Parts Industry’s Transition to Future Vehicles Remains Slow

Only 3.5% of Companies Focused on Future Vehicle Parts

"Government Needs to Expand Mid- to Long-Term Support"

The sense of crisis surrounding the domestic automobile parts industry is deepening. The massive shift from internal combustion engine vehicles to eco-friendly vehicles is already delivering significant shocks throughout the industry. Now, the looming tariff tsunami from the Donald Trump administration in the United States is accelerating, while rising production costs are rapidly worsening the business environment. In particular, as the so-called 'electric vehicle chasm'-a temporary stagnation in demand-is expected to gradually resolve, there are growing warnings that a large number of companies unable to adapt to the era of future vehicles may face the risk of collapse.

According to industry sources on September 22, domestic automakers are accelerating their transition toward future vehicles such as electric cars, raising concerns for companies still operating production systems centered on internal combustion engine parts. One example is Hyundai Motor Company, which recently announced at an overseas investment event its plan to increase annual sales to 5.55 million units by 2030, with 60% of these being eco-friendly vehicles.

Last year, Hyundai Motor Company filled 24% of its total sales volume (4.14 million units) with electric vehicles. The company has set a goal to more than double its electric vehicle sales within the next five years. This strategy by Hyundai Motor Company is seen as having a significant impact not only on the domestic automaker sector but also on the entire automotive industry.

This trend is expected to directly impact small and medium-sized automobile parts suppliers. Industry and academic experts commonly predict that around 10,000 parts will disappear as internal combustion engine vehicles are replaced by electric vehicles. Parts related to engines, transmissions, fuel, and exhaust systems will be replaced by new components related to batteries and motors. As production facilities and processes for finished vehicles undergo concentrated changes and automation becomes widespread, it is not difficult to foresee that the space available for parts suppliers will become increasingly limited.

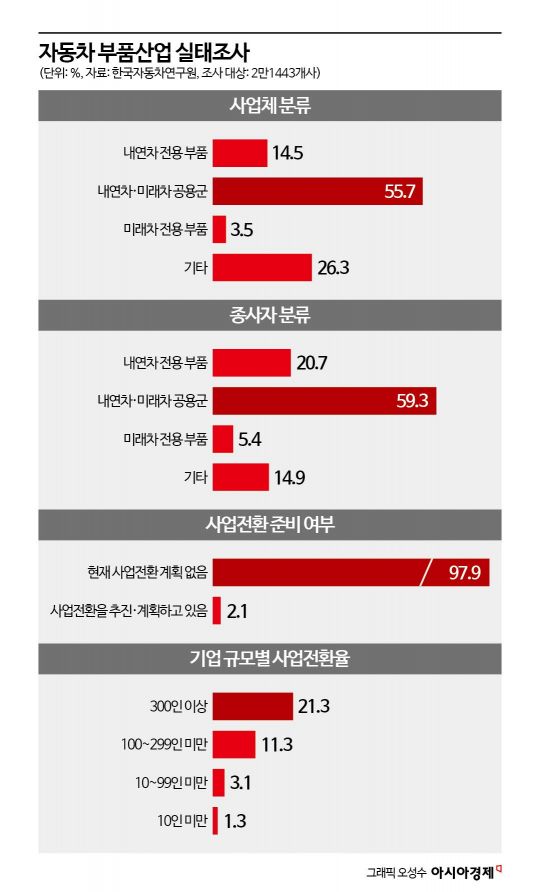

Despite these trends being predicted long ago, it remains extremely rare for small and medium-sized parts companies to have successfully transformed their business models in line with these changes. According to a survey by the Korea Automobile Research Institute last year, companies specializing in internal combustion engine parts accounted for 14.5% of all businesses and 20.7% of all employees. In contrast, only 3.5% of companies were dedicated to future vehicle parts. When asked about future plans, 97.9% of all companies responded that they had "no plans at all for business transformation."

Kim Pilsoo, professor of automotive engineering at Daelim University, said, "The transition to future vehicles is a very critical issue that determines the survival of small and medium-sized parts suppliers. Nevertheless, many parts companies have yet to recognize the seriousness and are still 'all in' on internal combustion engine-specific parts such as engines and transmissions."

This is why there are calls for the government to take a more proactive, mid- to long-term approach to supporting small and medium-sized parts suppliers as they attempt to overcome business risks and pursue transformation. In January last year, the government enacted the "Special Act on Future Vehicle Parts Industry" to encourage the parts sector to shift toward future vehicles. However, support such as transition funding and research and development (R&D) budgets remains mostly at an initial level, highlighting clear limitations.

Professor Kim added, "Future vehicle parts have a much higher proportion of advanced software and electronics compared to internal combustion engines, so securing facilities and technology requires much greater investment. The smaller the company, the greater the risks associated with business transformation, such as difficulties in finding new markets, making it hard to attempt such changes. The government should collaborate with local governments to expand mid- to long-term support for the parts sector's transition to future vehicles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.