Uncertain Future Value Amid High Interest Rates and Industry Downturn

Record-High Corporate Rehabilitations

Rising 'Liquidation Risk' as M&A Delays Persist

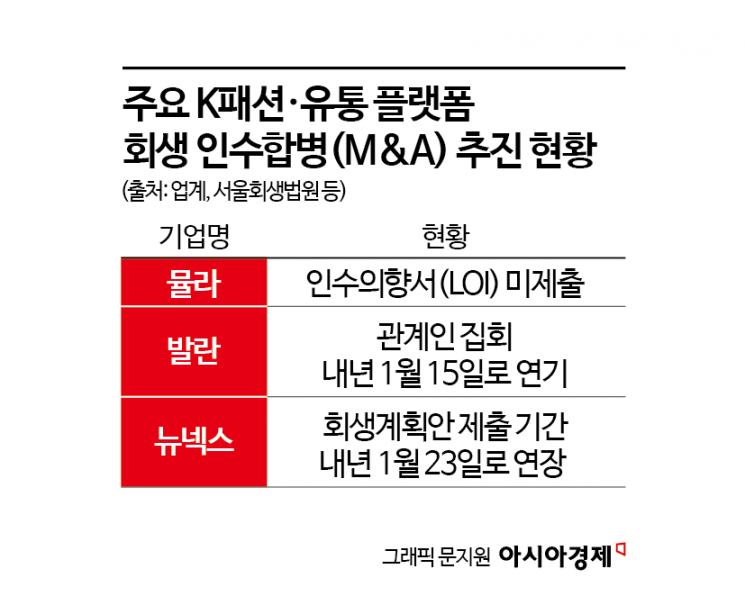

The likelihood of mergers and acquisitions (M&A) being completed within this year for K-fashion and distribution platform companies that once led the market, such as Mulawear, Ballan, and Newnex, has become unclear. There are growing concerns that the risk of liquidation is increasing as difficulties in the rehabilitation M&A process are prolonged.

Mulawear: No Bidders... Ballan and Newnex: 'Procedural Delays'

According to the investment banking (IB) industry on December 15, although letters of intent (LOI) for the acquisition of Mulawear, the operator of the athleisure brand "Mulawear," were recently solicited, it has been confirmed that not a single company submitted an LOI. Founded in 2011, Mulawear was considered one of the three major athleisure brands alongside Andar and Xexymix. However, due to intensifying industry competition and ongoing losses, the company fell into a state of complete capital impairment and filed for corporate rehabilitation last January. The M&A is being pursued through a "stalking horse" method, which involves selecting a preferred bidder and signing a conditional acquisition agreement before proceeding with an open bid. However, as no bidders have emerged, the prevailing view is that the sale is effectively off the table for this year.

Newnex, which operates the fashion platform "Brandi," is also experiencing delays in its rehabilitation process. The Seoul Bankruptcy Court recently extended the investigation period for rehabilitation claims and secured claims for Newnex by about a month, and the deadline for submitting the rehabilitation plan was changed from January 5 to January 23 of next year. As the submission of the rehabilitation plan is postponed, management uncertainty is expected to persist for a longer period.

For Ballan, a luxury goods platform that began its rehabilitation process last April, the final stage of the corporate rehabilitation procedure-the meeting of interested parties-has been repeatedly postponed. On December 9, the Seoul Bankruptcy Court rescheduled the meeting of interested parties, originally set for December 18, to January 15 of next year. There was also a previous delay (from November 20 to December 18). The meeting of interested parties is a process in which creditors, shareholders, and other stakeholders vote on the rehabilitation plan. If the plan is approved at this meeting, Ballan's rehabilitation process will be concluded. Currently, Ballan is being pursued for acquisition by Asia Advisors Korea (AAK), but due to the postponement of the meeting of interested parties, its "early graduation" from rehabilitation has been pushed to next year.

Market experts analyze that this trend is due to the prolonged high-interest rates and economic downturn, which have frozen the M&A market, as well as a significant decline in the investment appeal of these companies. Lee Jeongyeop, a corporate rehabilitation and bankruptcy specialist and managing attorney at Law Office Rojipsa, explained, "In the fashion and distribution platform sector, the business environment is unstable due to intensifying competition and shrinking consumption, and the profit model is weak compared to the massive marketing costs. Many potential acquirers are delaying deals because they believe the immediate costs outweigh the future value."

More Companies for Sale, But No Buyers

Currently, the number of companies filing for corporate rehabilitation is surging, and the number of assets coming onto the M&A market is also on the rise. According to the Supreme Court, from January to October this year, there were 1,092 corporate rehabilitation filings, a 24% increase compared to the same period last year (879 cases). This figure is close to last year's annual total (1,094 cases) and is expected to set a new record for the third consecutive year.

However, assets that have failed to find new owners are piling up in the market. For example, HuTech Industries, a massage chair manufacturer, was put up for sale along with its subsidiary Huen in March this year but failed to sell and is now attempting a resale. Silkroadsoft, a company specializing in system software development and solutions, has also struggled to attract investors despite two public sale attempts.

Attorney Lee explained, "If no acquirer emerges, companies will naturally proceed to liquidation. As a last resort, there may be attempts to bundle several companies of the same type for a collective acquisition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.