Korea Federation of SMEs Announces Results of '2026 SME Export Outlook Survey'

It was found that the number of small and medium-sized enterprises (SMEs) expecting exports to 'increase' in 2026 is more than twice the number of those expecting exports to 'decrease' compared to this year.

On December 21, the Korea Federation of SMEs announced the results of the '2026 SME Export Outlook Survey,' which included these findings. The survey was conducted from December 1 to December 12, targeting 1,300 export-oriented SMEs.

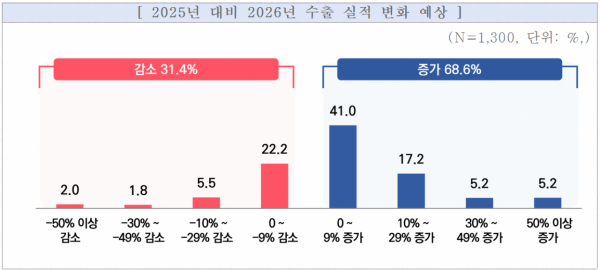

According to the survey, 68.6% of SMEs expect exports in 2026 to 'increase' compared to 2025, while 31.4% expect exports to 'decrease.' In particular, companies in the cosmetics (86.4%) and medical·bio (86.1%) sectors had the most positive outlook for exports in 2026.

The most common reason cited for expecting an increase in exports (multiple responses allowed) was 'improved product competitiveness, such as new product launches and quality enhancements,' chosen by 47.1% of respondents. This was followed by export market diversification (29.8%) and increased price competitiveness due to factors such as exchange rate rises (21.6%).

Among SMEs expecting a decrease in exports, 49.3% (multiple responses allowed) pointed to 'intensified low-price competition from China' as the main challenge. This was followed by ▲increased exchange rate volatility (44.6%) ▲sharp rises in raw material prices (37.0%) ▲uncertainty in US and EU tariff policies (35.0%).

As countermeasures in the event of declining export performance (multiple responses allowed), respondents cited ▲export market diversification (28.2%) ▲quality improvements or new product launches (23.0%) ▲reducing production costs such as labor and materials (21.8%).

Despite tariff policies, the market that export-oriented SMEs most want to newly enter or expand into is the United States (21.0%), followed by Europe (15.2%), Japan (10.6%), and China (10.6%).

As for key government tasks to strengthen export competitiveness, the highest demand was for 'expanding support for export voucher programs' (53.5%). This was followed by ▲establishing a response system against China's low-price competition (35.8%) ▲strengthening diplomacy to address US and EU tariffs (35.1%) ▲expanding support for participation in overseas exhibitions (including emerging markets) (31.5%) ▲support for responding to overseas certifications and regulations (27.2%).

Chu Moonkap, Head of Economic Policy at the Korea Federation of SMEs, stated, "It is significant that SMEs are projecting export growth through enhanced product competitiveness, even amid challenging external conditions such as strengthened export regulations in various countries." He added, "However, going forward, as a company's ability to reduce overall costs-including production, logistics, tariffs, and lead times-will determine export competitiveness, the government should prepare support measures to help SMEs counter China's low-price competition and enhance their competitiveness in the global market by reducing costs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.