24 Types of Information Provided for Identifying Risk Factors

Risk Signals Derived Based on Characteristics of Jeonse Fraud Landlords

On October 23, the Seoul Metropolitan Government announced the launch of the "Jeonse Fraud Risk Analysis Report" service, which allows users to easily check risk factors related to a property and its landlord before signing a lease agreement.

This service provides a total of 24 types of information, including 11 landlord-related items and various property details, enabling a comprehensive assessment of the safety of a jeonse contract.

The 11 landlord-related items include KCB credit score, default status, financial misconduct records, information on bad credit, bankruptcy or personal rehabilitation status, tax delinquency, history of arrears or fraud, and the debt service ratio (DSR), among others.

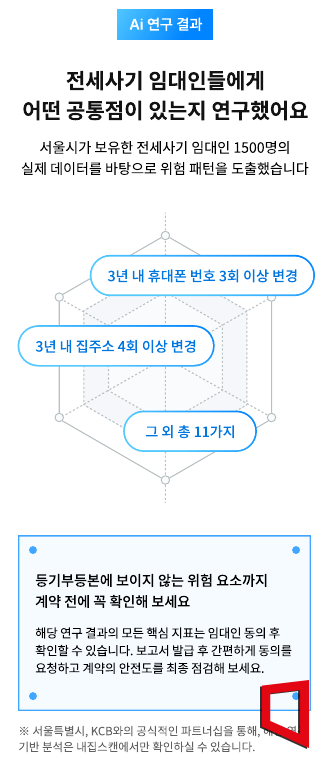

The Seoul Metropolitan Government analyzed data from over 1,500 landlords involved in jeonse fraud to identify common characteristics that distinguish them from ordinary landlords, ultimately identifying 11 risk signals.

The most significant difference was "creditworthiness." The average credit score of landlords involved in jeonse fraud at the time of contract was 591, which is more than 300 points lower than that of ordinary landlords (908).

Regarding "number of properties owned," 25% of fraudulent landlords owned four or more properties, whereas cases of ordinary landlords owning four or more properties were extremely rare. In terms of "public information retention rate," such as tax delinquency, 26% of fraudulent landlords had public records, compared to just 0.7% of ordinary landlords.

The service also allows users to check the number of mobile phone number changes in the past three years, the number of registered home addresses, and the number of overdue payments, providing a comprehensive overview of the landlord’s financial status and overall stability.

The 13 property-related items include building usage, presence of rights infringement, building code violations, debt compared to market value (mortgage), price appropriateness, guarantee insurance enrollment, recommended contract clauses, loan approval probability, contract safety, and a comprehensive opinion from an expert, among others.

To use the Jeonse Fraud Risk Analysis Report, users can access the private real estate risk analysis platform "Naejibscan" via the jeonse fraud risk analysis banner on the Seoul Housing Portal or Youth Information Portal, and use a coupon issued by the Seoul Metropolitan Government.

The report is provided free of charge to 1,000 prospective lease agreement signers in Seoul. By entering the address of the property under consideration, users can receive information collected and analyzed by AI.

Choi Jinseok, Director of Housing at the Seoul Metropolitan Government, stated, "The AI and big data-based 'Jeonse Fraud Risk Analysis Report' serves as a safety measure to quickly and accurately identify risk factors before signing a contract, thereby preventing damage. We will strengthen administrative services and actively pursue institutional improvements to prevent jeonse fraud and protect tenants' rights."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)