Fell More Than 5% After Investment Warning Designation

Rapid Stock Price Recovery Unlikely

Investment Warning Status May Be Lifted Only at Year-End

Large-Cap KOSPI Stocks Recently Designated as Investment Warning Stocks

Hanwha Aerospace, which had been gradually recovering its stock price this month, has been designated as an investment warning stock, hindering its momentum. With this designation, a rapid recovery in the stock price is unlikely in the near future.

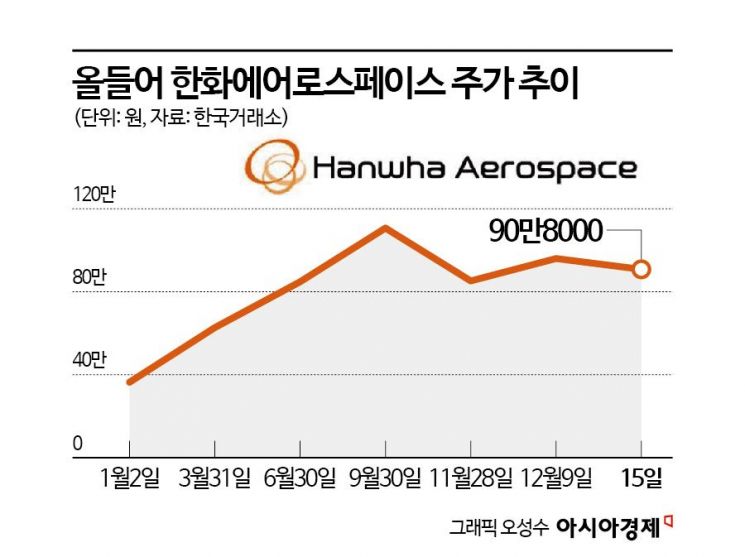

According to the Korea Exchange on December 16, Hanwha Aerospace fell by more than 5% the previous day. It closed at 908,000 won, down 5.52% from the previous session.

At the end of last month, Hanwha Aerospace's stock price fell below the 900,000 won mark, dropping as low as 810,000 won. However, it had been showing signs of recovery this month. On this day, however, the stock price plunged again after being designated as an investment warning stock.

The Korea Exchange announced on December 12 that Hanwha Aerospace would be designated as an investment warning stock starting from the 15th. The reasons for the designation were as follows: the recent closing price had increased by more than 200% compared to a year ago; the closing price on the 12th was the highest among the past 15 trading days; and, over the last 15 trading days, the top 10 accounts by buy participation rate, considering market impact, exceeded the set threshold for more than four trading days.

Hanwha Aerospace's stock price has risen 182.42% so far this year. As of December 12, it was up 213.3% compared to a year ago.

Once designated as an investment warning stock, investors must pay 100% of the margin when buying, making margin trading impossible. In addition, credit purchases are prohibited, and the stock cannot be used as collateral. Trading on alternative trading systems (ATS) is also restricted.

After a relentless rally in the first half of the year that elevated Hanwha Aerospace to the ranks of so-called "emperor stocks," the second half saw a downturn due to profit-taking and developments such as peace negotiations in Ukraine. The stock peaked at the end of September and has since declined, falling more than 19% from its late-September high.

With the investment warning designation, a swift recovery in the stock price is unlikely for the time being. The earliest the designation could be lifted appears to be at the end of the year. The first review date for lifting Hanwha Aerospace's investment warning status is scheduled for the 29th. If, on the review date, the closing price does not rise by more than 45% compared to five days prior, does not increase by more than 75% compared to fifteen days prior, and is not the highest closing price among the past fifteen trading days, the investment warning designation will be lifted on the following day, the 30th.

Not only Hanwha Aerospace but also several large-cap KOSPI stocks have recently been designated as investment warning stocks, affecting their share prices. SK Hynix and SK Square, which were designated as investment warning stocks on the 11th, fell by 2.98% and 5.03%, respectively, the previous day. Hyundai Rotem, designated on the 10th, declined by 5.62% after the designation, and Doosan Enerbility, designated on the 8th, has dropped by more than 4% since its designation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.