COGS Ratio Drops to 69.8% in the First Half

Price Effectively Increases Through Reduced Portions and Mixed Cuts

Kyochon Chicken improved its profitability by lowering its cost of sales ratio to the high 60% range in the first half of this year. However, there are criticisms that the company effectively raised prices by reducing the portion sizes of certain menu items and mixing in cheaper cuts of chicken. The benefit of reduced cost pressure is not being passed on to consumers and is instead leading to concerns over declining quality.

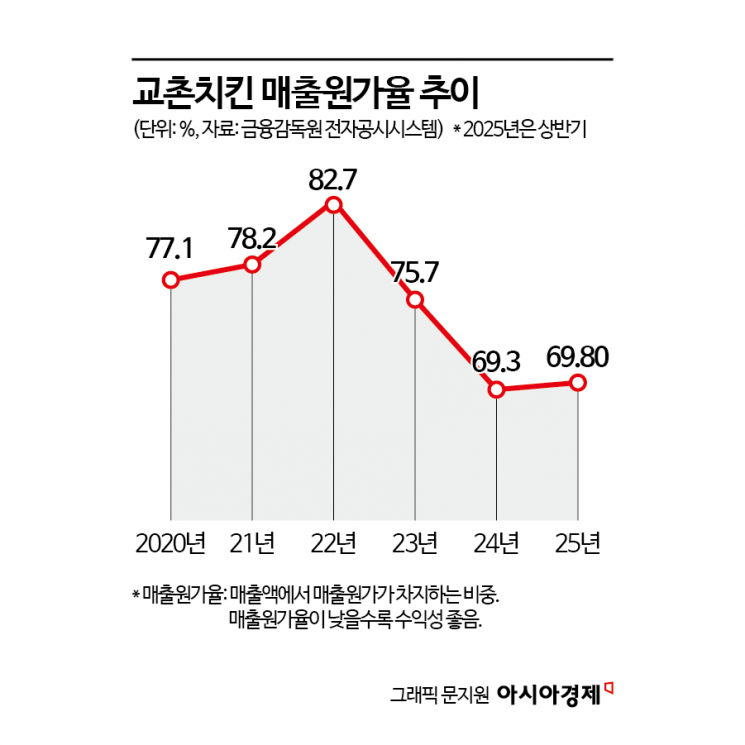

According to the industry on September 21, Kyochon F&B's cost of sales ratio for the first half of this year was 69.8%, down 1.18 percentage points from the same period last year. After peaking at 82.7% in 2022, the cost ratio has dropped by more than 10 percentage points in just two years. The cost of sales ratio refers to the proportion of direct costs, such as raw materials and labor, in total sales. A lower figure means the company is experiencing less cost pressure. As a result of this improvement, operating profit rose from 8.8 billion won to 20 billion won during the same period.

Nevertheless, Kyochon Chicken's cost of sales ratio remains among the highest in the industry. While major competitors such as BHC and BBQ have cost ratios in the 50% to 60% range, Kyochon hovers around 70%. This is because its signature menu item, "Honey Combo," is mainly composed of wings and drumsticks, making it difficult to assemble a single set from one chicken. As a result, two to three chickens are required to produce the same product, inevitably increasing raw material costs.

The adjustment made to boneless menu items on September 11 is interpreted as a measure to address these structural limitations. Kyochon Chicken reduced the pre-cooked weight of its boneless menu items from 700 grams to 500 grams and began mixing in some breast meat instead of using 100% thigh meat. Thigh meat is more expensive than breast meat. As a result, the chicken industry estimates that the consumer price per 100 grams has risen from about 3,300 won to 4,600 won, creating a perceived price increase of around 40%.

The main issue is consumer perception. If prices rise while quality declines, this could directly undermine brand loyalty. Kyochon has already established a reputation for leading chicken price hikes, having introduced delivery fees in 2018 and being the first in the industry to raise prices in 2021. There are concerns that the latest measures may further reinforce this negative perception. An industry insider commented, "Because Kyochon is seen as a premium brand, consumers have high expectations, so any change in quality is likely to trigger strong backlash. Short-term cost-cutting measures could damage the brand image and customer loyalty in the long run."

In fact, Kyochon’s operating margin last year was only 3.2%, much lower than competitors such as BHC (26.1%) and BBQ (15.6%). This is the result of unfavorable cost structures accumulating over time. It is clear that the company faces practical constraints that force it to pursue both cost reduction and price policy simultaneously. However, there are concerns that if these efforts are felt by consumers as direct price hikes or quality deterioration, the brand could face greater risks.

Experts agree that simple cost-cutting measures have their limits. If it is fundamentally difficult to lower the high cost ratio arising from the product structure, both transparency in pricing policies and operational efficiency are necessary. A senior official from a chicken company advised, "Cost reduction pressures may be unavoidable, but if consumers feel the impact directly, it will inevitably lead to backlash. As the portion sizes and cuts have been reduced, companies should introduce compensatory measures such as membership benefits, reduced delivery fees, and promotions to balance out the changes in taste and quantity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.