Samsung Biologics Reclaims Third Place

Hanwha Aerospace Takes Back Seventh Spot

Top Market Cap Rankings Continue to Reshuffle Early in the Year

Since the beginning of this year, the stock market has shown strong performance led by large-cap stocks, intensifying the competition for market capitalization rankings. Samsung Biologics has reclaimed the third spot in market capitalization, surpassing LG Energy Solution for the first time in a while. As the two companies show divergent results for the fourth quarter of last year and differing business outlooks for this year, attention is focused on whether Samsung Biologics can solidify its position as number three. Additionally, Hanwha Aerospace, which has also been performing strongly since the start of the year, has overtaken SK Square to reclaim seventh place. Given that Hanwha Aerospace has risen by nearly 30% so far this year, there is a possibility for further gains, suggesting that shifts among the top market cap stocks are likely to continue for some time.

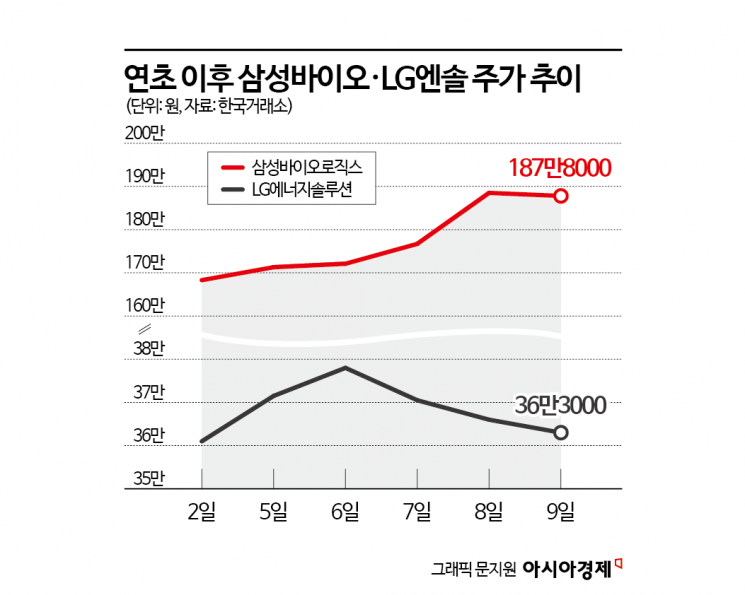

According to the Korea Exchange on January 12, as of January 9, Samsung Biologics ranked third in market capitalization at 86.9344 trillion won, while LG Energy Solution was fourth at 84.942 trillion won. Samsung Biologics reclaimed third place on January 8, and although LG Energy Solution briefly regained the spot on the morning of January 9, it lost the position again following the announcement of disappointing fourth-quarter results for last year.

Samsung Biologics and LG Energy Solution fiercely competed for third place throughout last year, but after July, LG Energy Solution secured the third position. Samsung Biologics also fell behind in the market cap race as it underwent a physical spin-off.

However, LG Energy Solution's stock price dropped last month following news of a supply contract termination, disappointing fourth-quarter results for last year, and an unfavorable business outlook for this year. These factors narrowed the market cap gap between the two companies, eventually leading to Samsung Biologics reclaiming third place. Over the past month, LG Energy Solution's stock price fell by 19.60%, while Samsung Biologics rose by 15.29% during the same period.

Last month, LG Energy Solution terminated battery supply contracts worth approximately 9.6 trillion won with Ford in the United States and 3.9217 trillion won with FBPS. For the fourth quarter of last year, LG Energy Solution recorded consolidated sales of 6.1415 trillion won and an operating loss of 122 billion won. Compared to the same period the previous year, sales decreased by 4.8% and losses continued. The outlook for this year is also not bright. Anna Lee, a researcher at Yuanta Securities, commented, "As sales for electric vehicles (EVs) are expected to decline this year, performance will likely be supported by energy storage systems (ESS) and small-sized batteries, so overall growth in 2026 compared to 2025 will be limited."

In contrast, Samsung Biologics is expected to post solid results for the fourth quarter of last year. Jae-Won Jung, a researcher at iM Securities, stated, "Samsung Biologics' fourth-quarter sales last year are expected to reach 1.2569 trillion won, up 32.3% year-on-year, with operating profit rising 77.1% to 557.4 billion won. The company is likely to meet the heightened market expectations driven by strong third-quarter results." He added, "Annual sales and operating profit for 2026 are forecast at 5.1151 trillion won and 2.3206 trillion won, respectively, representing year-on-year increases of 13.0% and 10.6%. This indicates that robust growth will continue this year as well."

Meanwhile, the seventh and eighth spots have also changed hands. Hanwha Aerospace's stock price has surged since the beginning of the year, allowing it to reclaim seventh place. On January 9, Hanwha Aerospace rose by more than 11%. As defense stocks have shown strength this year, Hanwha Aerospace has returned to blue-chip status and, riding this momentum, regained seventh place. Hanwha Aerospace has risen by 29.01% so far this year. If this upward trend continues, Hanwha Aerospace could potentially reclaim sixth place as well. The market capitalization gap with sixth-ranked HD Hyundai Heavy Industries is 1.3234 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.