Emart24 Becomes First in Industry to Enter Laos

Domestic Market Saturation Spurs Rapid Overseas Expansion Through Local Partnerships

Targeting Local Consumer Demand with Localization Strategies

Convenience store companies are accelerating their expansion into overseas markets. Facing negative growth in the domestic convenience store market, their strategy is to increase the number of stores abroad to sustain growth. Although the proportion of overseas sales remains minimal, with the global surge of the "K-culture" phenomenon, these companies are seeking breakthroughs by promoting Korean brand products and their own private label (PB) products.

According to the industry on October 2, Emart24 signed a master franchise (MF) agreement with the Laos-based Kolao Group on September 28. Under a master franchise, instead of directly entering a foreign market, a company contracts with a local business, selling the rights to operate franchise stores within a designated area.

From Laos to Hawaii: Expansion of Korean-Style Convenience Stores

The Kolao Group, established by Korean businessman Oh Seyoung, is known as the largest private company operating locally in Laos. Through this agreement, Emart24 plans to convert over 50 "KO KO MINI" convenience stores currently operated by the Kolao Group into Emart24 stores and to open new locations.

Laos is considered a retail market with high growth potential. The country’s per capita food consumption has recorded an average annual growth rate of 5.5%. In addition, the influence of K-culture among the younger generation in Laos has been growing explosively in recent years. An Emart official stated, "Laos boasts a variety of tourist resources, such as the popular Blue Lagoon and Luang Prabang, a UNESCO World Heritage city," adding, "However, the market is still centered around small-scale and traditional markets, and there is a lack of small retail channels." The official further explained, "There are only about 120 convenience stores operating in Laos, including Thai-owned stores and the Kolao Group’s KO KO MINI," outlining the background for entering the market.

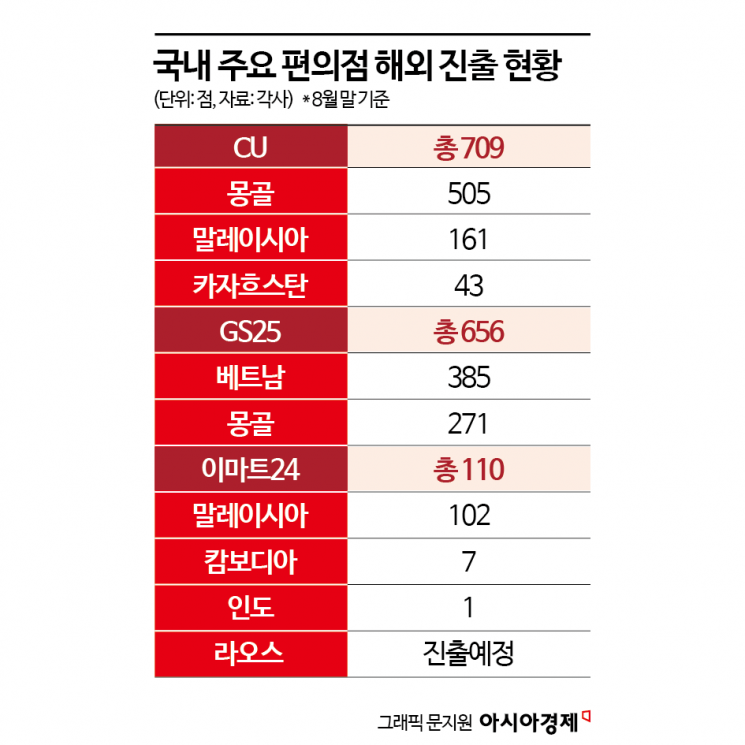

Since entering Malaysia in June 2021, Emart24 has been operating a total of 110 overseas stores across Malaysia, Cambodia, and India. In Malaysia, it operates 102 stores, and since entering Cambodia in June last year, it has opened 7 stores there. Last month, it launched its first store in India. Emart24 CEO Choi Jinsil stated, "Through overseas expansion, we expect to increase exports of Emart24’s private label products and help domestic small and medium-sized enterprises develop new export channels."

