Big Tech Corporate Bonds and Treasury TGA Balance Remain Unstable

Concerns Over Diverging Federal Reserve Views Amid Distorted Economic Indicators

The longest government shutdown in U.S. history has ended, but the strain in the short-term funding market continues. This is because conflicting assessments of the economy are emerging within the Federal Reserve, and political polarization is further intensifying anxiety in the financial markets.

U.S. Big Tech and Treasury Market Anxiety Persist

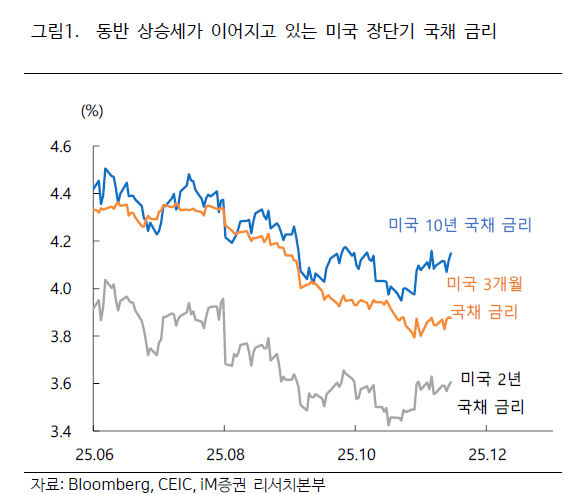

On November 17, iM Securities provided this analysis. The company noted that, as both short- and long-term U.S. interest rates continue to rise, key price indicators considered signals of short-term funding market stress are also showing persistent instability.

For example, the credit default swap (CDS) premium for Oracle and AAA corporate bond yields, which began rising with the surge in corporate bond issuance by big tech companies, have either continued to climb or remained elevated. In particular, the sharp increase in Oracle’s CDS premium, coupled with recent concerns about an overheating AI market, is amplifying market unease. While the risk of big tech companies’ debt levels being significantly affected by bond issuance remains low, analysts say this is still enough to create short-term instability in the funding market.

The U.S. Treasury General Account (TGA) balance, which was a trigger for the recent short-term funding market strain, has also shown little movement. Although the shutdown has ended, it will take some time for federal government functions to fully normalize, so the TGA balance is not expected to decrease immediately. This means it will take time for sufficient liquidity to flow into the market.

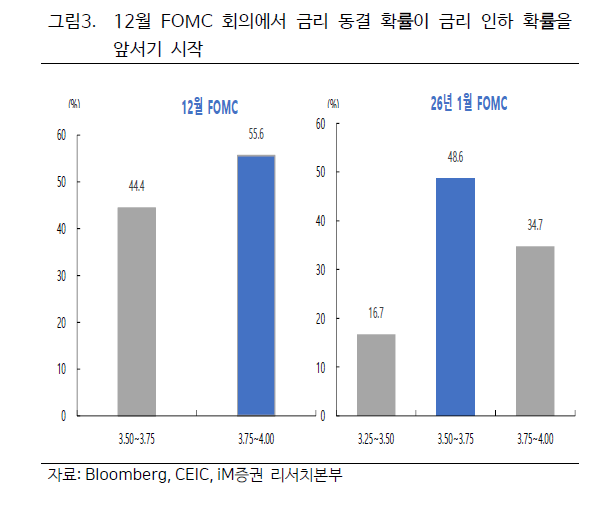

Growing uncertainty over whether the Federal Reserve will cut interest rates is also contributing to the ongoing strain in the short-term funding market. Already, the probability of a rate freeze at next month’s Federal Open Market Committee (FOMC) meeting has begun to surpass the likelihood of a rate cut.

Polarization in Both the U.S. Economy and Interest Rate Policy

iM Securities believes that the strain in the U.S. short-term funding market will ease this week. This expectation is based on the gradual normalization of federal government functions, which is anticipated to lead to a resumption of delayed fiscal spending. The recent pause in the strengthening of the dollar is also seen as a signal that concerns about a prolonged government shutdown are easing.

Regardless of whether interest rates are cut, the Federal Reserve could stabilize the market by purchasing bonds, especially short-term Treasuries. John Williams, President of the Federal Reserve Bank of New York, stated on November 12 that the time is approaching for the central bank to resume bond purchases to maintain control over short-term interest rates. He said, "The central bank is seeking a sufficient level of reserves to ensure stable control of its interest rate target and to allow the short-term funding market to function normally."

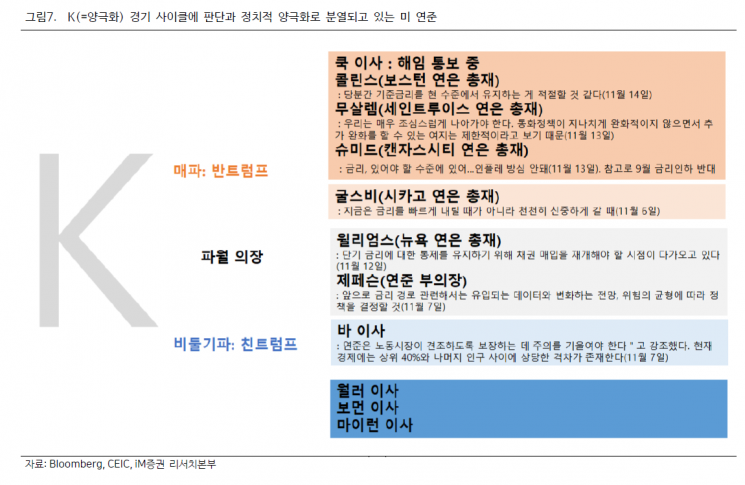

However, ongoing uncertainty over the Federal Reserve’s interest rate policy remains a source of instability for both interest rates and the funding market. Park Sanghyun, a researcher at iM Securities, explained, "The polarization cycle in the U.S. economy has deepened due to the government shutdown, and conflicting views within the Federal Reserve about the economic outlook, along with political polarization centered around support or opposition to President Donald Trump, are heightening market anxiety." He added, "As Federal Reserve officials disagree on whether to focus interest rate policy on addressing labor market instability or inflation-particularly in the face of distorted economic indicators-uncertainty may be further exacerbated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.