The Financial Supervisory Service, in collaboration with the Korea Financial Investment Association, is set to revise the criteria for calculating deposit fee rates. The reforms aim to prohibit discrimination between individuals and institutions and to establish calculation standards for foreign currency deposits, thereby improving the overall system.

On September 29, the Financial Supervisory Service announced plans to amend the Korea Financial Investment Association’s regulations and the “Model Guidelines for Calculating Deposit Fee Rates” to ensure that deposit fee rates are determined in a reasonable and fair manner.

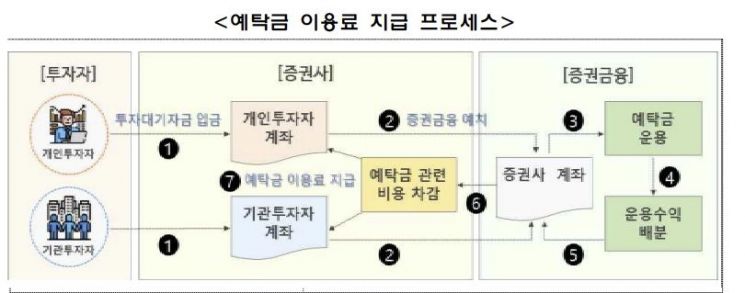

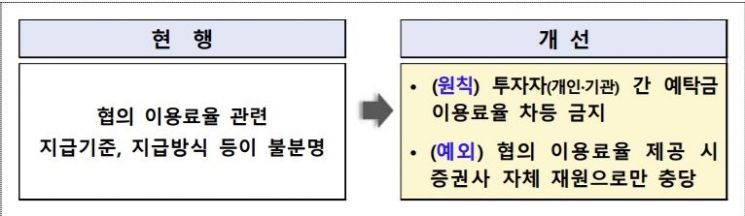

First, the new rules will fundamentally prohibit the application of different deposit fee rates to investors, such as individuals and institutions, without reasonable grounds. There have been concerns that securities firms have applied negotiated fee rates to institutional investors, with unclear standards and methods for payment.

Additionally, the criteria for calculating deposit fee rates will be improved. When calculating fee rates, direct and indirect costs related to deposits must be allocated according to reasonable standards. However, it has been unclear whether costs such as promotional event fees and monetary benefits can be allocated as indirect deposit expenses. To address this, the new rules will prohibit including costs unrelated to deposit collection, separate custody, or payment in deposit expenses.

Standards for calculating fees on foreign currency deposits will also be established. Like Korean won deposits, foreign currency deposits must have their fees calculated reasonably, reflecting both income and costs. Previously, many securities firms did not calculate the income and costs related to foreign currency deposits and therefore did not pay deposit fees on them. To resolve this, the new rules will require the establishment of calculation standards and procedures for each currency, and deposit fee payments and rates will be determined accordingly.

The disclosure system for deposit fee rates will also be enhanced. Currently, only rates based on the Korean won are disclosed, but going forward, rates and payment standards for both Korean won and foreign currencies will be made public separately.

The Financial Supervisory Service stated, “We expect that investors will be able to receive deposit fees in a fairer and more transparent manner,” adding, “In particular, the prohibition of discrimination between individuals and institutions and the clarification of cost calculation standards are also expected to have the effect of raising fee rates.”

The Korea Financial Investment Association plans to complete revisions to the regulations and model guidelines within this year, aiming for full implementation in January next year. The Financial Supervisory Service will also continue to monitor the status of deposit fee rates and pursue further system improvements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.