Pernod Ricard Sales Plunge 30%, Diageo Swings to Loss

Bottle-Focused Structure, Retroactive Tariffs, and Rising Channel Costs Squeeze Profitability

The earnings of the two leading players in the whiskey market, Diageo Korea and Pernod Ricard Korea, have both plummeted. As consumer preferences have shifted toward highballs and ready-to-drink (RTD) products, their strategies focused on premium bottled whiskey have revealed their limitations. The added burdens of tariffs, logistics costs, and promotional expenses have also sharply eroded profitability.

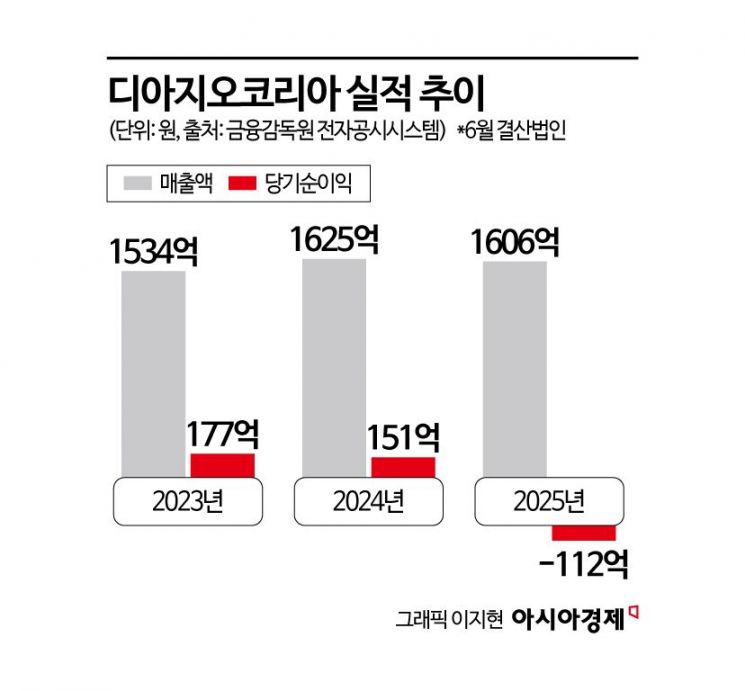

According to the Financial Supervisory Service's electronic disclosure system (DART) on October 14, Diageo Korea, which closes its books in June, recorded sales of 160.6 billion won for the 2024 fiscal year (July 2024 to June 2025), a slight decrease of 1.2% compared to last year’s 162.5 billion won. During this period, its net profit of 15.1 billion won turned into a net loss of 11.2 billion won, marking a shift to the red.

Diageo Korea is an importer of whiskey brands such as Johnnie Walker, Lagavulin, and Talisker.

In July 2022, Diageo Korea spun off all of its businesses except for the local whiskey brand Windsor. The former Diageo Korea, now focused solely on the Windsor business, changed its name to Windsor Global, while the newly established entity was named Diageo Korea. This is the third set of results since the split, and the first time the new entity has posted a loss since its establishment.

The decisive factor behind Diageo Korea's shift to a net loss was the retroactive payment of tariffs. Since 2020, Diageo Korea has been under a customs investigation regarding its method of determining transfer prices for imported whiskey products. In June, the company received a final tax notice from Busan Customs for retroactive tariffs and other charges on goods imported between January 6, 2020, and January 5, 2025. After paying 23 billion won in assessed charges, the company’s financial results were severely impacted.

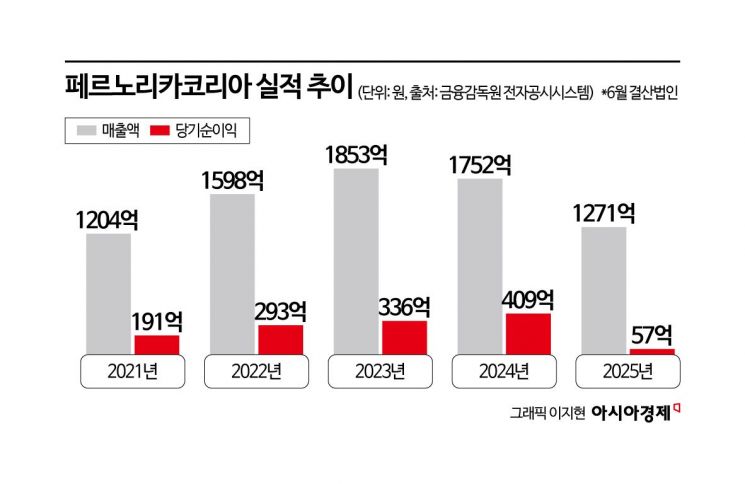

Pernod Ricard Korea, which owns leading brands such as Ballantine's, Royal Salute, and The Glenlivet, also posted disappointing results. Also operating on a June fiscal year, Pernod Ricard Korea reported sales of 120.7 billion won for the 2024 fiscal year, a 31.1% drop from the previous year’s 175.2 billion won. With sales falling by more than 50 billion won in a year, net profit plummeted from 40.9 billion won last year to just 5.7 billion won.

