Single-Institution System Dominated by KSD for Over 50 Years

"Need for Evolution in Unlisted Stock Trading Infrastructure"

Licensing Review and Approval... Driving Service Competition

As policy funds and venture capital are flowing into the venture investment market in large volumes, an infrastructure overhaul is being pursued to manage the rights and ownership of unlisted stocks through an "authorized digital ledger."

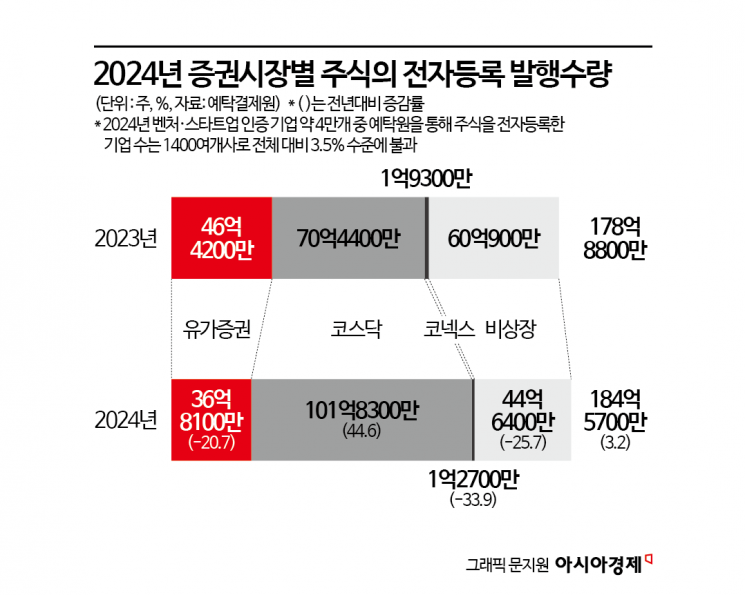

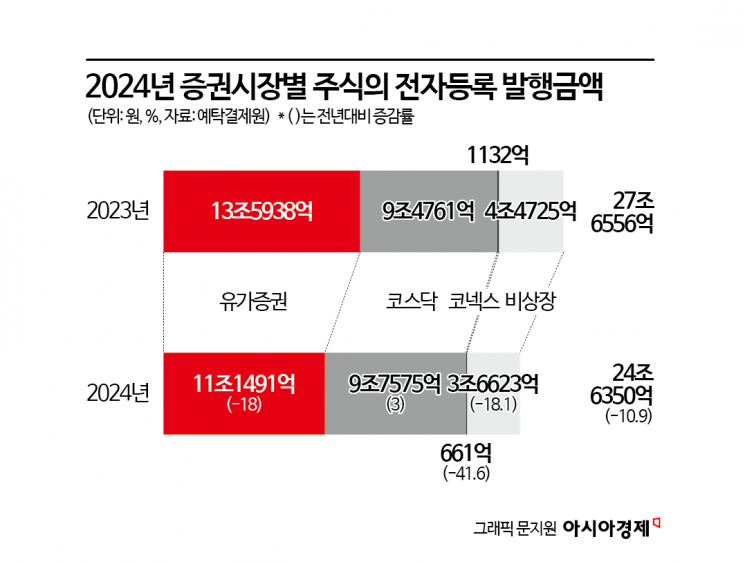

With the government set to implement a licensing system that allows private professional institutions, in addition to the Korea Securities Depository (KSD), to enter the unlisted electronic registration market, the electronic registration infrastructure-which has effectively operated under a single system since the KSD’s establishment in 1974-is now expected to see full-fledged competition. If analog record-keeping practices, such as using Excel, are modernized through this initiative, it is anticipated that transparency and efficiency in investment, recovery, and policy fund execution will be significantly enhanced.

'No Authorized Ledger' for Unlisted Stocks... Infrastructure Overhaul Ahead of Policy Fund Inflows

Electronic securities is a system that registers rights electronically, without physical certificates, so that issuance, distribution, and the exercise of rights are all processed digitally. The Electronic Securities Act aims to streamline the circulation of rights, protect the interests of stakeholders, and enhance the efficiency and transparency of the capital market.

