Surprise Fourth-Quarter Earnings Announcement

DRAM Sales Up 70% Year-Over-Year

Accounts for 78% of Total Company Revenue

HBM Revenue Reaches $2 Billion

SK Hynix Likely to Surpass 10 Trillion Won in Third-Quarter Operating Profit

On September 24, Micron Technology, a U.S. semiconductor company, released its financial results for the fourth quarter of fiscal year 2025, clearly signaling that the memory industry has entered a super cycle.

The most notable point drawing attention in the industry is the sharp increase in sales of DRAM and High Bandwidth Memory (HBM). It is no exaggeration to say that DRAM alone accounted for almost all of Micron's fourth-quarter revenue. On this day, Micron reported fourth-quarter DRAM sales of $8.98 billion. While the approximately 70% year-over-year increase is impressive, it is even more significant considering that DRAM was responsible for about 78% of Micron's total fourth-quarter revenue of $11.32 billion. Experts attribute the DRAM's upward trajectory to the recent surge in DRAM prices. As demand for AI servers and components used in electronic devices such as AI PCs and smartphones has increased, the amount of DRAM required for these devices has also grown. In contrast, the supply of DRAM produced by companies has remained limited, leading to a supply shortage and driving up prices-a view widely shared among industry experts.

The previous day, the average spot price of DDR4 8Gb (1Gx8) 3200, considered a standard for general-purpose DRAM, reached its highest point of the year at $5.868. This overall trend appears to have had a positive impact on Micron as well. During the earnings call, Micron stated, "We expect the DRAM supply shortage in the market to persist for the time being, and we plan to further increase our production."

Micron also highlighted its remarkable performance in HBM, which is manufactured by stacking DRAM, during the fourth quarter. In terms of revenue, HBM contributed $2 billion to the company. The Cloud Memory division, which oversees HBM-related business, posted sales of $4.543 billion, marking a 213.6% surge compared to the same period last year. Micron announced that it has already sold out most of its HBM3E products scheduled for mass production next year, and is currently negotiating supply agreements with clients following sample deliveries of its next-generation HBM4 products. Sanjay Mehrotra, CEO of Micron, stated, "We have achieved record-high results and will begin fiscal year 2026 (September 2025-August 2026) with the most competitive portfolio ever."

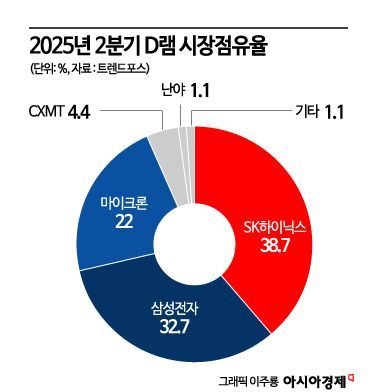

Given Micron’s strong performance in DRAM and HBM, it is expected that Samsung Electronics and SK Hynix, which also operate memory businesses, will report positive results in their upcoming earnings announcements. Both companies are scheduled to announce their third-quarter results in mid-October, after the Chuseok holiday. Since they have focused on DRAM and HBM4 alongside Micron, they are likely to be affected by the same upward price cycle for DRAM and deliver similar results. Samsung Electronics recently made significant progress in its supply tests of 12-layer HBM3E for Nvidia. SK Hynix is projected to surpass 10 trillion won in quarterly operating profit for the first time in its history in the third quarter of this year, driven by expanded HBM sales and a surge in DRAM demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.