Moody's, one of the world's top three credit rating agencies, recently downgraded the credit rating of Korea Investment & Securities, which has been posting strong results and is aiming for the title of "Korea's first Integrated Management Account (IMA) operator." This move has drawn attention to the credit evaluation status of other domestic securities firms as well. However, experts suggest that Moody's assessment is unlikely to significantly affect the ratings given by domestic credit rating agencies or the strategies of competing firms that have announced plans to expand venture capital investments.

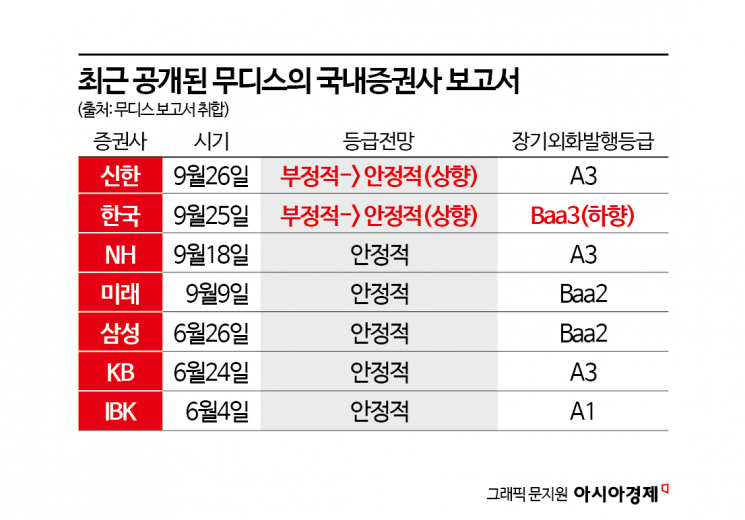

According to a compilation by Asia Economy on October 13 of seven credit rating reports on domestic securities firms released by Moody's between June and September, Korea Investment & Securities was the only company to receive a downgrade.

In its Credit Opinion report released on September 25, Moody's downgraded Korea Investment & Securities' long-term foreign currency issuer rating and senior unsecured bond rating from 'Baa2' to 'Baa3.' Baa3 is the lowest investment-grade rating. The short-term rating was also lowered from 'Prime-2' to 'P-3.'

The downgrade was attributed to the company's "high-risk, high-return" strategy, which has led to a higher risk appetite and greater leverage compared to peers in the industry. Moody's stated in its report, "The company demonstrates higher profitability and actively capitalizes on market opportunities compared to domestic peers," but also noted, "It has a high risk appetite. The company's liquidity and funding structure are vulnerable due to a high reliance on short-term funding and a significant use of long-term capital." Korea Investment & Securities' risk appetite ratio stands at 24.5%, exceeding the industry average of 20%.

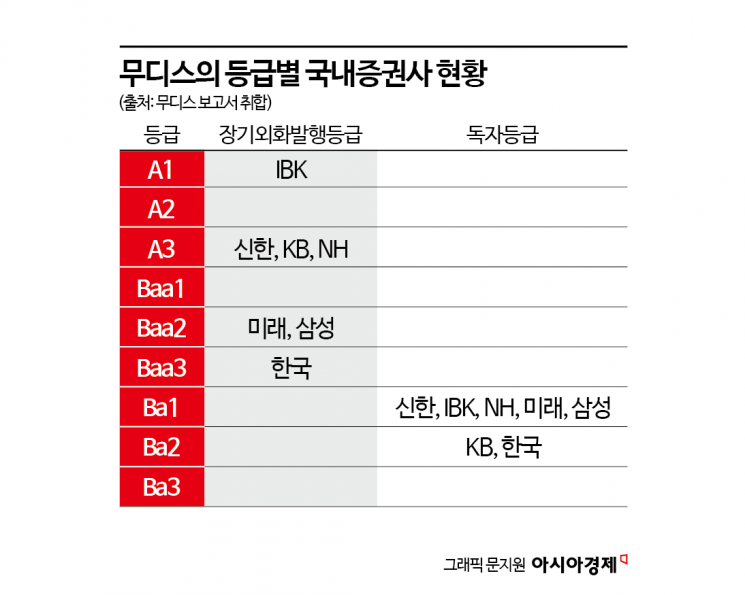

Among the long-term foreign currency issuer ratings for seven domestic securities firms recently released by Moody's, IBK Securities received the highest rating at A1. NH Investment & Securities, KB Securities, and Shinhan Investment & Securities were rated A3. Notably, for Shinhan Investment & Securities, a report was released on September 26-immediately after Korea Investment & Securities' downgrade-confirming its rating and raising its outlook to "Stable." Mirae Asset Securities and Samsung Securities both received Baa2, one notch above Korea Investment & Securities.

