Share of Top 10 Export Destinations Reaches 70%

Higher Than Japan and France

More Export Destinations and Items Reduce Risk of Discontinuation

South Korea has been found to have the highest concentration of export destinations and items among the world's top 10 exporting countries. The Korea International Trade Association analyzed that diversification of markets and items is the key factor determining the survival and growth of export companies.

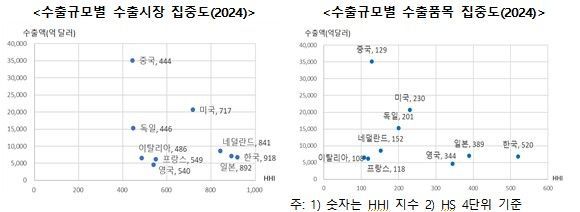

According to the report "Status of Export Diversification in Korea and Its Impact on Export Sustainability and Growth," released by the International Trade and Commerce Research Institute of the Korea International Trade Association on September 19, last year South Korea's Herfindahl-Hirschman Index (HHI) for export destination and item concentration stood at 918 and 520, respectively. These were the highest levels among the world's top 10 exporting countries (excluding Hong Kong). A lower HHI indicates a more diversified export portfolio. These figures are significantly higher compared to countries with similar export volumes, such as Japan (892, 389), France (549, 118), and Italy (486, 108).

The concentration of South Korea's exports was also evident when looking at the share of the top 10 export items and destinations. As of 2024, South Korea was the only major country where the top 10 export items accounted for more than 50% of total exports, and the share of the top 10 export destinations was also the highest at 70.8%.

The report stated that export diversification is an essential requirement for flexibly responding to changes in an uncertain external trade environment. An empirical analysis of the export performance of 92,385 domestic exporters over the past 15 years (2010-2024) by the International Trade and Commerce Research Institute found that increasing the number of export destinations or items by one unit reduced the risk of export discontinuation by 5.4% and 1.2%, respectively.

Furthermore, a panel analysis of 22,755 companies that continued exporting during the same period showed that for each additional export destination or item, a company's annual export volume increased by 7.8% and 1.1%, respectively. This suggests that even at the individual company level, having a diversified export market and item portfolio leads to greater export sustainability and growth potential.

The report revealed that more than half of companies with an export duration of five years or less rely on a single item and a single market, emphasizing the need for customized support that takes into account company size and stage of growth. It particularly noted the importance of strengthening overseas buyer discovery and marketing support for early-stage small businesses, while expanding research and development (R&D) and localization support for mid-sized companies, calling for a differentiated approach.

Shim Hyejeong, Senior Researcher at the Korea International Trade Association, stated, "For our exports to take a further leap forward, it is crucial to break away from dependence on specific markets and items and pursue strategic diversification into emerging markets and new industries." She added, "However, export diversification should not be limited to quantitative expansion. It is also necessary to pursue 'qualitative diversification,' which means leveraging accumulated experience in established markets such as the United States and China to secure new export opportunities, and flexibly responding to changes in the external trade environment, such as the spread of artificial intelligence (AI) and the growing demands for environmental, social, and governance (ESG) standards."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.