CU, the convenience store operated by BGF Retail, will also open its first store in Hawaii, USA, next month. To this end, in May, it signed an MF agreement with "CU Hawaii LL," a newly established local convenience store company under "WKF Inc." As of last month, CU operates a total of 709 overseas stores: 505 in Mongolia, 161 in Malaysia, and 43 in Kazakhstan. The company aims to open its 500th store in Malaysia by 2028 and in Kazakhstan by 2029.

GS25, operated by GS Retail, is reviewing new overseas markets, focusing on the Asian region. As of last month, GS25 had 271 stores in Mongolia and 385 in Vietnam, totaling 656 overseas stores. The company plans to reach 1,000 global stores by 2027.

Convenience Store Market Saturation: Negative Growth Since the First Half of This Year

The domestic convenience store market has faced negative growth since the beginning of this year. During the COVID-19 pandemic, convenience stores with good accessibility emerged as a key offline distribution channel due to social distancing measures. However, after the end of the pandemic, the dispersal of consumer channels and sluggish domestic demand have combined to impact the market.

According to the Ministry of Trade, Industry and Energy, sales of the three major convenience store chains (CU, GS25, and 7-Eleven) in the first half of this year decreased by 0.5% compared to the previous year. This is the first time since the COVID-19 pandemic that semiannual sales have declined. The number of stores is also on a downward trend. According to the Ministry’s "Major Retailers’ Sales Trends," the number of stores, which had been increasing from January to March, has steadily declined: down 0.2% in April, 0.6% in May, 1.3% in June, and 2.0% in July. In response, convenience store operators are restructuring their businesses by closing unprofitable stores and focusing on improving profitability.

Overseas expansion is part of this business restructuring. Convenience store outlets are operated through the "master franchise" model, in which local companies oversee re-franchising and operations. To reduce initial investment and operational risks, Korean companies grant local partners the rights to operate businesses and open stores, and receive royalties in return.

Previously, CU entered Mongolia in 2018 through a contract with Premium Nexus (formerly Central Express), Malaysia in 2020 with My CU Retail (My News Holdings), and Kazakhstan in 2023 with Shin-Line, a local convenience store company. GS25 partnered with Son Kim Group in Vietnam in 2018 and Shunkhola Group in Mongolia in 2021. Emart24 operates in Malaysia and Cambodia through MF agreements, and entered India via a licensing contract.

However, the share of overseas sales for convenience store companies remains minimal. Last year, GS25 recorded sales of 204.1 billion won from its overseas subsidiaries in Vietnam and Mongolia, accounting for about 2% of its total sales of 11 trillion won during the same period. CU’s overseas sales account for around 4% of its total sales.

For this reason, convenience store chains are targeting local consumers through localization strategies. CU plans to continue aggressive store openings, capitalizing on the rapid growth in popularity of Korean culture, especially among younger generations. The company provides its local partners with distribution infrastructure and expertise, including logistics centers, food production, and manufacturing facilities, and aims to enhance store operations by offering clean, spacious rest areas and convenient facilities compared to small offline retail channels. In terms of products, CU is introducing three concepts: differentiation, localization, and collaboration. The company plans to target local demand not only with K-food items such as ramen and snacks, but also with ready-to-eat products featuring iconic Korean dishes like tteokbokki and dakgangjeong.

After simultaneously opening six stores in Hanoi, Vietnam, in April, GS25 has expanded its presence in the northern region to 32 stores. In March, it collaborated with Jung Sun Pharma (Dongwha Pharm’s Vietnamese chain) to launch a new concept store-a "shop-in-shop convenience store within a pharmacy." In Mongolia, GS25 is pursuing a localization strategy by combining Mongolian food culture with the K-food trend. In the first half of this year, the best-selling item at GS25 Mongolia was "Cafe 25" (Americano, latte, etc.), and the top sellers included not only traditional Mongolian foods but also popular K-foods such as tuna gimbap and bulgogi gimbap.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.