Partnering with Altria to Acquire Sweden's ASF

Full-Scale Entry into the Nicotine Pouch Market

KT&G has embarked on pioneering a new market with "nicotine pouches," leveraging cash secured from the sale of real estate assets. Although nicotine pouches, a type of non-combustible tobacco, have not yet been officially distributed in South Korea, they represent a high-growth market that global tobacco manufacturers are actively entering. As global demand for traditional cigarettes declines, industry observers are watching to see if KT&G can secure a new growth engine.

According to industry sources on October 8, KT&G recently announced that, together with Altria, the leading tobacco manufacturer in the United States, it will acquire Another Snus Factory (ASF), a Nordic nicotine pouch company. The total acquisition price is 262.4 billion won, with KT&G planning to invest 160.5 billion won to secure a 51% stake.

Major M&A After 14 Years... Accelerating Real Estate Sales

This is KT&G’s first major acquisition in 14 years, following its purchase of Indonesian tobacco company Trisakti (TSPM) for 140 billion won in 2011.

KT&G plans to use its available liquid assets for the acquisition. The company recently signed a contract to sell the Euljiro Tower, located on Marunnae-ro in Jung-gu, Seoul, to Chun Kyung Shipping for approximately 120 billion won. KT&G had acquired this building, which has a total floor area of 18,188 square meters, from Golden Bridge Partners in 2014 for 61.2 billion won, realizing a capital gain of about 60 billion won over 11 years.

Previously, KT&G sold the Bundang Tower in Seongnam, Gyeonggi Province, to Pebblestone Asset Management for 124.7 billion won last year. The company is also in the process of selling the hotel "Courtyard by Marriott Seoul Namdaemun," having selected Heungkuk REITs Management as the preferred bidder and HHR Asset Management as the secondary negotiator. The market estimates the sale price could reach up to 200 billion won. KT&G plans to secure approximately 1 trillion won in cash by liquidating real estate and financial assets by 2027.

Bang Kyungman, President of KT&G (left), is signing a comprehensive Memorandum of Understanding (MOU) with Billy Gifford, CEO of Altria, on September 23 to establish a strategic cooperation foundation in the global nicotine and non-nicotine markets, and they are taking a commemorative photo. KT&G

Bang Kyungman, President of KT&G (left), is signing a comprehensive Memorandum of Understanding (MOU) with Billy Gifford, CEO of Altria, on September 23 to establish a strategic cooperation foundation in the global nicotine and non-nicotine markets, and they are taking a commemorative photo. KT&G

Annual Growth Rate Projected at 29.1%... Will It Disrupt Zyn’s Dominance?

Through this MOU, KT&G plans to introduce ASF’s product "Loop" and Altria’s "On!" through KT&G’s global distribution network.

Nicotine pouches are a type of smokeless tobacco where nicotine is formed into a solid mass and placed in a pouch, which is then inserted between the gums and lips. The nicotine pouch market initially grew in Northern Europe, particularly Sweden, and is rapidly expanding to regions such as the United States. According to market research firm Grand View Research, the U.S. nicotine pouch market, valued at $5.4 billion (7.5 trillion won) this year, is expected to nearly quadruple to $19.7 billion by 2030.

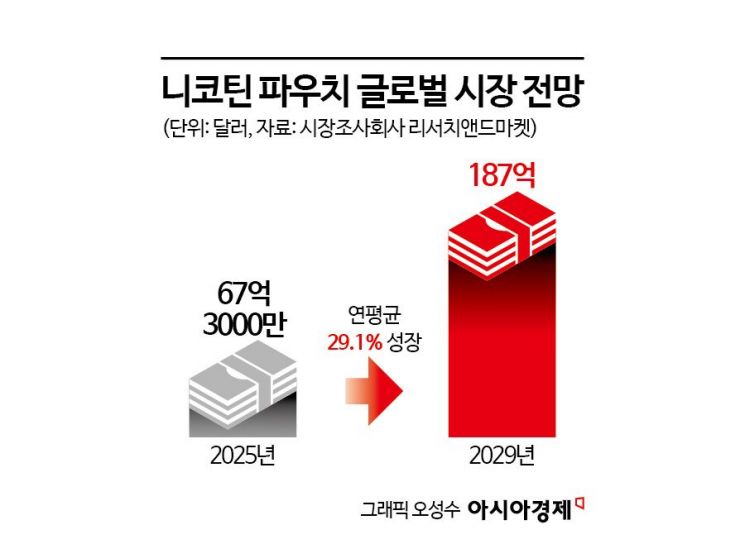

According to Research and Markets, the global nicotine pouch market is projected to grow from $6.73 billion this year to $18.7 billion in 2029, representing an average annual growth rate of 29.1%. KT&G anticipates the market will grow at an average annual rate of 50% through 2030.

Global tobacco companies are already fiercely competing in the nicotine pouch market. Philip Morris International (PMI) acquired Swedish Match in 2022, obtaining the world’s largest nicotine pouch brand, Zyn. Some Zyn products have received sales approval from the U.S. Food and Drug Administration (FDA), and last year, Zyn commanded an overwhelming 74% market share in the United States.

British American Tobacco (BAT) is targeting the global market with its "Velo" brand, intensifying marketing efforts in Europe and the United States as it chases Zyn’s lead. Altria is also working to expand its U.S. market share with On! Through the recent MOU with KT&G, Altria will seek to enter new markets such as Europe.

An industry insider commented, "Currently, the global nicotine pouch market can be summed up as 'Zyn versus the rest,' highlighting Swedish Match’s clear dominance. The key question is how quickly KT&G can establish itself in the global landscape through this acquisition."

Regulatory Uncertainty in Korea... Focusing on Overseas Success Stories First

In South Korea, nicotine pouches remain in a regulatory gray area, as they have not yet been incorporated into the legal framework. The country maintains strict regulations on tobacco and nicotine products, and nicotine pouches are not clearly defined under current domestic laws, resulting in restrictions on their import and sale. However, they can be purchased through overseas direct purchase (direct import) channels, including the country’s largest e-commerce platform, Coupang.

The industry expects that, given ongoing social concerns about youth smoking rates that emerged during the spread of liquid-type e-cigarettes, nicotine pouches will not quickly gain a foothold in the domestic market.

Experts anticipate niche demand, noting that the nearly odorless and trace-free nature of nicotine pouches could attract interest among office workers, women, and those attempting to quit smoking. Multinational tobacco companies are also closely monitoring the Korean market, and there is a high likelihood that global big players will intensify their efforts.

Another industry source predicted, "Due to significant regulatory uncertainty in the domestic market, KT&G is likely to focus on creating successful overseas cases before reintroducing the product to Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.