Kosdaq ETF Premium/Discount Turns Positive

Buoyed by the government’s policy support, exchange-traded funds (ETFs) linked to the Kosdaq that has broken through the 1,000-point level have seen a surge of inflows, pushing their premium/discount rate, a key risk indicator, into positive territory. Since this indicates that investors are buying ETFs at prices higher than their actual asset value, analysts advise paying close attention to how this trend develops.

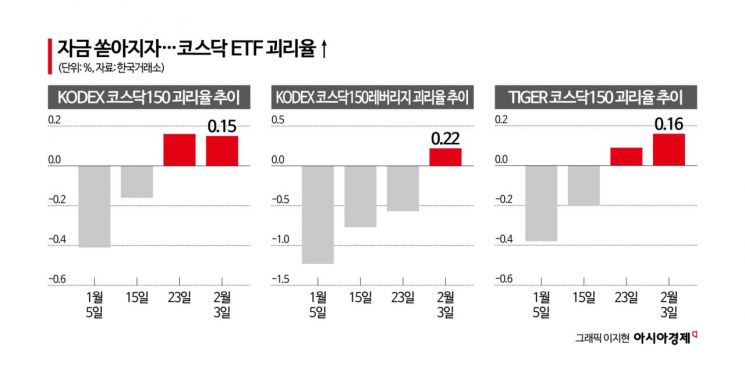

According to the Korea Exchange on February 4, the premium/discount rate of KODEX Kosdaq 150, the largest domestic ETF tracking the Kosdaq 150 in terms of net assets, stood at 0.15% the previous day. After remaining negative from January 5 to 22, the premium/discount rate turned positive at 0.16% on January 23. Except for February 2, when it briefly fell to -0.32%, it stayed in positive territory for seven trading days. On January 26, it climbed as high as 0.44%.

The situation is similar for other large ETFs tied to the Kosdaq 150. The premium/discount rate of KODEX Kosdaq 150 Leverage, the second-largest by net assets, was 0.22% as of the previous day. After remaining negative throughout this year, it turned positive for the first time on January 26, rising to 0.12%. It then stayed positive for four consecutive trading days on January 29 and 30, and through the previous day.

TIGER Kosdaq 150, which ranks third in net assets, also had a negative premium/discount rate from January 5 to 22 before widening to 0.09% on January 23. Like KODEX Kosdaq 150, it maintained a positive premium/discount rate except for a single day on February 2. As of the previous day, the premium/discount rate of TIGER Kosdaq 150 was 0.16%.

Given that these ETFs showed an average negative premium/discount rate last year, the recent shift into positive territory warrants attention. A positive premium/discount rate for an ETF is a warning signal that the ETF’s market price is trading above its net asset value (NAV). A negative reading means the ETF is undervalued relative to its market value. Last year, the average daily premium/discount rate of KODEX Kosdaq 150 was -0.33%, while that of TIGER Kosdaq 150 was -0.26%.

The recent move of Kosdaq-tracking ETFs into positive premium/discount territory is seen as the result of a rapid concentration of demand. According to ETFCheck, the top three ETFs by net inflows over the past week were all Kosdaq 150 ETFs. KODEX Kosdaq 150 attracted 4.2969 trillion won (No. 1), KODEX Kosdaq 150 Leverage drew in 1.7994 trillion won (No. 2), and TIGER Kosdaq 150 saw inflows of 1.2095 trillion won (No. 3).

Lim Eunhye, a researcher at Samsung Securities, said, “It is very unusual for the premium/discount rate of Kosdaq 150 ETFs to be in positive territory,” adding, “This reflects the fact that strong buying demand is flowing into these ETFs.” She continued, “From the buyer’s perspective, a positive premium/discount rate means having to pay more than the net asset value by the amount of that premium, which also indicates that the market is in an overheated state,” and added, “Accordingly, it seems important to select ETFs whose premium/discount rates are relatively stable.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.