These ratings reflect each company's standalone assessment as well as the potential for government and parent company support. Due to the industry’s inherent risks and weaker capital structures compared to other financial sectors, the highest standalone credit rating for private domestic securities firms is Ba1. Of the seven companies, IBK Securities, Shinhan Investment & Securities, NH Investment & Securities, Mirae Asset Securities, and Samsung Securities received Ba1. KB Securities and Korea Investment & Securities were rated one notch lower at Ba2.

Despite similar standalone ratings, IBK Securities stands out with a significantly higher final rating (long-term foreign currency issuer rating) at A1, primarily due to strong backing. The Ministry of Economy and Finance owns 62% of its parent company, Industrial Bank of Korea, while the National Pension Service holds 7%. Moody's explained in a June report, "IBK Securities' A1 rating reflects a two-notch uplift for the strong support from its parent, Industrial Bank of Korea (Aa2, Stable), and a four-notch uplift for the very high probability of support from the Korean government (Aa2, Stable), in addition to its standalone Ba1 rating."

KB Securities has the second largest gap between standalone and final ratings after IBK Securities. Like Korea Investment & Securities, KB Securities has the lowest standalone rating among the seven at Ba2, but its final rating is five notches higher. In its June report, Moody's stated, "KB Securities' standalone Ba2 rating was upgraded by four notches due to the very high probability of support from its affiliates, KB Financial Group and Kookmin Bank. Additionally, the possibility of moderate public support from the Korean government was assumed to result in a one-notch uplift."

Moody's investment grade scale consists of four main categories, from the highest Aaa down to Baa3, spanning ten rating levels. Anything below this is considered junk grade.

However, these rating rankings do not directly indicate the order of stable funding access in times of crisis. The market response to Moody's downgrade of Korea Investment & Securities' foreign currency issuer rating was reportedly limited. An official from another securities firm explained, "The impact is minor because foreign currency bonds are rarely issued. If anything, the cost of issuing foreign currency bonds may rise. Domestic issuance rates could also increase slightly, and interest costs may climb when rolling over bonds." Korea Investment & Securities also emphasized that, unlike Moody's, global rating agency S&P has upgraded its outlook. The company stated that its continued strong performance demonstrates high profitability and that it is making risk investments at a manageable level.

Industry observers generally agree that this decision will not have a significant impact on domestic credit rating agencies. A representative from a domestic rating agency commented, "Moody's evaluates creditworthiness based on foreign currency, while domestic agencies assess overall creditworthiness in local currency. At most, it should be seen as a 'market signal.'" Another industry official pointed out, "Moody's is particularly conservative among global credit rating agencies." Currently, all three major domestic credit rating agencies have assigned an AA rating to Korea Investment & Securities' senior unsecured bonds.

Some have noted that Moody's downgrade of Korea Investment & Securities was partly due to its expansion in venture capital investments, raising concerns that future credit evaluations for securities firms could become stricter in line with the government's policy to expand venture capital. However, a securities firm official clarified, "While the government does require the expansion of venture capital, it is important to note that the intention was to reduce (riskier) real estate project financing." Nonetheless, both domestic and international rating agencies are expected to more closely monitor leverage ratios, such as increases in issuance notes.

All seven companies rated by Moody's between June and September received a "Stable" outlook, indicating a low likelihood of rating changes over the next 12 to 18 months. This reflects the recent outlook upgrades for Shinhan Investment & Securities and Korea Investment & Securities, both of which previously had "Negative" outlooks. However, while Shinhan Investment & Securities maintained its existing long- and short-term foreign currency ratings with an upgraded outlook, Korea Investment & Securities' stable outlook was assigned following a downgrade. Moody's added in its latest report that Korea Investment & Securities could see its rating upgraded if it reduces its risk appetite ratio to around 20%, maintains leverage below six times, and improves its long-term funding structure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.