Seasonal and Participatory Marketing on the Rise

Seasonality and Playfulness Drive Purchasing Decisions

In this era of high inflation, consumers are increasingly seeking greater satisfaction for the same amount of spending. As the trend of so-called "highly concentrated consumption," which values the meaning and enjoyment gained from a single choice over simple "consumption," becomes stronger, changes are emerging in the snack market as well. From seasonal limited-edition products made with in-season ingredients, to "Matcha Core" snacks reflecting the global matcha craze, and even experiential marketing that involves direct consumer participation, the criteria for purchasing products are expanding beyond simple taste to the "density of experience." As a result, the food industry is paying close attention to which brands will be able to secure a lasting fandom.

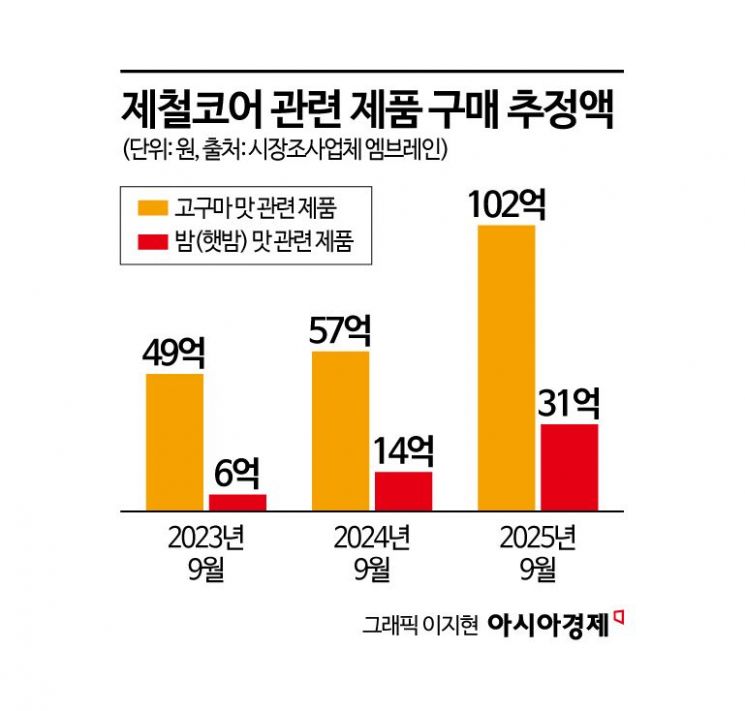

According to F&B purchase trend analysis by the market research firm Embrain on November 22, "Seasonal Core" products that emphasize seasonality are emerging as a new formula for success in the distribution industry. In particular, there has been a remarkable increase in demand for snacks using autumn seasonal ingredients such as sweet potatoes and chestnuts. As of September this year, the estimated purchase amount for sweet potato-related products sold at large supermarkets and convenience stores reached 10.2 billion won, a 78.7% surge compared to the same period last year (5.7 billion won). Chestnut (fresh chestnut) products also more than doubled, from 1.4 billion won in September 2024 to 3.1 billion won this September. As the "rarity" of experience and "consumption possible only now" become important values, products that maximize the seasonal experience are drawing attention.

The spread of "Matcha Core," reflecting global trends, is also noteworthy. The purchase amount of matcha products, which have shown steady growth since early this year, peaked at 7 billion won in September. The matcha craze, which began among overseas Generation Z, has rapidly spread in Korea as it has become a symbol of "clean eating" that values the original taste of raw ingredients and minimal processing, rather than just a passing fad. The diversification of product categories-including ice cream, biscuits, snacks, and chocolate-has also contributed to this growth. Recently, Matcha Core has been expanding beyond food into lifestyle areas such as fashion, beauty, and interior design, leading to predictions that this trend will likely continue for some time.

Cases combining participatory marketing have also boosted consumer choices. The chocolate snack "Kancho," which sparked a "name-finding challenge" craze on social media, had seen a decline in estimated purchases for a while, but recorded 4.7 billion won in September this year, showing a 157.4% growth rate in just one month. The method of finding names imprinted on the product and sharing them through photos and videos has rapidly expanded content consumption not only among individuals but also among friends, families, and fandoms based on relationships. Marketing that combines storytelling and playful elements is credited with stimulating new demand.

The F&B industry sees the shift away from consumption as a simple act of tasting products, with "what kind of experience is provided" becoming the core competitive edge. As elements such as seasonality, rarity, and participation that stimulate consumers' emotional satisfaction determine the success or failure of the snack market, there is growing interest in which product concepts and brands will be able to secure ongoing attention and loyalty in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.