Analysis of the Report: "Estimating the Economic Value of Tax Platforms"

On September 30, Jarvis and Villains announced that research results showed the socioeconomic value of the tax platform SamjeomSam exceeds 3 trillion won.

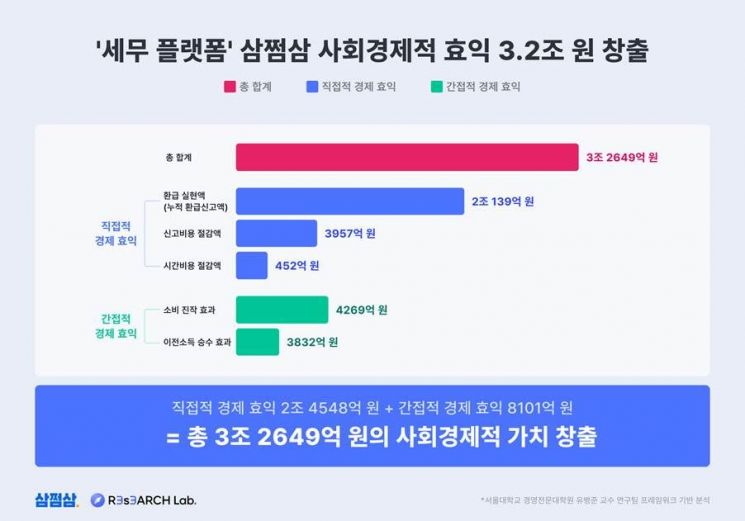

Jarvis and Villains explained that the recently released report by the SamjeomSam Research Lab, a policy research institute, titled "Estimating the Economic Value of Tax Platforms; Approximately 3.2 Trillion Won in Benefits as Seen Through SamjeomSam," found that tax technology not only reduces the tax filing burden for individuals, but also contributes to the economic welfare of citizens and revitalizes domestic demand.

This analysis quantified the economic benefits of tax platforms by categorizing them into direct and indirect forms, based on the research methodology (framework) previously presented by Professor Yoo Byungjoon’s research team at Seoul National University Business School, who conducted a prior study in 2022.

On the 30th, Jarvis and Villains announced that a study revealed the socioeconomic value of the tax platform SamjeomSam exceeds 3 trillion won. Jarvis and Villains

On the 30th, Jarvis and Villains announced that a study revealed the socioeconomic value of the tax platform SamjeomSam exceeds 3 trillion won. Jarvis and Villains

First, the direct economic benefit was calculated at 2.4548 trillion won. Since the launch of SamjeomSam in 2020, the cumulative amount of tax refunds filed over the past six years was tallied at 2.0139 trillion won as realized refunds, and the estimated tax agent filing costs of 395.7 billion won and time costs of 45.2 billion won that would have been incurred without using SamjeomSam were added.

The indirect economic benefit amounted to 810.1 billion won. The largest component was the "consumption stimulation effect (primary effect)" at 426.9 billion won, which resulted from direct economic benefits leading to increased individual consumption and thereby contributing to the domestic economy. This was measured by applying the marginal propensity to consume, which is the proportion of additional income spent rather than saved.

The transfer income multiplier effect was found to be 383.2 billion won. This was calculated by separately measuring the pure ripple effects from the second round onward, excluding the primary effect. The transfer income multiplier refers to the concept of how much government transfer payments increase gross domestic product (GDP), and it was assumed that the logic is similar to the transfer income that taxpayers receive through refunds.

The SamjeomSam Research Lab also emphasized the clear intangible effects of tax platforms. It noted that ordinary taxpayers, who were previously unaware of tax refunds due to complex procedures, have begun to understand their refund rights through the platform. By popularizing the concept of refunds, the platform has also contributed to the tax administration system.

Chae Ibae, head of the SamjeomSam Research Lab, stated, "We have confirmed that tax platforms not only increase gross domestic product, but also provide intangible benefits such as improving the efficiency of tax administration and spreading a culture of faithful tax payment. Through further advancement of artificial intelligence (AI), we will be able to provide even more substantial benefits to citizens and taxpayers in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.