Strong exit prospects for Mirae, including Semifive, Moloco, and HeyDealer

Aju IB sees strong results from U.S. local investments...spotlight on Arcellx and Yanolja

The share prices of domestically listed venture capital (VC) firms that have invested in SpaceX, the U.S. private space development company led by Elon Musk, are soaring. After SpaceX filed an application with the U.S. Federal Communications Commission (FCC) for approval to launch up to 1 million satellites for AI data centers, and news broke that it would merge with artificial intelligence (AI) company xAI, the VCs that had proactively deployed venture capital into SpaceX saw their stock prices rise on the back of this momentum.

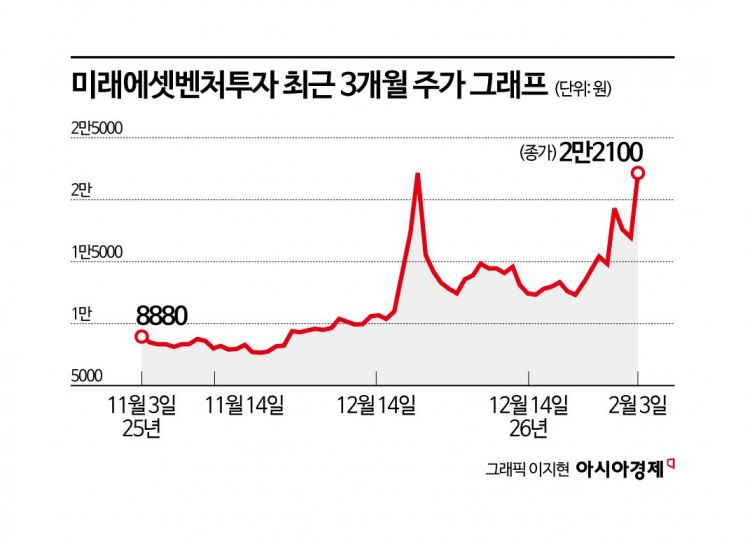

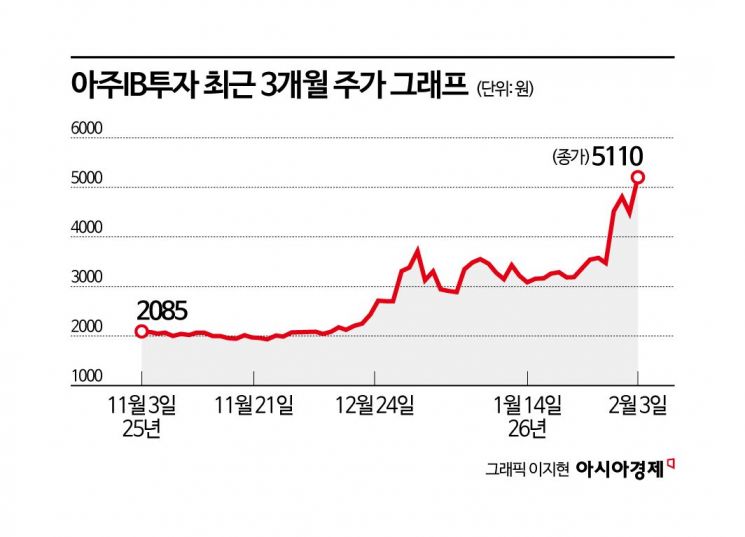

According to the Korea Exchange on the 4th, Mirae Asset Venture Investment closed at 22,100 won the previous day, hitting the upper price limit with a jump of 5,100 won from the prior trading session. Aju IB Investment also finished trading at 5,110 won, up 635 won (14.19%).

These VCs are all regarded as leading domestic investment firms that have invested in SpaceX. They began to attract attention as SpaceX-related theme stocks in mid-December last year, when its listing plans became more concrete. This week, news emerged that SpaceX had asked the FCC for approval to launch up to 1 million satellites as part of its plan to build space-based AI data centers, and that it had decided to acquire xAI.

Jeong Euihoon, an analyst at Eugene Investment & Securities, said, "If SpaceX and xAI merge, there will be synergy in building space-based AI data centers," and added, "Once they proceed with an IPO after the merger, the valuation (the stock price level relative to corporate value) is expected to far exceed what SpaceX could achieve if it were listed alone."

Cho Kyungjin, an analyst at IBK Investment & Securities, explained, "Last year, the space-related industry recorded high growth, supported by increased government spending and expanded private-sector investment, and investors' interest in space technology is expected to grow even further this year," adding, "Spending on satellite and missile defense systems, the integration of AI into space equipment and analytics, and expectations for a SpaceX IPO are likely to drive this year's investment momentum."