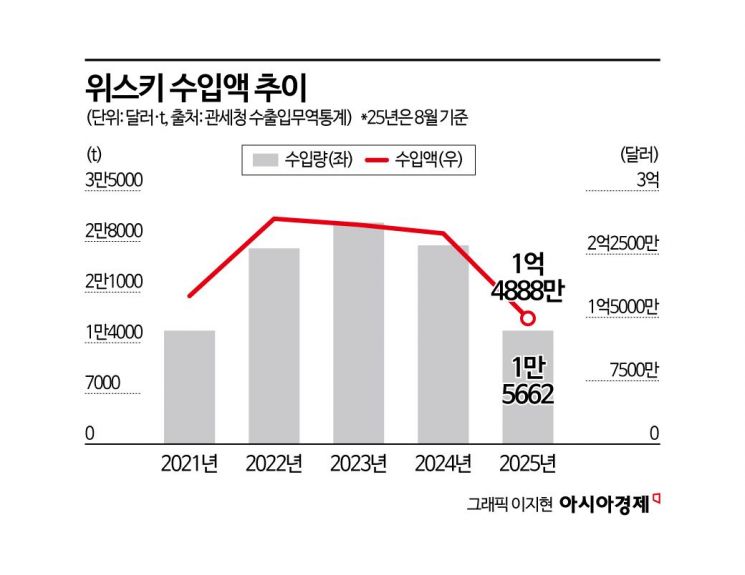

The poor performance of both companies is attributed to the deterioration of the whiskey market. The domestic whiskey market, which grew rapidly during the COVID-19 pandemic, is now struggling to maintain quantitative growth after the boom. According to the Korea Customs Service, whiskey imports for the year as of August totaled 148.88 million dollars (about 210 billion won), an 8.7% decrease compared to the same period last year (163.07 million dollars).

With the overall whiskey market stagnating, recent changes in consumer behavior have also negatively affected the industry. Pernod Ricard Korea, which focuses on premium whiskey, has a portfolio dominated by bottled products. However, as consumer trends shift toward smaller-sized options like highballs and RTDs, the sales barriers for relatively large bottled whiskey products continue to rise.

The concentration of consumption in easily accessible channels such as convenience stores is another negative factor for Pernod Ricard Korea. Traditionally, Pernod Ricard has focused on on-trade channels such as bars, hotels, and restaurants, where brand experience is key. However, with the recent downturn in the foodservice industry, consumption in these venues has slowed, intensifying the impact of declining demand in their main channels. As a result, dependence on off-trade channels such as convenience stores and supermarkets has increased.

As competition to secure channels has intensified, Pernod Ricard Korea has likely ramped up various promotions, discounts, and events tailored to each channel. An industry insider commented, "While frequent promotions can help drive sales, the associated costs eat into margins. For example, this year’s Chuseok holiday gift sets often featured lower prices but included more elaborate items such as exclusive glasses."

With the growing influence of distributors like convenience stores and supermarkets, suppliers are increasingly faced with tougher terms, such as higher commissions and display fees. In this environment, Pernod Ricard Korea may not have allocated enough resources to secure favorable entry terms or prominent shelf placement. In particular, the high number of convenience store locations increases logistics costs and inventory risks for suppliers, who must absorb these challenges.

However, some argue that the poor performance of the two companies cannot be attributed solely to market conditions. Even in the same environment, importers such as William Grant & Sons Korea and Beam Suntory Korea, which have led single malt whiskey and highball trends with brands like Balvenie and Kakubin, continue to post strong growth. An industry insider noted, "Rather than a market slump, it is more accurate to view this as a period of normalization and adjustment, with intensified competition. In the case of Pernod Ricard Korea, while it has many heritage brands, it lacks so-called hip or hype brands. Strategically building a portfolio based on trends and channel suitability will be crucial."

A Pernod Ricard Korea representative stated, "An unstable market environment marked by weakened consumer sentiment, exchange rate volatility, and changing consumption patterns is leading to intensified competition. Pernod Ricard Korea plans to drive the growth of the domestic liquor market by providing diverse brand experiences and continuing to invest and innovate in response to market changes, trends, and consumer needs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.