According to the financial investment industry on December 22, the Financial Services Commission included this topic in its presidential work report on December 19. This move is interpreted as a response to growing demands that unlisted shares be managed through an authorized electronic ledger.

In the unlisted sector, there has long been a practice of managing shareholder registers and investment records manually, leading to criticism over lack of transaction transparency and liquidity. Since founders or financial officers have relied on traditional programs like Excel to manage records individually, there has been no authorized ledger. As a result, when shareholder registers change or rights relationships become complicated, investors have difficulty immediately verifying ownership. There have also been significant concerns about vulnerability to forgery and fraud.

Electronic registration is a mechanism to address these "ledger trust" issues, but in practice, a single structure with only the KSD as the registration institution has persisted. Although the law has allowed for a licensing system for electronic registration institutions, there have been very few applicants. The KSD system is designed mainly for listed stocks and bonds, and the unlisted sector, with its smaller issuance volumes and larger number of companies, has found it difficult to adopt electronic registration widely, according to industry experts.

Competition in Securities Registration Services... "Promoting Venture Investment"

From the perspective of policy authorities, as policy funds such as the 150 trillion won National Growth Fund and Business Development Company (BDC) funds are set to flow into unlisted companies starting next year, the need to transparently track equity flows and generate accurate statistics has grown. As the investment and post-management systems of investment institutions such as venture capital firms-the actual execution channels-must also be upgraded, digital management infrastructure can help prevent unfair practices such as tax evasion and illicit inheritance.

In March, the KSD also stated, "With the emergence of new electronic registration institutions becoming visible, it is necessary to respond preemptively to the new competitive environment," and conducted a strategic research project. In its proposal, the KSD noted, "There are companies preparing to apply for a license with the goal of specializing as electronic registration institutions for unlisted companies," and emphasized the need to analyze overseas cases of multiple registration institutions, examine how interoperability can be achieved among them, and consider improvements needed for the introduction of token securities.

This new licensing system for electronic registration service providers is expected to operate such that when a private corporation applies, the authorities will review the application according to established requirements and manuals before granting a license. An industry insider commented, "Given the high level of complexity and expertise required in the stock issuance market compared to the distribution market, it has not been easy for general companies to enter this field." The insider added, "This improvement plan appears to be aimed at selecting and allowing entry for qualified professional institutions to promote competition and drive service innovation in a stagnant market."

Expectations for Greater Transparency and Direct Financing... The Key to Expansion Is 'Linking Policy Funds'

Liquidity in the unlisted market is also expected to increase. If the procedures for verifying ownership and exercising rights are standardized, it will reduce the burden of due diligence and settlement in secondary (existing shareholder sales) transactions and mergers and acquisitions (M&A). If participation expands beyond venture and startup companies to include unlisted small and medium-sized enterprises and mid-sized companies, there will be greater opportunities to shift from collateral-based indirect financing to equity-based direct financing.

However, some point out that for the system to go beyond mere "licensing" and achieve real adoption, incentives and mandatory measures to encourage participation are needed. In this regard, there is discussion of making electronic registration mandatory-by revising investment management regulations and loan plans-for unlisted companies receiving policy loans from policy funds such as the Korea Growth Investment Corporation, Korea Development Bank, or policy loans from institutions like the Small and Medium Business Corporation, Korea Credit Guarantee Fund, or Korea Technology Finance Corporation. The rationale is that making electronic registration a "requirement for receiving policy funds" could quickly establish it as a market standard.

An industry insider said, "It is necessary to revise and pursue legislation to establish criteria for target companies via presidential decree, building on the previously scrapped National Assembly discussions on mandatory electronic registration of unlisted securities." The insider added, "As the system moves toward competition, it will become even more important to establish robust issuer protection measures, such as interoperability, security and failure response, and liability and compensation in the event of incidents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.