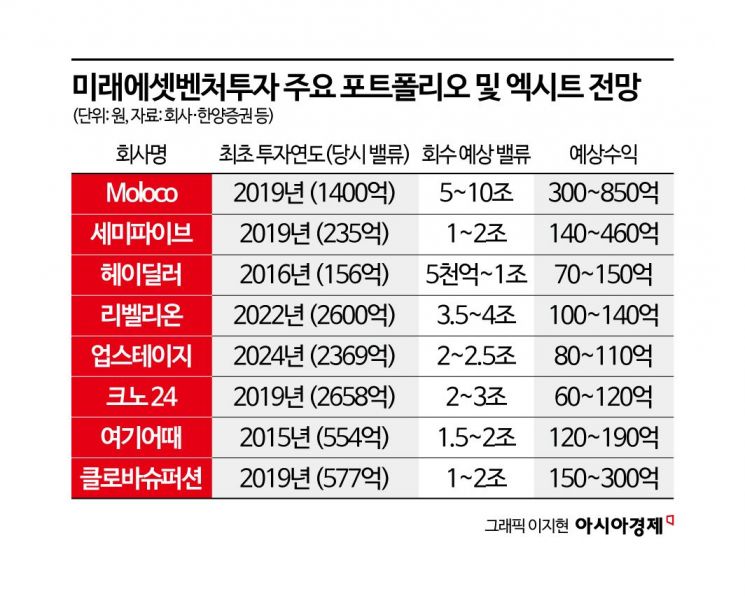

Strong exit prospects for Mirae Asset Venture Investment, including Semifive and Moloco

Earlier, the Mirae Asset Group invested a total of 278 million dollars (about 400 billion won) in SpaceX at the group level between 2022 and 2023. In a fund created by Mirae Asset Capital, group affiliates such as Mirae Asset Securities and Mirae Asset Venture Investment, as well as retail capital, participated as limited partners (LPs). In particular, Mirae Asset Venture Investment is regarded as an investment firm whose structure allows the rise in SpaceX's corporate value to translate directly into a revaluation of its investment assets.

This year, beyond SpaceX, expectations are also high for exits from major domestic portfolio companies. Semifive, an application-specific integrated circuit (ASIC) specialist that Mirae Asset Venture Investment has backed since its early start-up stage in 2019, successfully listed on the KOSDAQ at the end of last year. At the time of listing, Mirae Asset Venture Investment held a 10.01% stake, and it subsequently sold a 3% stake, recouping about 30 billion won.

Moloco, an AI-based advertising solutions company that is seeking a Nasdaq listing, is another portfolio firm drawing close attention from securities firms. Mirae Asset Venture Investment has invested a total of 72.3 billion won in Moloco. Analysts in the securities industry estimate that, upon exit, Moloco could generate profits in the range of 30 billion to 85 billion won.

Lee Joonseok, an analyst at Hanyang Securities, said, "For Mirae Asset Venture Investment, exit scenarios are possible through Moloco's future overseas listing or through a strategic transaction with a large global company," and analyzed, "In particular, exiting investments in global technology companies can make a meaningful contribution to increasing performance fees, even on a single-transaction basis." A Mirae Asset Venture Investment official said, "We expect Moloco to be able to go public within this year, and we believe an exit will be possible at the time of listing."

In addition, used-car platform HeyDealer, AI semiconductor company Rebellions, AI startup Upstage, and accommodation platform Yanolja are also entering full-fledged exit phases.

Aju IB Investment, investing in U.S. biotech and Yanolja, among others

Aju IB Investment is distinguishing itself in global investments through its U.S. subsidiary, Solarsta Ventures. The SpaceX investment was also executed through Solarsta Ventures' Silicon Valley branch. Although the exact investment amount has not been disclosed, it is reported that Aju IB Investment is expecting more than a tenfold return if a SpaceX IPO materializes.

Beyond SpaceX, Aju IB Investment has invested more than 16 billion won in total in U.S. biotech company Arcellx through Solarsta Ventures since 2019. Arcellx, which is developing CAR-T therapies for patients with refractory multiple myeloma, is drawing attention and was listed on the Nasdaq in 2022. Its share price, which was 15 dollars at the IPO, has recently risen to around 70 dollars, roughly a fivefold increase. Aju IB Investment is reportedly expecting a multiple of more than eight times its investment if it completes the exit from Arcellx.

Among its domestic portfolio, accommodation and travel platform Yanolja, which sought a Nasdaq listing last year, stands out. Aju IB Investment plans to accelerate its exit strategy, focusing on funds such as "Aju Joeun PEF," which includes Yanolja and generates performance fee income. Yanolja postponed its listing last year in order to achieve its target corporate value of more than 10 trillion won, and Aju IB Investment's remaining principal investment in Yanolja is known to be a little over 35 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.