Lip Cosmetics Exports Surge 37%, Outpacing Basic Skincare Growth at 11%

Natural Makeup Trends and Diverse Formulations Drive Global Demand

Amazon: "Focused Support for Popular Korean Color Cosmetics Brands in Japan"

K-beauty, which has already conquered the global basic skincare market, is now setting its sights on the color cosmetics sector. Traditionally, this market has been dominated by American and European brands, with K-beauty brands having a relatively low penetration rate. However, recently, Korean brands have been expanding their product range with various formulas and shades, increasing sales-particularly of lip products-in Japan and the United States.

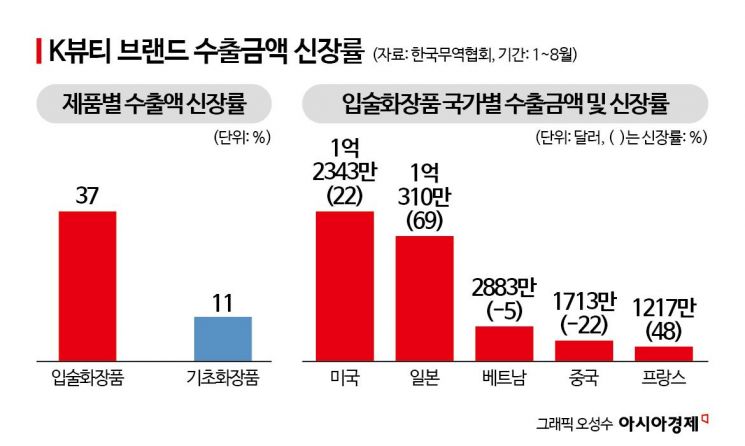

According to the Korea International Trade Association (KITA) on September 25, the export value of lip cosmetic products from January to August this year reached 409.96 million dollars, a 37% increase compared to 299.09 million dollars during the same period last year. This growth rate far surpasses that of basic skincare products (such as essences, ampoules, creams, etc.), which recorded 5.48521 billion dollars in exports, up 11% year-on-year. While the absolute export value of basic products remains much higher, reflecting K-beauty’s traditional export focus, the steep growth in lip product exports signals rising global demand.

The top export destinations for lip cosmetics are the United States (123.43 million dollars), Japan (103.1 million dollars), Vietnam (28.83 million dollars), China (17.13 million dollars), and France (12.17 million dollars), in that order. Among these, Japan stands out with the highest sales growth rate: since the beginning of the year, lip product sales in Japan have surged by 69%. France follows with 48%, and the United States with 22%.

The popularity of domestic color cosmetics brands in global markets is attributed to the growing number of consumers seeking a natural makeup look. As more global consumers prioritize natural shine, subtle pigmentation, and non-sticky formulas over strong color payoff, K-beauty products have attracted significant attention. In particular, the Japanese market has seen rapid sales growth due to shared cultural and makeup trends, as well as similar ethnic backgrounds. The lip products from Amuse, known as the “Jang Wonyoung tint,” and Rom&nd, a brand by iFamilySC, are enjoying immense popularity in Japan. Amuse has even launched exclusive shades tailored for the Japanese market.

A representative from the cosmetics manufacturing industry commented, “It is true that European and American brands have long led in color payoff and formula technology. However, as Korean cosmetics manufacturers have recently introduced a wider variety of shades and formulas tailored to different ethnicities, sales have been increasing.”

Industry insiders expect that, following the rise of brands recognized in the global basic skincare market, more popular brands will emerge in the color cosmetics sector as well. Currently, top-selling lip cosmetic brands on Amazon include Nooni Applecider Lip Oil, Laneige Tinted Lip Serum, Clio Peripera Tint, and Nature Republic Honey Melting Lip.

Global e-commerce platform Amazon is also optimistic about the success potential of color cosmetics brands. At the “Amazon Beauty in Seoul” event held this month, Amazon announced its intention to actively promote color cosmetics brands that have succeeded in Japan across its global platforms.

The upcoming broadcast of “Just Makeup”-scheduled to air next month on Amazon Prime Video and Coupang Play-is further fueling expectations for growth in the color cosmetics sector. The show features leading K-beauty makeup artists competing in makeup techniques. Orin A, a researcher at LS Securities, explained, “K-beauty has recently grown around cleansing oils, toners, and eye care, but it is expected to expand into color cosmetics, beauty devices, and hair care. If the global survival show becomes a hit, it could serve as a momentum boost for K-beauty products during the fourth quarter shopping season.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.