U.S. President Donald Trump is launching a $12 billion (approximately 17.43 trillion won) strategic mineral stockpiling initiative to reduce dependence on Chinese rare earth elements and support domestic manufacturers. The project aims to prevent supply disruptions that could affect manufacturers as the U.S. seeks to decrease its reliance on Chinese rare earths and other metals.

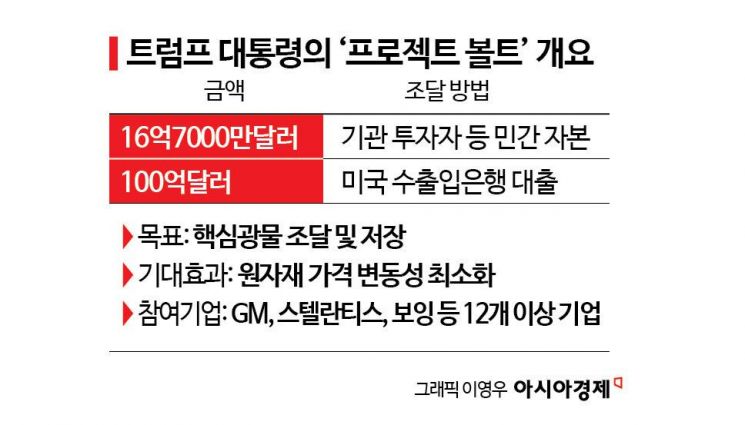

According to Bloomberg News on February 3 (local time), President Trump explained at the White House in Washington, D.C., that the initiative is intended "to ensure that American companies and workers are not harmed by resource shortages." Dubbed "Project Vault," the initiative combines $1.67 billion in private capital with a $10 billion loan from the U.S. Export-Import Bank to procure and store critical minerals.

President Trump referred to last year’s situation, when access to the rare earth supply chain controlled by China was restricted due to U.S.-China trade tensions, stating, "We never want to go through what we experienced a year ago again." He added, "Just as we have long operated the Strategic Petroleum Reserve (SPR) and stockpiled critical minerals for defense, we will now create reserves for American industry to ensure that no problems arise."

The United States already maintains national stockpiles of critical minerals for its defense industrial base, but there has been no reserve for private sector demand. Project Vault, which will be the first private-sector stockpiling initiative in the U.S., is similar to the country’s emergency oil reserves but focuses on minerals such as gallium and cobalt, which are used in cell phones, batteries, and jet engines instead of crude oil. In addition to rare earth elements and critical minerals, the program will also include minerals with high price volatility or other strategic importance. Specific details have not yet been announced.

To date, more than 12 companies, including General Motors, Stellantis, Boeing, Corning, GE Vernova, and Alphabet, are participating in the project. Three commodity trading firms-Hartree Partners, Traxys North America, and Mercuria Energy Group-have been contracted to purchase the raw materials needed to fill the stockpiles. The initiative provides participating manufacturers with a way to protect their operations from major raw material price fluctuations without having to maintain their own inventories.

The U.S. administration has signed cooperation agreements on this issue with several countries, including Australia, Japan, and Malaysia. In addition, at a summit of dozens of countries held in Washington on February 4, the groundwork was laid for advancing these agreements. Information about the institutional investors who contributed $1.67 billion to Project Vault has not been disclosed. A senior government official told Bloomberg News that investor interest exceeded expectations, as they were attracted by the participation of a group of highly creditworthy manufacturers, long-term investment commitments, and the involvement of U.S. export credit agencies.

Under the agreement, companies that make initial commitments to purchase materials at a later designated inventory price and pay a portion of the cost up front can submit a list of preferred materials they require to Project Vault.

The project aims to procure and store these materials. Manufacturers will bear costs such as loan interest and material storage fees. They can access the required materials on the condition that they replenish inventory. In the event of a major supply disruption, all materials will be made available.

A key element of the project’s design is that manufacturers who commit to purchasing a specific quantity of materials at a set price also agree to repurchase the same quantity at the same price in the future. The U.S. government believes this mechanism will help suppress raw material price volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)