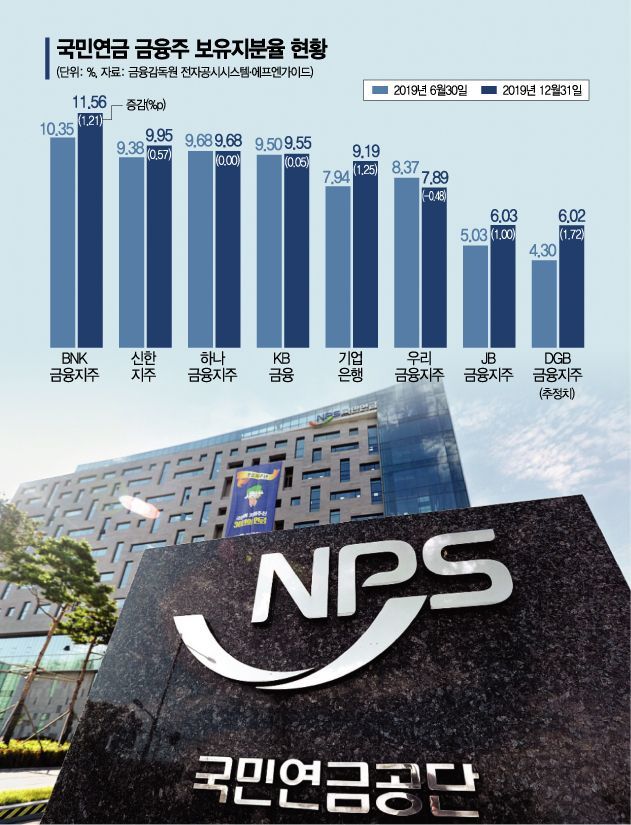

According to the Financial Supervisory Service's electronic disclosure system and FnGuide on the 9th, among financial sectors in which the NPS held more than 5% of shares (common stock basis) as of the end of last year, a total of six stocks saw an increase in shareholding in the second half.

During this period, the NPS increased its shareholding ratios in BNK Financial Group, Shinhan Financial Group, KB Financial Group, Industrial Bank of Korea, JB Financial Group, and DGB Financial Group. BNK Financial had the highest shareholding ratio at 11.56% (+1.21 percentage points), followed by Shinhan Financial Group at 9.95% (+0.57 percentage points), KB Financial Group at 9.55% (+0.05%), Industrial Bank of Korea at 9.19% (+1.25%), JB Financial Group at 6.03% (+1.00 percentage points), and DGB Financial Group at 6.02% (+1.72 percentage points). Among these, DGB Financial's shareholding ratio increased again to above 5%.

The shareholding ratio of Woori Financial Group slightly decreased to 7.89% (-0.48 percentage points), while Hana Financial Group (9.68%) saw no change in its shareholding ratio.

In particular, the NPS's significant increase in the proportion of regional financial stocks such as BNK, JB, and DGB drew attention. All three holding companies increased their shareholding ratios by more than 1%. This appears to be due to the perception that the relatively undervalued regional financial stocks have sufficient potential for stock price appreciation.

Despite the NPS's active share purchases, the stock values of domestic financial stocks collectively failed to avoid a downward trend. Representative domestic financial stocks in the second half of last year include Shinhan Financial Group (-3.45%), Industrial Bank of Korea (-16.01%), DGB Financial Group (-12.64%), Hana Financial Group (-1.34%), and JB Financial Group (-7.11%). The decline in interest rates, the implementation of the price ceiling system for pre-sale housing, and the expansion of domestic and international uncertainties acted as major negative factors, making it difficult for stock prices to rise.

Choi Jung-wook, a researcher at Hana Financial Investment, said, "Bank stocks have low earnings volatility and high dividend appeal, making them one of the stocks with strong investment demand from long-term investors such as pension funds. However, due to the NPS's 10% ownership limit, an abnormal ownership structure has emerged where foreigners hold 60-70% of bank stocks."

Accordingly, the supply and demand heavily depend on foreigners, and if foreigners sell, the stock price inevitably shows weakness. During the same period, the NPS also increased its shareholding in the materials, parts, and equipment (SoBuJang) sector along with financial stocks. Among the stocks for which the NPS disclosed shareholding changes in the fourth quarter, YMT and UniTest, ranked 2nd and 3rd in shareholding increase rate, belong to this category.

On the other hand, it was found that the NPS reduced its shareholding in automobile parts, machinery, and media-related stocks, which have concerns about sluggish business conditions.

Meanwhile, the stock valuation of stocks in which the NPS holds more than 5% of shares was 120.6387 trillion won as of the closing price on the 7th. This is an increase of 8.7248 trillion won compared to the end of the third quarter of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)