Gifts of Apartment Units and Gifts to Minors in Seoul Reach Highest Level Since 2022 This Year

Thorough Audit of Transactions Reported Far Below Market Value, Low Appraisals, and Split Gifting

The National Tax Service will conduct a comprehensive review of high-priced apartment gifts in eight districts of Seoul: the four Gangnam districts (Gangnam, Seocho, Songpa, and Gangdong) and the so-called "Mayongseong" area (Mapo, Yongsan, and Seongdong). This is the first time the National Tax Service has launched a full-scale investigation targeting specific regions. The agency will verify whether apartment values were reported below market price at the time of gifting and whether so-called "split gifting" was used to disperse gifted assets, with plans to impose taxes accordingly.

On the 4th, the National Tax Service announced that it would conduct a thorough review of gift tax filings for apartments located in the four Gangnam districts and the Mayongseong area, where high-priced apartments are concentrated.

Sanghoon Oh, Director of the Asset Taxation Bureau at the National Tax Service, is giving a related briefing at the Government Complex Sejong on the 4th. National Tax Service

Sanghoon Oh, Director of the Asset Taxation Bureau at the National Tax Service, is giving a related briefing at the Government Complex Sejong on the 4th. National Tax Service

From January to October of this year, the number of gifted collective buildings in Seoul reached 7,708, the highest in three years since 10,068 cases were recorded as of October 2022. The number of gifts to minors also reached 223 cases, the highest since 2022. Sanghoon Oh, Director of the Asset Taxation Bureau at the National Tax Service, said, "More than half of the apartments gifted to minors are concentrated in the leading price-increase areas such as the four Gangnam districts and Mayongseong, further deepening asset polarization among the younger generation. We will verify whether apartment prices were reported at fair market value and conduct a detailed review of cases suspected of debt-utilizing expedient gifts, such as burdened gifts. In cases of suspected tax evasion, we will conduct thorough tax investigations."

The review will target apartments in the four Gangnam districts and Mayongseong where the transaction price exceeds 100 million won per 3.3 square meters (one pyeong). For example, a 24-pyeong apartment with a transaction price over 2.4 billion won or a 30-pyeong apartment over 3 billion won will be subject to investigation.

Initially, the National Tax Service plans to focus on cases where the reported value was significantly lower than the market price. As of November this year, among 2,077 apartment gifts in the four Gangnam districts and Mayongseong from January to July (after the gift tax filing deadline), 1,699 cases had gift tax filings. Of these, 1,068 cases were reported at market value based on comparable sales, while 631 cases were reported using the officially announced price of multi-unit housing without calculating the market value.

For the 1,068 cases reported at market value, the National Tax Service will check whether the valuation was appropriate and whether there were any unfair appraisal values not recognized under the Inheritance and Gift Tax Act. For the 631 cases reported using the official price, if the reported value is significantly lower than the market price, the National Tax Service will directly appraise the property and impose taxes based on the market value.

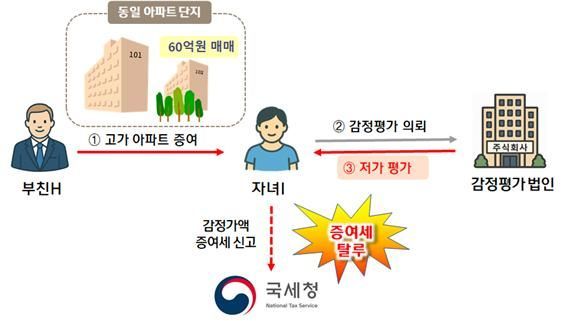

According to the National Tax Service, a father, H, gifted a high-priced apartment in Seoul to his child, I. While preparing the gift tax filing, I discovered that an apartment of the same size in the same complex had been sold for 6 billion won. As the expected gift tax increased, I asked an appraisal firm, introduced by an acquaintance, to appraise the property at a value lower than the market price. As a result, I filed the gift tax using an appraised value of 3.9 billion won, about 65% of the nearby transaction price. The National Tax Service commissioned its own appraisal, corrected the value to several billion won higher, and is considering designating the appraisal firm that provided the low valuation as a "non-recognized appraisal institution."

The agency will also scrutinize cases where individuals easily acquire high-priced apartments with parental assistance but use debt to avoid tax obligations. For "burdened gifts" that include liabilities such as jeonse deposits, the National Tax Service will thoroughly check whether the child who received the property actually repaid the mortgage or jeonse deposit, and whether, despite repaying the loan with their salary, they are also receiving separate living expenses from their parents.

According to the National Tax Service, B received a burdened gift from his mother, A, taking over several hundred million won in mortgage debt on a high-priced apartment in Seoul. B claimed to be repaying the mortgage with his earned income, but the National Tax Service found that the sources of funds for luxury living expenses, such as several hundred million won in annual credit card spending, children's overseas education, and travel expenses, were unclear. The agency suspects that while B's income was used to repay the mortgage, living expenses and other costs were gifted by his mother, and has selected this case for a source-of-funds investigation.

The National Tax Service will also examine whether there were any tax evasion issues in the process by which the donor accumulated the assets used to acquire the real estate. If it is found that the funds used to purchase the apartment were obtained through business income tax evasion or by recording fictitious expenses, the investigation will be expanded to related businesses. In cases of illegal or tax-evading activities, the agency will not only collect back taxes but also, if necessary, refer the case to relevant authorities, strictly enforcing the law and principles.

In addition, the agency will thoroughly check for tax avoidance in cases of generation-skipping gifts to minors, where grandparents gift assets directly to grandchildren, bypassing their children. The National Tax Service will conduct sample reviews of large generation-skipping gifts to determine whether they are disguised gifts intended to avoid higher tax brackets or split gifts intended to disperse assets, and will expand the scope of the investigation depending on the results.

Director Oh stated, "Despite stricter lending regulations, we will focus our efforts on blocking speculative activities that deepen asset polarization by verifying the sources of funds for cash-rich individuals fueling the 'Gangnam subscription' craze. We will regularly analyze the asset and debt status of those who acquire high-priced homes relative to their income or maintain a luxurious lifestyle, and take strict action against those suspected of tax evasion who fail to fulfill their proper tax reporting and payment obligations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.