Gold: "Volatility Is Temporary... Safe-Haven Demand Remains Clear"

Debate Continues Over Whether Silver's Rally Will Persist

The prices of gold and silver, which had previously soared to record highs, plummeted significantly, causing volatility in related exchange-traded fund (ETF) markets on February 2. Experts analyzed that the sharp drop in gold and silver prices is a temporary correction and forecast that their investment value will remain robust going forward.

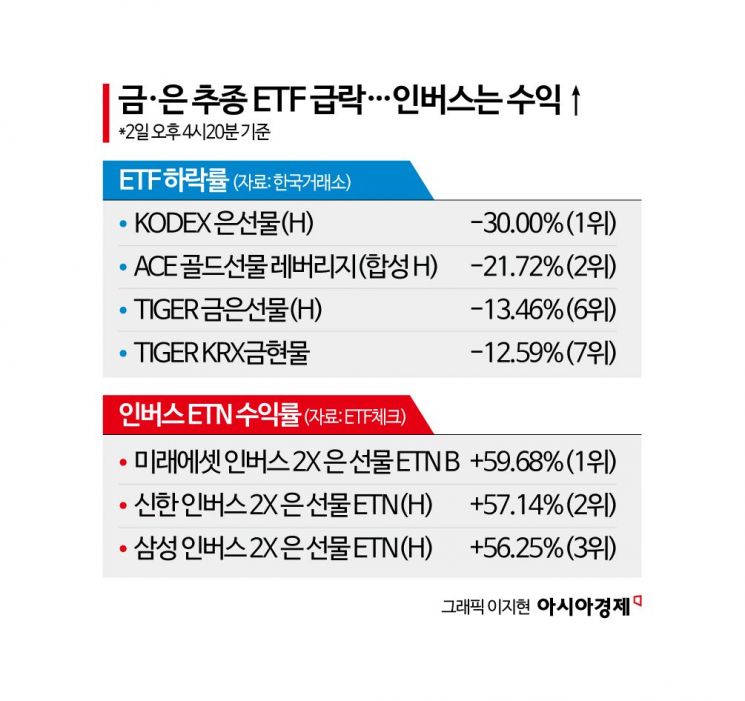

According to the Korea Exchange on February 3, gold and silver-related ETFs dominated the list of top ETFs with the largest declines the previous day. KODEX Silver Futures (H) fell 30.00% compared to the previous session, marking the steepest drop. ACE Gold Futures Leverage (Synthetic H) fell 21.72% (ranked 2nd), TIGER Gold & Silver Futures (H) dropped 13.46% (6th), and TIGER KRX Gold Spot fell 12.59% (7th). According to the Korea Exchange, the domestic gold price (99.99_1kg) closed at 227,700 won, down 10% from the previous day.

In contrast, inverse ETNs, which move in the opposite direction of gold and silver prices, saw significant gains. According to ETF Check, the top three ETNs by returns on the previous day were all silver futures ETNs. Mirae Asset Inverse 2X Silver Futures ETN B recorded a return of 59.68%, Shinhan Inverse 2X Silver Futures ETN (H) returned 57.14%, and Samsung Inverse 2X Silver Futures ETN (H) posted 56.25%.

Previously, on January 30, the nomination of Kevin Warsh, perceived as relatively hawkish, as Federal Reserve Chair led to a stronger dollar and a plunge in gold and silver prices. The drop was the largest in over a decade, and as the decline continued for a second day, demand-driven ETFs also showed downward trends. The sharp plunge in gold and silver prices stabilized overnight on February 2. On the New York Mercantile Exchange, the international gold price fell 11.39% to $4,745.10 per ounce on January 30, but on February 2, it declined only 1.95% to close at $4,652.60. Silver prices also plunged 35.90% to $78.53 per ounce on January 30, but finished at $77.01 the previous day, narrowing the decline to 1.52%.

The drop in silver prices was also influenced by increased margin requirements at the Chicago Mercantile Exchange (CME). CME has been raising margin requirements in response to the rapid surge in silver prices. From January 28, the margin for silver futures was raised from 9% to 11%, and starting from the close of the previous session, it was further increased to 15%. Ok Jihee, a researcher at Samsung Securities, explained, "Although silver futures hit an all-time high on January 29, profit-taking triggered a 12% drop to $106 immediately after, and such a steep decline was driven by the burden of higher margin rates. The shift to a margin-based system combined with increased margin rates made silver futures more vulnerable, even to minor negative factors such as the 'Kevin Warsh' news, resulting in a 30% plunge."

However, experts maintained their investment recommendations, citing the solid fundamentals of gold. They forecast that gold's value will remain strong due to ongoing geopolitical uncertainties and weakening confidence in dollar assets. Yoon Jaehong, a researcher at Mirae Asset Securities, emphasized, "Despite the temporary increase in volatility, gold is still likely to serve as a hedge against global geopolitical risks and economic policy changes. In addition to retail demand, global central banks are steadily increasing their gold reserves, and the proportion of banks planning to raise their gold holdings is also on the rise."

According to the World Gold Council (WGC), central banks continued robust gold purchases last year despite record-high gold prices. The WGC reported that in the fourth quarter of last year, central banks purchased 230 tons of gold, a 6% increase from the previous quarter. The National Bank of Poland was the largest buyer, acquiring 102 tons last year, followed by the National Bank of Kazakhstan with 57 tons. The People's Bank of China has also reportedly been increasing its gold reserves. The WGC stated in its report, "Last year, central bank gold purchases remained at impressive levels, demonstrating gold's continued strategic appeal. This trend is expected to continue through this year, and persistent economic and geopolitical uncertainty is likely to sustain demand for gold as a reserve asset."

Nam Yongsoo, head of ETF Management at Korea Investment Management, said, "Gold ETFs differ in performance and risk depending on their structure-physical, international, or futures-based. In a highly volatile gold market, physical gold ETFs are likely to draw more attention." He added, "Futures-based ETFs may face a drag on long-term performance due to rollover costs, whereas physical ETFs have the advantage of a simple and intuitive structure by directly tracking the spot price of gold. Also, when market volatility is high, bonds can help reduce downside risk, so bond-mixed ETFs such as 'ACE US Nasdaq 100 US Treasury 50 ETF' could also be good investment alternatives."

Kim Yonggu, a researcher at Yuanta Securities, also explained, "A change in the Fed chair alone cannot fundamentally alter the basis of the Fed's monetary policy. Rather than approaching gold as a speculative asset, systematic investment through installment funds or ETFs remains a valid strategy." However, regarding silver, he stated, "Gold has clear uses as a rare metal and its supply is controlled, making it a clear safe-haven asset, but silver does not fall into that category, so the validity of investing in silver products is questionable."

Meanwhile, some analysts warn that a period of prolonged gold price decline, as seen in the past, could occur again. In 1974, after gold prices soared more than fivefold, prices fell for 20 consecutive months. At that time, the easing of the oil shock and expectations for the end of the Vietnam War diminished gold's appeal, leading to a prolonged decline. In 2013, gold prices surged due to the European fiscal crisis, but then fell for two years as concerns grew over weak economic indicators in China and the possibility of gold purchases by central banks in emerging markets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)